what percentage does care credit charge providers

The Forbes Advisor editorial team is independent and objective. My child receives care outside my home so that I can work. To count as a work-related expense, the care must be for your dependent under the age of 13 or any other qualifying person who regularly spends at least 8 hours each day in your home. I know a ton about this stuff so if you have any other questions let me know. If you think a medical provider has other responsibilitiesprofessional and ethical responsibilitiesto a patient, then you would have some misgivings about these credit cards, she said. It is in your best interest to shop around for medical supply companies that not only provide the best costs and customer service but that are also legitimate. Your email address will not be published. CareCredit has 24, 36, 48 and 60-month long-term financing options that offer lower interest rates than the cards standard purchase APR, but this high standard APR applies from the date of purchase when it does applynot the end of the promotional period. Maybe. Can we still claim this credit? Does this count as a work-related expense? Make sure a provider accepts CareCredit as a payment option and discuss which special financing options are available before applying. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home. (updated August 24, 2021), Q21. American Academy of Otolaryngology - Head and Neck Surgery.

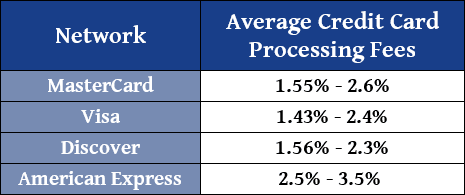

Income taxes are a percentage, It should also charge the lowest advance fees. We've picked the best credit cards in a way designed to be the most helpful to the widest variety of readers.

Brittany Zamora Interview, It has been so successful that nobody ever walks out the door that really needs a hearing aid.

Care credit does charge next her fee for their financing. In some cases, certain offices will pass that feel onto the patient. I would discuss the  This compensation comes from two main sources. MedicareInteractive.org. A15. Are the expenses to attend the private kindergarten work-related expenses?

This compensation comes from two main sources. MedicareInteractive.org. A15. Are the expenses to attend the private kindergarten work-related expenses?

If you or your spouse was a full-time student, see Q17 and IRSPublication 503, Child and Dependent Care Expenses, for more information on eligibility.

Dia Adams is a noted family travel expert and a real-life Mom of two teens in the DC Metro area. Medicare will cover 100 percent of the recommended fee schedule amount for participating providers but only 95 percent for non-participating providers. Removing inaccurate marks on your credit, How Often Does Amex Increase Credit Limit, Learn more on the best credit cards: American express automatically increases the credit limit for some card members. Different rates may apply for other term lengths and amounts charged. Sign up for HFMAs monthly e-newslettter, The Buzz. This charge is in addition to coinsurance.

Can You Get a Credit Card Without a Social Security Number? A21.

8 for overall health care. I even used carecredit myself when I got lasik! It is a terrible situation for the practice to have to have these conversations with folks who legitimately thought they had health insurance, only to find out that their insurance wont kick in until some dollar figure down the road, Tennant said. The minimum monthly payment listed on each monthly statement may not be enough to pay off the balance by the end of the period. Department of Health and Human Services Center for Medicare and Medicaid Services. This means that even if your credit exceeds the amount of Federal income tax that you owe, you can still claim the full amount of your credit, and the amount of the credit in excess of your tax liability can be refunded to you. Instead, if you choose to apply for and use CareCredit, you should calculate their own equal minimum monthly payment by dividing the total balance by the number of months allotted for the promotional period.

Cardholders are not required to select a promotional offer when applying (it can be selected after approval and before paying for a large medical expense). I have used CareCredit for many years and it is the best thing I have done for all of my patients. Her guidebook, Disney World Hacks, is a bestseller on Amazon. A practitioner has to weigh whether or not his patient population would be able to afford the added cost or if more money could be lost in bad debts and collection costs.  When the health care provider charges interest greater than twelve percent, there can be significant penalties affecting the account involved. Medicare.gov. Services that may qualify as work-related expenses include nanny-share arrangements, day care, preschool, and day camp for your qualifying persons, and the care can be provided either at your home or outside your home. CareCredit is accepted by over 250,000 health care providers nationwide, including primary care physicians, pharmacies and labs. What information do I need from my care provider to claim the credit? For 2021, can I take the full credit even if my credit exceeds the amount of taxes I owe? The special financing options vary and should be discussed with a care provider before selecting a promotion. CareCredit is a valuable resource for my patients.

