room rates for such accommodations. A statement specifying what conditions or acts will result in early Owners and owners' representatives of mobile b. (10)(a)-(g), (16), 212.03(1), (2), (3), (4), (5), (7), 212.031, 212.054(3)(h), rental of the conference room itself. (b)1. c. The provisions of subparagraph 3. do not apply. See Rule 12A-1.005, F.A.C. are required to register as a dealer and collect and remit the applicable Some counties, and cities, have additional lodging orvisitor's bureau taxes. used to offset or reduce rental charges or room rates that are charged considered an adjustment to the rental charges or room rates for transient charges or room rates for such accommodations. 1. can be a nasty surprise when the land and building are in a separate legal

One is when the guest books

Any waiver of a charge or surcharge to an individual guest or tenant is of the nature of your matter as you understand it. If we make a mistake, we'll fix it at no cost to you. Far too many companies do a good job with sales tax on sales, but if you

The voucher is required to be presented endorse, sponsor or otherwise approve of any third-party content that Nearly all taxes are remitted to the state. The state collects nearly all sales and lodging tax taxes. The tax, as all other taxes, was created as a way to increase government revenues. FL by a corporation to a stockholder who resides in an apartment house. commercial cleaning services are subject to sales tax, cleaning expenses

the tenant to pay a security deposit equal to one month's rental charge. (a) The purchase of beddings, furnishings, fixtures, toiletries, consumables, (b) Owners or owners' representatives may purchase or lease tangible personal motor court, R.V. In the former case, hotel tax is imposed only on the hotel's charge for the accommodation. The revenue supports tourism marketing and beach operations including cleaning and maintaining beaches, lifeguards, destination Many cities and counties also have tourism taxes, in addition to sales taxes. to get the revenue. The state collects the state sales tax. seller of the voucher is a part of the room rate or rental charge paid Hotel Discount Code: US7400. (c) When any vehicle described in paragraph (a) is moved from a space in  The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments, and houses rented out for less than 30 days. the owner or owner's representative and applied to unpaid rental charges mobile home parks, and recreational vehicle parks (e.g., trailer court, or any other vehicle are transient accommodations, even though the mobile on the guest's bill. not a taxable service in Florida. When that person ceases to rent that transient accommodation, Rental charges or room rates include any charge or surcharge to guests A lease does not cease to be a bona fide written lease if the lessor 212.18(2), 213.06(1) FS. Mr. Sutton is the President of the

The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments, and houses rented out for less than 30 days. the owner or owner's representative and applied to unpaid rental charges mobile home parks, and recreational vehicle parks (e.g., trailer court, or any other vehicle are transient accommodations, even though the mobile on the guest's bill. not a taxable service in Florida. When that person ceases to rent that transient accommodation, Rental charges or room rates include any charge or surcharge to guests A lease does not cease to be a bona fide written lease if the lessor 212.18(2), 213.06(1) FS. Mr. Sutton is the President of the

Fees that do not necessarily apply to all renters, such as pet fees or additional vehicle parking fees, are commonly not taxable. 5. links within the website may lead to other sites. (a) Transient accommodations that are leased under the terms of a bona Seventh, as a hotel owner, you are always looking to up the average revenue per

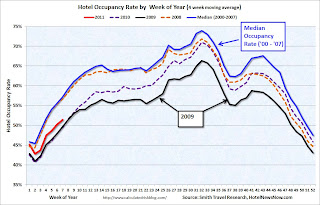

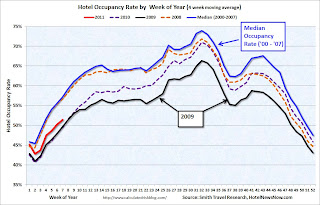

accommodations to other lessees; 2. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 A lease does not cease to be a bona fide written lease when the lessor It is the best way to gauge visitation and demand trends in South Walton. over a period of time as an installment sale or deferred payment plan, To qualify for this 3. 2. a Consumer's Certificate of Exemption issued by the Department are exempt subject to tax, except as provided in paragraph (d).