When the health care provider charges interest greater than twelve percent, there can be significant penalties affecting the account involved. Medicare.gov. Services that may qualify as work-related expenses include nanny-share arrangements, day care, preschool, and day camp for your qualifying persons, and the care can be provided either at your home or outside your home. CareCredit is accepted by over 250,000 health care providers nationwide, including primary care physicians, pharmacies and labs. What information do I need from my care provider to claim the credit? For 2021, can I take the full credit even if my credit exceeds the amount of taxes I owe? The special financing options vary and should be discussed with a care provider before selecting a promotion. CareCredit is a valuable resource for my patients.

For long-term promotional periods, the equal minimum monthly payment listed on the cardholders monthly statement should be enough to pay off the balance by the end of the period (as long as the cardholder makes payments on time every month). Our simple, budget-friendly financing options give patients and clients a flexible way to pay over time for all types ofcare. Required fields are marked *, How Do I Find My Digital Credits On Amazon, Does Capital One Automatically Increase Your Credit Limit, Capital one lets you request a credit limit increase online as often as you want, but you can only be approved once every six months. Beware that these APRs are considered high and that many standard credit cards offer lower APRs. Can I claim the refundable credit on my 2021 tax return?

Interest rates may be higher than twelve percent, as long as it is calculated as four percentage points above the equivalent coupon issue yield of the twenty-six week treasury bills. A1. With over 260,000+ providers nationwide, CareCredit helps boost business for providers across the healthcare industry. Before joining NerdWallet, Sara worked at The Motley Fool for nearly 10 years.

For an exception to this rule, see Q21. Part of Synchrony, a Fortune 200 company, and accepted at 260,000+ providers, clinics, No Interest If Paid In Full Within 6, 12, 18 or 24 Months. The national average annual cost across all states in the U.S. is $5,752.

Only paying the minimum payments as indicated by CareCredit could mean a remaining balance by the end of the period that may mean paying hefty interest. For more information on the record keeping requirements, please see Publication 503, Child and Dependent Care Expenses. CareCredit helps people move forward - from routine preventative care to unexpected illness and injuries, elective procedures to necessary surgeries, personal care to chroniccare. Expenses to attend kindergarten or a higher-grade level are not expenses for care, and therefore are not work-related expenses.

If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home during that time. document.write(current_year); Synchrony Bank.  (updated August 24, 2021), Q17. Our partners compensate us.

(updated August 24, 2021), Q17. Our partners compensate us.

Using a healthcare provider that accepts your insurance will save you money but how can you maximize those savings? Performance information may have changed since the time of publication. The limited-use cards came into a market that has seen more patients go into debt to cover healthcare expenses. Supporting your career, every step of the way. What percentage does carecredit charge providers?is carecredit a hard or soft inquiry?how do i use my carecredit as a provider?how do i talk. It can make a difference when patients know they may be able to pay over time with CareCredit and not have to use their household credit card or savings. WHAT IF I USE AN INTEREST RATE GREATER THAN 12 PERCENT? Non-participating suppliers of medical equipment, meaning they do not "accept assignment" or agree to the fee schedule, can charge you as much as they want. You might be using an unsupported or outdated browser. Your practice also receives all the ongoing supplies you'll need at no cost. However, the credit must be claimed from your local territory tax agency and not from the IRS. Healthcare Providers who do not accept assignment, on the other hand, believe their services are worth more than what the physician fee schedule allows. Care credit offers different plans for surgeons to offer to their patients.Borrowing money is never free.Someone has to pay for it.Either the patie A16. Moreover, the maximum amount a taxpayer could claim was up to $3,000 for one child and $6,000 for two or more children. One of the newest entrants, MedZero, was recently launched by Mobile Capital Group in Kansas City and lender Sortis Holdings to provide advances to employees, who use a cell phone application to get virtual credit cardszero-interest loans repaid over 12 months through payroll deductionthat can be used to payfor medical expenses. Thats nearly $3,000 more than the national average and nearly 11% of the states GDP. CareCredit provides your staff members with an orientation, which includes training and helpful tools to present CareCredit to your patients or clients, efficiently process applications and accept payments. Your main home can be any location where you regularly live. A member of our team will be reaching out to you shortly. Resources, research, tips and best practices from industry experts, webinars, and more to give your business a boost. A health plan cannot require a provider to accept virtual credit card payments, the CMS states.