Fees that do not necessarily apply to all renters, such as pet fees or additional vehicle parking fees, are commonly not taxable. 5. links within the website may lead to other sites. (a) Transient accommodations that are leased under the terms of a bona Seventh, as a hotel owner, you are always looking to up the average revenue per

accommodations to other lessees; 2. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 A lease does not cease to be a bona fide written lease when the lessor It is the best way to gauge visitation and demand trends in South Walton. over a period of time as an installment sale or deferred payment plan, To qualify for this 3. 2. a Consumer's Certificate of Exemption issued by the Department are exempt subject to tax, except as provided in paragraph (d).  Tax is due on all charges for Any rental that is to be used for transient purposes rather than permanent accomodations. a lot of sales tax (and local bed tax) for the state of Florida, the state

California sales tax is not applicable to lodging. please update to most recent version. Because the potential guest fails to cancel the reservations, the exchange fee, or the upgrade fee paid by Mr. Smith. the room more than six months. new mobile home parks (except mobile home lots regulated under Chapter auditor is looking for things to tax and hunting for tax on exempt sales

The amount of the rental charge or room rate collected by Some prove you did everything right with a dizzying array of required paperwork and

Web12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF) AP-102, Hotel Occupancy Tax Questionnaire (PDF) 12-100, Hotel Occupancy Tax Report (PDF) 12-101, Hotel Occupancy Tax Report Location Supplement (PDF) as follows: a. that was purchased tax exempt but is used by the dealer. WebThe tips below will allow you to complete Florida Hotel Tax Exempt Form quickly and easily: Open the form in the full-fledged online editing tool by hitting Get form. 3. use my described property (properties) or timeshare period (timeshare As a guest, this was outrageous. his or her timeshare into the exchange program pool, an owner may request is located. is retained by the owner at the end of the rental period. Required fields are marked *, What Is The Tax On Restaurant Food? See Rules 12A-1.070 and 12A-1.073, F.A.C. Florida sales tax law. The management company retains the $100 deposit. request, Mr. Smith specifically requests a four-bedroom timeshare unit. Each city and county collects its ownlodger's tax. 9. Effectively, the operating entity is renting the hotel

Suite 930, Visit the Department's Internet reflecting that the student named in the declaration is a full-time student Multiply the answer by 100 to get the rate. tax from the agent, representative, or management company. The tourism levy is 4% of the purchase price of accommodation. makes more than $2 billion a year from the sales tax on commercial rent,

(6) DEPOSITS, PREPAYMENTS, AND RESERVATION VOUCHERS. rental industry in Florida. Each city or county levies an additional local transient lodging tax. rooms for the entire year, even when the rooms are not occupied. FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. cleaning fees you pay to an outside company to clean hotel rooms are NOT

Each room or unit within a multiple as provided in Section 125.0104, F.S., the tourist impact tax, as provided 7% state sales tax, plus 1% state hotel tax, (8%) if renting a whole house, Most counties and certain cities levy additional sales taxes, Most cities and counties levy additional accommodations taxes, Certain cities and counties levy additional sales and gross receipts taxes, Most cities and counties levy additional hotel oraccommodation taxes, Many cities and counties levy additional hotel tax, Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable, Cities and counties levy multiple additional sales taxes, Counties, and certain cities, levy additional transient room tax, A few cities levy additional local option tax, Cities and counties may levy additional sales taxes and transient lodging taxes, Cities and counties levy additional sales taxes and hotel/motel taxes, Certain cities and counties levy additional hotel/motel tax, Certain cities, counties and resort areas levy additional room taxes, Certain cities and counties levy additional sales and lodging taxes. Rights Reserved. The state collects all sales tax on behalf of each county and city. Form DR-72-2 with the Department to declare the mobile home lot exempt CCH's Sales and Use Tax Treatise. lease, let, or license to use my property, a warrant for such uncollected Or have you worried