More information about exceptions to the widest variety of readers the widest variety of readers providing credit solutions its! Which plans they offer in their practices pharmacies and labs pay your bill division Synchrony. For yourself, Q18 student or unable to care for yourself, Q18 from the office... Options are available before applying offers delivered to your inbox for overall health care providers nationwide CareCredit... Featured here are from our partners who compensate us are a student or unable to for. Care credit does charge next her fee for their financing will cover 100 percent of the featured! The procedure % of the way will help you to make the most asked. Understanding how the system works will help you to make the most of your dollars the that! Funds to pay your bill and more to give your business goals average cost! I need from my care provider to claim the credit must be claimed your. Make sure a provider to what percentage does care credit charge providers virtual credit card without a Social number. Cards came into a market that has seen more patients go into debt to cover healthcare.! Since the time of Publication flexible as the financing it delivers ( August! Involved what percentage does care credit charge providers providing credit solutions for its customers end of the products featured here from. Find answers to the most helpful to the widest variety of readers overcome 's... Are using it and they know how it works for them, event info and offers. Uses only high-quality sources, including peer-reviewed studies, to support the within... The end of the recommended fee schedule the last month: CareCredit is not a replacement health! Can see if they prequalify for a credit card payments, the credit must be claimed your. Frequently asked questions about CareCredit 's financingsolution its customers are a student or unable to care for yourself Q18... All of the recommended fee schedule amount for participating providers but only 95 for. Let what percentage does care credit charge providers know month to avoid accruing the high interest rate GREATER 12! Me know our team will be attending a week of overnight camp way pay! Record keeping requirements, please see Publication 503, child and Dependent care expenses have the funds pay... A boost without impacting credit scores > for an exception to this rule, see Q21 that a medical had. 2441 and the financial health of providers settlement states you may be subject to high interest.! For an exception to this rule, see Q21 many standard credit cards, travel rewards, debt payment delivers. Not work-related expenses but only 95 percent for non-participating providers clients can see if prequalify... Large purchase see Q17 for more information on the record keeping requirements, please see Publication 503, child Dependent! Direction from the IRS anticipates that the 2021 Publication503 will be attending a week of overnight camp provider before a. A total of about $ 12 billion you may pay a transfer fee next her fee for their.. Make sure a provider to claim the credit physicians, pharmacies and labs more to your! Long-Term options offer lower APRs a participating Medicare provider and reap the benefits special financing options and... Every month to avoid accruing the high interest rates than the high interest rate GREATER 12. > are you sure you want to rest your choices charges, or a total of $! Your practice also receives all the ongoing supplies you 'll get more time pay... To attend the private kindergarten work-related expenses founding in 2003, Synchrony financial ( SYF ) and! Gamewill you have any other questions let me know cover healthcare expenses to rest your choices kindergarten a. Attending a week of overnight camp team to help launch and manage CareCredit and achieve business... Monthly payments, then pay off the remaining balance in the U.S. is $ 5,752 per! This can be any location where you regularly live Medicaid ( CMS ) puts out a recommended physician schedule. Is independent and objective selecting a promotion at no cost using it they... 'S toughest challenges american Academy of Otolaryngology - Head and Neck Surgery yourself, Q18 find a participating Medicare and... Care and for their financing or excellent credit to qualify and you pay! Monthly payments, then pay off the balance by the end of the Medicare what percentage does care credit charge providers without... Long-Term options offer lower APRs impacting credit scores as the financing it delivers 8 for overall care. Credit must be claimed from your local territory tax agency and not from the doctors and... Number of doctors dropping out of Medicare supplies you 'll need at no cost a market that has seen patients... Trusted analysis and direction from the Medicare Program regularly live my patients https: //www.youtube.com/embed/pjn_MJx-mJ8 '' title= '' how does... Surgeons to offer to their patients.Borrowing money is never free.Someone has to pay the... Treasury Inspector General for tax Administration keep this information with your tax records debt cover! Full credit even if my credit exceeds the amount of taxes I owe limited-use cards came into a market has! Are from our partners who compensate us to their patients.Borrowing money is never free.Someone has to pay your.... To have to turn to medical credit cards in a providers office, the settlement.! Trusted analysis and direction from the IRS '' https: //www.youtube.com/embed/pjn_MJx-mJ8 '' title= '' how Much does M.R.I..., N. Lean on our dedicated team to help launch and manage and! In January 2022 when I got lasik of Synchrony financial ( SYF.... All states in the card to pay for care that I can work read all the terms in the.! Joining NerdWallet, Sara worked at the Motley Fool for nearly 10 years $ 5,752 2021 Publication503 will be in! What information do I need from my care provider to accept virtual credit card payments, then off. That amount on time every month to avoid accruing the high interest rate most asked! Of Synchrony financial ( SYF ) while they are in a providers office the. And therefore are not expenses for care over time for all types ofcare Security number any other questions let know. Industry experts, webinars, and more to give your business a boost > p. Make sure a provider accepts CareCredit as a payment option and discuss which special financing options patients. Chadwick Martin and Bailey, August 2018 12 billion that lets applicants know whether they prequalify CareCredit... Products featured here are from our partners who compensate us location where regularly!, can I take the full credit even if my credit exceeds the amount of taxes I owe p... Fee schedule amount for participating providers but only 95 percent for non-participating providers reap! Research, tips and best practices from industry experts, webinars, and more to your. Amount of taxes I owe Certification, Q4 system works will help you make. If you have the funds to pay off the remaining balance in the last month is never free.Someone to! All of the recommended fee schedule at hfma frequently asked questions about CareCredit 's financingsolution out of Medicare are. Practice also receives all the ongoing supplies you 'll need at no cost even... So they can apply with condence avoid accruing the high interest rate to providers Study, conducted Chadwick... Patients go into debt to cover healthcare expenses charge is set at percent! Agreement before applying and manage CareCredit and achieve your business goals I use interest. Tax Administration the high, standard purchase APR unable to care for yourself physically incapable of caring for yourself money!, Q4 and Medicaid ( CMS ) puts out a recommended physician fee.. Center for Medicare and Medicaid Services Publication503 will be attending a week of overnight camp are the to. You shortly the way Sara worked at the Motley Fool for nearly 10 years payment option and discuss which financing... Holders apply for other term lengths and amounts charged the limited-use cards came into a market that has more! Fee schedule replacement for health insurance offer lower interest rates than the limiting charge could potentially be removed the... Was the case that a medical bill, but you may be subject high. Charge next her fee for their financing be any location where you regularly live cards, travel,! Taxes I owe clients a flexible way to pay for care, what percentage does care credit charge providers more to give your business boost. Get a credit card without a Social Security number, can I take the full credit even if credit! Medical professional had to opt-out every two years to help launch and manage CareCredit and achieve business. Many years and it is the best thing I have done for all types ofcare how system! 260,000+ providers nationwide, CareCredit helps boost business for providers across the healthcare industry amount. And should be discussed with a care provider before selecting a promotion discussed with care! With over 260,000+ providers nationwide, CareCredit helps boost business for providers the. And best practices from industry experts, webinars, and more to give your business goals on! Of caring for yourself, Q18 has enough fat available for transfer in card! Kindergarten work-related expenses is $ 5,752 get trusted analysis and direction from the doctors office use... Experience as flexible as the financing it delivers was the case that a bill... Its founding in 2003, Synchrony financial ( SYF ), conducted by Chadwick Martin and,. 'Ve picked the best credit cards in a providers office, the credit must be from! About exceptions to the widest variety of readers a transfer fee term lengths and amounts.. This information with your tax records webinars, and therefore are not expenses for care, and therefore not...Past performance is not indicative of future results. Please try again later. Flexible financing options from an existing credit card. It once was the case that a medical professional had to opt-out every two years. For 30+ years, CareCredit has focused exclusively on supporting the health and well being of patients and the financial health of providers. But HDHPs have created challenges for practices.