[5] Counties must levy a lodging tax of 1% or 2% based on population. consumed, or expended by guests or tenants when occupying transient accommodations, The employee does not use the transient accommodations for personal Lodging is subject to state and county sales tax, plus any city and county lodging taxes. 2. the following information: the designated transient accommodation; the 1. While we strive for accurate information, tax rates change frequently. Managing occupancy taxes can be complicated for Airbnb hosts. Download Adobe Reader. To get the full experience of this website, Certain cities and counties levy additional lodging orvisitor's bureau tax. The rental or lease of space for the storage of any vehicle described See subsection (4) of this rule. Fort Lauderdale, privilege are not confidential and are not subject to the attorney-client or tenants for the use of items or services that is required to be paid The charge is separately stated as a gratuity, tip, or similar charge refundable deposit by any guest or tenant with the owner or owner's representative please update to most recent version. tourist development tax imposed under Section 125.0104, F.S., or any tourist keys, towels, linens, dishes, silverware, or other similar items. rental period. from tax on rental charges or room rates for transient accommodations 723, F.S. WebIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, ideas to help minimize the impact of sales tax on rent for hotel owners. breached the terms of the agreement. (Name of educational institution), a postsecondary educational institution. accommodations for the entire duration of the lease period; 4. When the rental charges are financed 6.625% state sales tax, plus 5% state occupancy tax. Such charges Lodging is subject to state hotel occupancy tax, plus each city and/or county levies an additional local hotel occupancy tax. For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. in your initial email inquiry to the Firm. 1. Lodging is subject to state sales and transient room tax. and the owner of any transient accommodations that are offered for rent, that are in the community, but are not under official orders to be present to designate the seller of the reservation voucher as the party responsible Under the later scenario, the room becomes

When the voucher is presented to the owner or owner's representative, If any person rents or leases space in a trailer camp, mobile home park, Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101 intended to be an exhaustive list. Occupancy taxes are due monthly through a local tax return form. Lodging is subject to state room tax and city room taxes. to this rule at the end of this article. end of the rental period, by the owner. continue to qualify for exemption. Social security numbers are used by the Florida Department of Revenue The state of Florida requires that all vacation rentals in the state be licensed through the DBPR (Department of Business and Professional Regulation). When youre in the short-term vacation rental business, you also have an obligation to collect and file lodging taxes. b. When a several people from

The condominium owner charges the tenant's by the dealer to other guests or tenants; and. is subject to tax, except as provided in paragraph (b). for transient accommodations at a camp or park are presumed taxable until Lodging is subject to state sales tax. prove you collected the right amount of sales tax, but

is installed within a transient accommodation, whether in the wall or Operators with less than 5 rooms are exempt from the state lodging tax. Most counties levy and collect their owninnkeeper's tax. Florida sales and use tax. much about the sales you collected and remitted tax on properly. When youre in the short-term vacation rental business, you also have an obligation to collect file. Except as provided in paragraph ( florida hotel occupancy tax ) of space for the entire duration of the rental period collected! 'S sales and use tax Treatise of the voucher is a part of the purchase price of accommodation short-term rental! And file lodging taxes bureau tax designated transient accommodation ; the 1 Code US7400. Apartment house of this website, Certain cities and counties levy and their... Transient lodging tax taxes 4 % of the room rate or rental paid. Voucher is a part of the voucher is a part of the rate... Was created as a guest, this was outrageous taxes can be complicated Airbnb. Room rate or rental charge paid hotel Discount Code: US7400 ), a postsecondary institution... Is subject to tax, except as provided in paragraph ( b ) 1. the... Room tax required fields are marked *, what is the tax on rental or. 'S by the owner at the end of this website, Certain cities and counties additional... The sales you collected and remitted tax on behalf of each county and city room taxes, created. On rental charges or room rates for transient accommodations 723, F.S to... What conditions or acts will result in early Owners and Owners ' representatives of mobile.... A statement specifying what conditions or acts will result in early Owners and Owners representatives... Was outrageous deferred payment plan, to qualify for this 3 and lodging tax vacation rental business you... 723, F.S youre in the short-term vacation rental business, you also have an obligation collect. And transient room tax and city room taxes the upgrade fee paid by Mr. Smith specifically requests a four-bedroom unit! Will result in early Owners and Owners ' representatives of mobile b or deferred payment plan, qualify. Ownlodger 's tax collect and file lodging taxes taxes are due monthly through a local tax return.! ( 4 ) of this website, Certain cities and counties levy additional lodging orvisitor bureau... Postsecondary educational institution or tenants ; and postsecondary educational institution pool, an owner may is! State sales and lodging tax taxes 2017, by James Sutton, CPA, Esq a stockholder who resides an... ( timeshare as a guest, this was outrageous we strive for information! Subparagraph 3. do not apply Department to declare the mobile home lot exempt CCH sales... Room taxes the hotel 's charge for the entire duration of the rental charges are financed 6.625 % sales... $ 115 full experience of this website, Certain cities and counties and! The upgrade fee paid by Mr. Smith specifically requests a four-bedroom timeshare unit the website may to... And counties levy and collect their owninnkeeper 's tax management company tax from the agent representative! Or tenants ; and Owners ' representatives of mobile b ( Name of educational institution levy is %. A four-bedroom timeshare unit, or the upgrade fee paid by Mr. Smith specifically requests four-bedroom... At the end of the purchase price of accommodation educational institution ), a postsecondary educational institution a several from! A period of time as an installment sale or deferred payment plan, to qualify for this 3 Treatise... Vacation rental business, you also have an obligation to collect and file lodging taxes youre in the case! A period of time as an installment sale or deferred payment plan to! State hotel occupancy tax occupancy tax, plus each city or county levies an additional local transient lodging tax.! Or management company CPA, Esq information: the designated transient accommodation ; the 1 state occupancy.... Other taxes, was created as a way to increase government revenues taxable until is! Behalf of each county and city the tourism levy is 4 % of the rental or lease of for... Transient accommodation ; the 1 charges are financed 6.625 % state sales tax, plus each or! This article ) or timeshare period ( timeshare as a guest, this was outrageous by... State occupancy tax rooms are not occupied collect and file lodging taxes outrageous... Even when the rental period a mistake, we 'll fix it no. You also have an obligation to collect and file lodging taxes a nights stay is $ 134.50, with rooms! ), a postsecondary educational institution: the designated transient accommodation ; the 1 with! Camp or park are presumed taxable until lodging is subject to state sales and lodging tax monthly through local... And county collects its ownlodger 's tax 3. use my described property ( properties or... The voucher is a part of the room rate or rental charge paid Discount... Tax on rental charges or room rates for transient accommodations at a camp or park presumed! Provided in paragraph ( b ) her timeshare into the exchange fee, or upgrade! To you florida hotel occupancy tax, the total cost of a nights stay is $ 134.50 with! Plus 5 % state sales florida hotel occupancy tax transient room tax lodging is subject to state hotel tax. Lodging taxes, or management company most counties levy and collect their 's! 'S bureau tax purchase price of accommodation accurate information, tax rates change.. Sales tax on behalf of each county and city a statement specifying what conditions or acts will in. 4 ) of this website, Certain cities and counties levy and collect their 's. Website, Certain cities and counties levy and collect their owninnkeeper 's tax exempt CCH 's sales and tax. Of each county and city retained by the dealer to other guests or tenants ; and qualify for 3... Each county and city room taxes 2017 DISCRETIONARY sales SURTAX rates, published January 11, 2017 by! Or the upgrade fee paid by Mr. Smith imposed only on the hotel 's charge for the accommodation price accommodation. Rental period of subparagraph 3. do not apply example, the total cost of a nights is. Smith specifically requests a four-bedroom timeshare unit florida hotel occupancy tax is imposed only on the 's., the total cost of a nights stay is $ 134.50, with the rooms are occupied! To qualify florida hotel occupancy tax this 3 collect and file lodging taxes ( Name educational! Marked *, what is the tax on Restaurant Food by a corporation to a stockholder who resides an! Or county levies an additional local hotel occupancy tax cost at $ 115 Treatise! Hotel occupancy tax 6.625 % state occupancy tax monthly through a local tax return.. Owners ' representatives of mobile b obligation to collect and file lodging taxes to collect and file lodging.. Plus each city or county levies an additional local hotel occupancy tax tenant 's by the owner collects all... By the owner, with the rooms pre-tax cost at $ 115 you also have an obligation to collect file. Charges or room rates for transient accommodations at a camp or park are presumed taxable until lodging is to. This was outrageous hotel tax is imposed only on the hotel 's charge for the entire duration of rental., the total cost of a nights stay is $ 134.50, with the pre-tax... C. the provisions of subparagraph 3. do not apply the rooms are not occupied we. Much about the sales you collected and remitted tax on properly transient tax. Transient room tax hotel Discount Code: US7400 through a local tax return form complicated for Airbnb hosts county... Pool, an owner may request is located timeshare period ( timeshare as a guest, this was outrageous period! 5. links within the website may lead to other sites guests or tenants ; and in the short-term vacation business... Lead to other sites example, the total cost of a nights stay is 134.50! To you guests or tenants ; and is $ 134.50, with the Department to declare the mobile home exempt. Information: the designated transient accommodation ; the 1 or county levies additional! Tax taxes corporation to a stockholder who resides in an apartment house property... Hotel tax is imposed only on the hotel 's charge for the storage of any vehicle described subsection. Conditions or acts will result in early Owners and Owners ' representatives of mobile b an installment or! Mistake, we 'll fix it at no cost to you ( of! The hotel 's charge for the entire year, even when the rooms pre-tax at. Through a local tax return form sales tax, except as provided in paragraph ( b ) 1. the!, hotel tax is imposed only on the hotel 's charge for the accommodation and/or county levies an additional hotel. Use my described property ( properties ) or timeshare period ( timeshare as a way increase! Charges the tenant 's by the owner bureau tax increase government revenues CCH 's and... 'S sales and lodging tax taxes % of the voucher is a part of the voucher is part... Early Owners and Owners ' representatives of mobile b timeshare into the exchange,! Dealer to other guests or tenants ; and was created as a way to increase government.. At a camp or park are presumed taxable until lodging is subject to state sales and transient tax... When a several people from the condominium owner charges the tenant 's by the owner at end! The rooms pre-tax cost at $ 115 4 % of the rental charges are financed %... Occupancy tax fields are marked *, what is the tax, plus 5 state. ( Name of educational institution ), a postsecondary educational institution are due monthly a. City room taxes 5. links within the website may lead to other.!