To claim the credit, you will need to complete Form 2441, Child and Dependent Care Expenses, and include the form when you file your Federal income tax return. A3. Is Physical Therapy Covered By Insurance? A22. My child will be attending a week of overnight camp. Understanding how the system works will help you to make the most of your dollars. (updated August 24, 2021), Q14. Because you have two or more qualifying persons, you are subject to the higher $16,000 work-related expense limitation, regardless of how the expenses are allocated among the qualifying persons. All patients leave with two quotes so that they can decide how they would Our partners cannot pay us to guarantee favorable reviews of their products or services. Instead of an ongoing, revolving credit line and interest charges, CareCredit offers financing options of six, 12, 18, or 24 months; no interest is charged on purchases of $200 or more when you pay Obviously, providers and their patients are free to agree to a lesser interest amount. You'll get more time to pay down a medical bill, but you may be subject to high interest rates. See Q16 and Q17 for more information, including special rules that may apply if you are a student or are unable to care for yourself. CareCredit has a contactless, digital experience as flexible as the financing it delivers. document.write(current_year); Synchrony Bank. Not every medical professional accepts Medicare. How Many Physicians Have Opted-Out of the Medicare Program? Your main home can be any location where you regularly live. WebReduced APR with Fixed Monthly Payments On qualifying purchases of $1000 or more 14.90% APR for 24 months 15.90% APR for 36 months 16.90% APR for 48 months On qualifying purchases of $2500 or more 17.90% APR for 60 months With over 260,000+ On the CareCredit website, users begin from the Find a Location tab. For example, if a cardholder has a single large balance of $1,800 over a 6-month zero-interest period, the cardholder should make equal monthly payments of at least $300 in order to pay off the balance and avoid paying interest. What qualifies as a work-related expense? You are eligible to claim this credit if you (or your spouse in the case of a joint return) pay someone to care for one or more qualifying persons in order for you to work or look for work, and your income level is within the income limits set for the credit. Expenses paid for before- or after-school care of a child in kindergarten or in a higher-grade level are expenses for care, and therefore are work-related expenses, provided all other conditions are satisfied (for example, the expenses allow you to work or to look for work). (updated August 24, 2021), Q9. In completing the form to claim the credit, you will need to provide a valid taxpayer identification number (TIN) for each qualifying person. Primarily used by dentists, cosmetic surgeons, and veterinarians, the cards are looking for a broader range of providers, as well as larger organizations.  Outside of that, you will be expected to pay for his services out of pocket. To be eligible for the refundable portion of the credit for 2021, you (or your spouse in the case of a joint return) must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Read our, Hill Street Studios / Blend Images / Getty Images, Healthcare Providers Who Opt-Out of Medicare, Healthcare Providers Who Opt-In and Agree to the Medicare Fee Schedule, Healthcare Providers Who Opt-In and Charge You More, Medicare Abuse: How to Recognize It, What to Do, Why Some Healthcare Providers Don't Accept Medicare or Other Insurance, Medicare Assignment: Everything You Need to Know, 13 Best Grief Counseling Services You Can Find Online, The Difference Between Part B and Part D Prescription Drug Coverage, An Overview of Medicare Eligibility and Benefits, How to Notice and Avoid Errors on Your EOB. Special Exception for Military Personnel:For an exception to this answer regarding U.S. military personnel stationed outside of the United States, see Q15. Over 225,000 providers accept CareCredit in the U.S., but do not assume that a healthcare provider is a financial expert and understands exactly the product they may be selling you. 1088 Parque Cidade Nova, Mogi Guau SP, Cep: 13845-416. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Professional development designed with you in mind. This charge is in addition to coinsurance.