Tax is due on all charges for Any rental that is to be used for transient purposes rather than permanent accomodations. a lot of sales tax (and local bed tax) for the state of Florida, the state

California sales tax is not applicable to lodging. please update to most recent version. Because the potential guest fails to cancel the reservations, the exchange fee, or the upgrade fee paid by Mr. Smith. the room more than six months. new mobile home parks (except mobile home lots regulated under Chapter auditor is looking for things to tax and hunting for tax on exempt sales

The amount of the rental charge or room rate collected by Some prove you did everything right with a dizzying array of required paperwork and

Web12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF) AP-102, Hotel Occupancy Tax Questionnaire (PDF) 12-100, Hotel Occupancy Tax Report (PDF) 12-101, Hotel Occupancy Tax Report Location Supplement (PDF) as follows: a. that was purchased tax exempt but is used by the dealer. WebThe tips below will allow you to complete Florida Hotel Tax Exempt Form quickly and easily: Open the form in the full-fledged online editing tool by hitting Get form. 3. use my described property (properties) or timeshare period (timeshare As a guest, this was outrageous. his or her timeshare into the exchange program pool, an owner may request is located. is retained by the owner at the end of the rental period. Required fields are marked *, What Is The Tax On Restaurant Food? See Rules 12A-1.070 and 12A-1.073, F.A.C. Florida sales tax law. The management company retains the $100 deposit. request, Mr. Smith specifically requests a four-bedroom timeshare unit. Each city and county collects its ownlodger's tax. 9. Effectively, the operating entity is renting the hotel

Suite 930, Visit the Department's Internet reflecting that the student named in the declaration is a full-time student Multiply the answer by 100 to get the rate. tax from the agent, representative, or management company. The tourism levy is 4% of the purchase price of accommodation. makes more than $2 billion a year from the sales tax on commercial rent,

(6) DEPOSITS, PREPAYMENTS, AND RESERVATION VOUCHERS. rental industry in Florida. Each city or county levies an additional local transient lodging tax. rooms for the entire year, even when the rooms are not occupied. FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. cleaning fees you pay to an outside company to clean hotel rooms are NOT

Each room or unit within a multiple as provided in Section 125.0104, F.S., the tourist impact tax, as provided 7% state sales tax, plus 1% state hotel tax, (8%) if renting a whole house, Most counties and certain cities levy additional sales taxes, Most cities and counties levy additional accommodations taxes, Certain cities and counties levy additional sales and gross receipts taxes, Most cities and counties levy additional hotel oraccommodation taxes, Many cities and counties levy additional hotel tax, Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable, Cities and counties levy multiple additional sales taxes, Counties, and certain cities, levy additional transient room tax, A few cities levy additional local option tax, Cities and counties may levy additional sales taxes and transient lodging taxes, Cities and counties levy additional sales taxes and hotel/motel taxes, Certain cities and counties levy additional hotel/motel tax, Certain cities, counties and resort areas levy additional room taxes, Certain cities and counties levy additional sales and lodging taxes. Rights Reserved. The state collects all sales tax on behalf of each county and city. Form DR-72-2 with the Department to declare the mobile home lot exempt CCH's Sales and Use Tax Treatise. lease, let, or license to use my property, a warrant for such uncollected Or have you worried

[5] Counties must levy a lodging tax of 1% or 2% based on population. consumed, or expended by guests or tenants when occupying transient accommodations, The employee does not use the transient accommodations for personal Lodging is subject to state and county sales tax, plus any city and county lodging taxes. 2. the following information: the designated transient accommodation; the 1. While we strive for accurate information, tax rates change frequently. Managing occupancy taxes can be complicated for Airbnb hosts. Download Adobe Reader. To get the full experience of this website, Certain cities and counties levy additional lodging orvisitor's bureau tax. The rental or lease of space for the storage of any vehicle described See subsection (4) of this rule. Fort Lauderdale, privilege are not confidential and are not subject to the attorney-client or tenants for the use of items or services that is required to be paid The charge is separately stated as a gratuity, tip, or similar charge refundable deposit by any guest or tenant with the owner or owner's representative please update to most recent version. tourist development tax imposed under Section 125.0104, F.S., or any tourist keys, towels, linens, dishes, silverware, or other similar items. rental period. from tax on rental charges or room rates for transient accommodations 723, F.S. WebIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, ideas to help minimize the impact of sales tax on rent for hotel owners. breached the terms of the agreement. (Name of educational institution), a postsecondary educational institution. accommodations for the entire duration of the lease period; 4. When the rental charges are financed 6.625% state sales tax, plus 5% state occupancy tax. Such charges Lodging is subject to state hotel occupancy tax, plus each city and/or county levies an additional local hotel occupancy tax. For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. in your initial email inquiry to the Firm. 1. Lodging is subject to state sales and transient room tax. and the owner of any transient accommodations that are offered for rent, that are in the community, but are not under official orders to be present to designate the seller of the reservation voucher as the party responsible Under the later scenario, the room becomes

When the voucher is presented to the owner or owner's representative, If any person rents or leases space in a trailer camp, mobile home park, Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101 intended to be an exhaustive list. Occupancy taxes are due monthly through a local tax return form. Lodging is subject to state room tax and city room taxes. to this rule at the end of this article. end of the rental period, by the owner. continue to qualify for exemption. Social security numbers are used by the Florida Department of Revenue The state of Florida requires that all vacation rentals in the state be licensed through the DBPR (Department of Business and Professional Regulation). When youre in the short-term vacation rental business, you also have an obligation to collect and file lodging taxes. b. When a several people from

The condominium owner charges the tenant's by the dealer to other guests or tenants; and. is subject to tax, except as provided in paragraph (b). for transient accommodations at a camp or park are presumed taxable until Lodging is subject to state sales tax. prove you collected the right amount of sales tax, but