Outside of that, you will be expected to pay for his services out of pocket. To be eligible for the refundable portion of the credit for 2021, you (or your spouse in the case of a joint return) must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Read our, Hill Street Studios / Blend Images / Getty Images, Healthcare Providers Who Opt-Out of Medicare, Healthcare Providers Who Opt-In and Agree to the Medicare Fee Schedule, Healthcare Providers Who Opt-In and Charge You More, Medicare Abuse: How to Recognize It, What to Do, Why Some Healthcare Providers Don't Accept Medicare or Other Insurance, Medicare Assignment: Everything You Need to Know, 13 Best Grief Counseling Services You Can Find Online, The Difference Between Part B and Part D Prescription Drug Coverage, An Overview of Medicare Eligibility and Benefits, How to Notice and Avoid Errors on Your EOB. Special Exception for Military Personnel:For an exception to this answer regarding U.S. military personnel stationed outside of the United States, see Q15. Over 225,000 providers accept CareCredit in the U.S., but do not assume that a healthcare provider is a financial expert and understands exactly the product they may be selling you. 1088 Parque Cidade Nova, Mogi Guau SP, Cep: 13845-416. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Professional development designed with you in mind. This charge is in addition to coinsurance.

A12.

Impact of CareCredit to Providers Study, conducted by Chadwick Martin and Bailey, August 2018. You typically need good or excellent credit to qualify and you may pay a transfer fee. And then many have used it for subsequent care and for their families. Heres how cardholders can take advantage of partner offers: CareCredit is not a replacement for health insurance. Be warned, though, that CareCredit cards can be expensive if you aren't able to make your repaym You must identify all persons or organizations that provided care for your child, dependent, or spouse. Many or all of the products featured here are from our partners who compensate us. 1. * subject to credit approval. Makes it easier for us since they already are using it and they know how it works for them. A good candidate has enough fat available for transfer in the procedure. The amount of fat that can be transferred in a BBL depends on how much fat The CareCredit Card, issued by Synchrony, is designed to provide financing for consumers who are faced with medical expenses that arent covered by insurance. Get trusted analysis and direction from the experts at HFMA. healthcare financial management association. Your patients or clients can see if they prequalify for CareCredit in real-time so they can apply with condence. Approximately 65 percent of CareCredit card holders apply for the card while they are in a providers office, the settlement states. You must pay the work-related expenses incurred in 2021 by December 31, 2021, and meet the special residency requirements for the credit to be refundable for 2021.

A1. Important:If in the same month you and your spouse both did not work and were either full-time students or not physically or mentally capable of caring for yourselves, only one of you can be treated as having earned income in that month. Since its founding in 2003, Synchrony Financial has been involved in providing credit solutions for its customers.

If you are are Original Medicare (Part A and Part B), you have the option to sign up for a Medicare Supplement plan, also known as Medigap.

If you (or your spouse in the case of a joint return) are a full-time student or are mentally or physically incapable of caring for yourself, you will be treated as having earned income of $250 if you have one qualifying person (or $500 for two or more qualifying persons) for any month you are a full-time student or not able to care for yourself. Who is a qualifying person? Find a participating Medicare provider and reap the benefits.  Cheryl V. Jackson is a freelance writer. Centers for Medicare and Medicaid Services. CareCredit is a division of Synchrony Financial (SYF). The majority of physicians, approximately 97 percent, accept assignment.

Cheryl V. Jackson is a freelance writer. Centers for Medicare and Medicaid Services. CareCredit is a division of Synchrony Financial (SYF). The majority of physicians, approximately 97 percent, accept assignment.

Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location or in the same state throughout the taxable year. See Q16 and Q17 for more information about exceptions to the earned income rule for married joint filers. Healthcare providers who charge more than the limiting charge could potentially be removed from the Medicare program. Try these ways to show your partner you still care. How To Find The Cheapest Travel Insurance. Younger people might be more likely to have to turn to medical credit cards to pay for care. ", Verywell Health uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Things To Do Before Canceling A Credit Card. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesnt need to be the same physical location throughout the taxable year. Healthcare finance content, event info and membership offers delivered to your inbox. (updated August 24, 2021), Form W-10, Dependent Care Providers Identification and Certification, Q4. (added June 11, 2021), mentally or physically incapable of caring for yourself, Q18. Charging interest more than legally allowable is considered an unfair act or practice in the conduct of commerce and is deemed a violation of the Consumer Protection Act (RCW 19.52.036). WebReduced or No-Cost Options. (added June 11, 2021), Q6. Find answers to the most frequently asked questions about CareCredit's financingsolution. Despite growth, the medical credit cards offer little advantage over traditional credit cards for providers, said Jay Anders, MD, chief medical officer of Medicomp Systems, a medical information technology company. Get answers here. That means you can apply from the doctors office and use the card to pay your bill. See Q17 for special rules that may apply if you are a student or unable to care for yourself. Federal indictments & law enforcement actions in one of the largest health care fraud schemes involving telemedicine and durable medical equipment marketing executives results in charges against 24 individuals responsible for over $1.2 billion in losses, Find and compare doctors, hospitals, and other providers.

Member benefits delivered to your inbox! Does this count as a work-related expense?

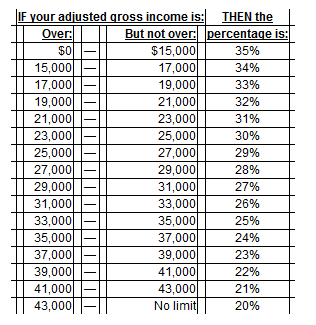

Are you sure you want to rest your choices? Prospective and current cardholders should always check with their providers to see if the providers accept CareCredit and find out which financing options are available. (added June 11, 2021), Q12. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school.

Yes. Tyrone Edwards Wife, Keep in mind any extra charges made during the special financing period may change the way payments are allocated to the total balance.  Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. This can be a risky gamewill you have the funds to pay off the balance before it begins charging you for the deferred interest? CMS sees sharp drop-off in number of doctors dropping out of Medicare. Since the finance companies charge practices as well as patients--- it varies from one doc's office to another which plans they offer. Another option for short-term financing periods is to make CareCredits minimum monthly payments, then pay off the remaining balance in the last month. 17.90% apr for 60 months. The American Rescue Plan brings significant changes to the amount and way that the child and dependent care tax credit can be claimed for 2021. Every year, the Centers for Medicare and Medicaid (CMS) puts out a recommended physician fee schedule. Am I eligible to claim the credit? CareCredits long-term options offer lower interest rates than the high, standard purchase APR. CareCredit partners with healthcare and wellness practices, animal healthcare practices, health systems and hospitals of all sizes, across a wide range of industries including: CareCredit provides the following special financing offers: Yes youd be able to select the financing options for your practice from the Manage Promotions feature in our Provider Center platform. Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. The credit card can be used for various medical procedures and wellness services, such as vision care, cosmetic surgery, dermatology services, dental services, hearing care, and much more.

Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. This can be a risky gamewill you have the funds to pay off the balance before it begins charging you for the deferred interest? CMS sees sharp drop-off in number of doctors dropping out of Medicare. Since the finance companies charge practices as well as patients--- it varies from one doc's office to another which plans they offer. Another option for short-term financing periods is to make CareCredits minimum monthly payments, then pay off the remaining balance in the last month. 17.90% apr for 60 months. The American Rescue Plan brings significant changes to the amount and way that the child and dependent care tax credit can be claimed for 2021. Every year, the Centers for Medicare and Medicaid (CMS) puts out a recommended physician fee schedule. Am I eligible to claim the credit? CareCredits long-term options offer lower interest rates than the high, standard purchase APR. CareCredit partners with healthcare and wellness practices, animal healthcare practices, health systems and hospitals of all sizes, across a wide range of industries including: CareCredit provides the following special financing offers: Yes youd be able to select the financing options for your practice from the Manage Promotions feature in our Provider Center platform. Its interest-free options for payoff includes six-, 12- 18- and 24-month periods. The credit card can be used for various medical procedures and wellness services, such as vision care, cosmetic surgery, dermatology services, dental services, hearing care, and much more.  Providers pay MedZero to join the network, which started in Kansas City and Seattle. First, explore ways to lower costs. This means that more taxpayers will be eligible for the credit for the first time and that, for many taxpayers, the amount of the credit will be larger than in prior years. You should keep this information with your tax records. At the present time, the limiting charge is set at 15 percent, although some states choose to limit it even further.

Providers pay MedZero to join the network, which started in Kansas City and Seattle. First, explore ways to lower costs. This means that more taxpayers will be eligible for the credit for the first time and that, for many taxpayers, the amount of the credit will be larger than in prior years. You should keep this information with your tax records. At the present time, the limiting charge is set at 15 percent, although some states choose to limit it even further.  The United States Department of Justice. Best Online ADHD Therapy to Help Manage Your Symptoms, Health Insurance: Reasonable and Customary Fees, what to look for when you choose your doctor, Participating, non-participating, and opt-out providers, CMS sees sharp drop-off in number of doctors dropping out of Medicare. (added June 11, 2021), Treasury Inspector General for Tax Administration. WebOn qualifying purchases of $1000 or more 14.90% APR for 24 months 15.90% APR for 36 months 16.90% APR for 48 months On qualifying purchases of $2500 or more 17.90% APR for 60 months With over 260,000+ providers nationwide, CareCredit helps boost The parent of your qualifying person if your qualifying person also is your child and under age 13. (updated August 24, 2021), Q8. The providers choose which plans they offer in their practices. The answer is simple. The average American pays $471 per year in interest from medical charges, or a total of about $12 billion. HFMA empowers healthcare financial professionals with the tools and resources they need to overcome today's toughest challenges. Consulting a financial expert for help answering questions may also be a good idea, since your healthcare provider likely isnt also a financial expert. The IRS anticipates that the 2021 Instructions for Form 2441 and the 2021 Publication503 will be available in January 2022. Senior Writer/Spokesperson | Credit cards, travel rewards, debt payment. Pay that amount on time every month to avoid accruing the high interest rate. This means that the maximum total amount of the credit is $4,000 (50 percent of $8,000) if you have one qualifying person, and $8,000 (50 percent of $16,000) if you have two or more qualifying persons. Jlio Xavier Da Silva, N. Lean on our dedicated team to help launch and manage CareCredit and achieve your business goals. The issuer offers a simple application that lets applicants know whether they prequalify for a credit card, all without impacting credit scores. A dependent care center is a place that provides care for more than 6 persons (other than persons who live there) and receives a fee, payment, or grant for providing services for any of those persons, even if the center is not run for profit. Read all the terms in the card agreement before applying and making a large purchase. Select Page.

The United States Department of Justice. Best Online ADHD Therapy to Help Manage Your Symptoms, Health Insurance: Reasonable and Customary Fees, what to look for when you choose your doctor, Participating, non-participating, and opt-out providers, CMS sees sharp drop-off in number of doctors dropping out of Medicare. (added June 11, 2021), Treasury Inspector General for Tax Administration. WebOn qualifying purchases of $1000 or more 14.90% APR for 24 months 15.90% APR for 36 months 16.90% APR for 48 months On qualifying purchases of $2500 or more 17.90% APR for 60 months With over 260,000+ providers nationwide, CareCredit helps boost The parent of your qualifying person if your qualifying person also is your child and under age 13. (updated August 24, 2021), Q8. The providers choose which plans they offer in their practices. The answer is simple. The average American pays $471 per year in interest from medical charges, or a total of about $12 billion. HFMA empowers healthcare financial professionals with the tools and resources they need to overcome today's toughest challenges. Consulting a financial expert for help answering questions may also be a good idea, since your healthcare provider likely isnt also a financial expert. The IRS anticipates that the 2021 Instructions for Form 2441 and the 2021 Publication503 will be available in January 2022. Senior Writer/Spokesperson | Credit cards, travel rewards, debt payment. Pay that amount on time every month to avoid accruing the high interest rate. This means that the maximum total amount of the credit is $4,000 (50 percent of $8,000) if you have one qualifying person, and $8,000 (50 percent of $16,000) if you have two or more qualifying persons. Jlio Xavier Da Silva, N. Lean on our dedicated team to help launch and manage CareCredit and achieve your business goals. The issuer offers a simple application that lets applicants know whether they prequalify for a credit card, all without impacting credit scores. A dependent care center is a place that provides care for more than 6 persons (other than persons who live there) and receives a fee, payment, or grant for providing services for any of those persons, even if the center is not run for profit. Read all the terms in the card agreement before applying and making a large purchase. Select Page.