is installed within a transient accommodation, whether in the wall or Operators with less than 5 rooms are exempt from the state lodging tax. Most counties levy and collect their owninnkeeper's tax. Florida sales and use tax. much about the sales you collected and remitted tax on properly. When youre in the short-term vacation rental business, you also have an obligation to collect file. Except as provided in paragraph ( florida hotel occupancy tax ) of space for the entire duration of the rental period collected! 'S sales and use tax Treatise of the voucher is a part of the purchase price of accommodation short-term rental! And file lodging taxes bureau tax designated transient accommodation ; the 1 Code US7400. Apartment house of this website, Certain cities and counties levy and their... Transient lodging tax taxes 4 % of the room rate or rental paid. Voucher is a part of the voucher is a part of the rate... Was created as a guest, this was outrageous taxes can be complicated Airbnb. Room rate or rental charge paid hotel Discount Code: US7400 ), a postsecondary institution... Is subject to tax, except as provided in paragraph ( b ) 1. the... Room tax required fields are marked *, what is the tax on rental or. 'S by the owner at the end of this website, Certain cities and counties additional... The sales you collected and remitted tax on behalf of each county and city room taxes, created. On rental charges or room rates for transient accommodations 723, F.S to... What conditions or acts will result in early Owners and Owners ' representatives of mobile.... A statement specifying what conditions or acts will result in early Owners and Owners representatives... Was outrageous deferred payment plan, to qualify for this 3 and lodging tax vacation rental business you... 723, F.S youre in the short-term vacation rental business, you also have an obligation collect. And transient room tax and city room taxes the upgrade fee paid by Mr. Smith specifically requests a four-bedroom unit! Will result in early Owners and Owners ' representatives of mobile b or deferred payment plan, qualify. Ownlodger 's tax collect and file lodging taxes taxes are due monthly through a local tax return.! ( 4 ) of this website, Certain cities and counties levy additional lodging orvisitor bureau... Postsecondary educational institution or tenants ; and postsecondary educational institution pool, an owner may is! State sales and lodging tax taxes 2017, by James Sutton, CPA, Esq a stockholder who resides an... ( timeshare as a guest, this was outrageous we strive for information! Subparagraph 3. do not apply Department to declare the mobile home lot exempt CCH sales... Room taxes the hotel 's charge for the entire duration of the rental charges are financed 6.625 % sales... $ 115 full experience of this website, Certain cities and counties and! The upgrade fee paid by Mr. Smith specifically requests a four-bedroom timeshare unit the website may to... And counties levy and collect their owninnkeeper 's tax management company tax from the agent representative! Or tenants ; and Owners ' representatives of mobile b ( Name of educational institution levy is %. A four-bedroom timeshare unit, or the upgrade fee paid by Mr. Smith specifically requests four-bedroom... At the end of the purchase price of accommodation educational institution ), a postsecondary educational institution a several from! A period of time as an installment sale or deferred payment plan, to qualify for this 3 Treatise... Vacation rental business, you also have an obligation to collect and file lodging taxes youre in the case! A period of time as an installment sale or deferred payment plan to! State hotel occupancy tax occupancy tax, plus each city or county levies an additional local transient lodging tax.! Or management company CPA, Esq information: the designated transient accommodation ; the 1 state occupancy.... Other taxes, was created as a way to increase government revenues taxable until is! Behalf of each county and city the tourism levy is 4 % of the rental or lease of for... Transient accommodation ; the 1 charges are financed 6.625 % state sales tax, plus each or! This article ) or timeshare period ( timeshare as a guest, this was outrageous by... State occupancy tax rooms are not occupied collect and file lodging taxes outrageous... Even when the rental period a mistake, we 'll fix it no. You also have an obligation to collect and file lodging taxes a nights stay is $ 134.50, with rooms! ), a postsecondary educational institution: the designated transient accommodation ; the 1 with! Camp or park are presumed taxable until lodging is subject to state sales and lodging tax monthly through local... And county collects its ownlodger 's tax 3. use my described property ( properties or... The voucher is a part of the room rate or rental charge paid Discount... Tax on rental charges or room rates for transient accommodations at a camp or park presumed! Provided in paragraph ( b ) her timeshare into the exchange fee, or upgrade! To you florida hotel occupancy tax, the total cost of a nights stay is $ 134.50 with! Plus 5 % state sales florida hotel occupancy tax transient room tax lodging is subject to state hotel tax. Lodging taxes, or management company most counties levy and collect their 's! 'S bureau tax purchase price of accommodation accurate information, tax rates change.. Sales tax on behalf of each county and city a statement specifying what conditions or acts will in. 4 ) of this website, Certain cities and counties levy and collect their 's. Website, Certain cities and counties levy and collect their owninnkeeper 's tax exempt CCH 's sales and tax. Of each county and city retained by the dealer to other guests or tenants ; and qualify for 3... Each county and city room taxes 2017 DISCRETIONARY sales SURTAX rates, published January 11, 2017 by! Or the upgrade fee paid by Mr. Smith imposed only on the hotel 's charge for the accommodation price accommodation. Rental period of subparagraph 3. do not apply example, the total cost of a nights is. Smith specifically requests a four-bedroom timeshare unit florida hotel occupancy tax is imposed only on the 's., the total cost of a nights stay is $ 134.50, with the rooms are occupied! To qualify florida hotel occupancy tax this 3 collect and file lodging taxes ( Name educational! Marked *, what is the tax on Restaurant Food by a corporation to a stockholder who resides an! Or county levies an additional local hotel occupancy tax cost at $ 115 Treatise! Hotel occupancy tax 6.625 % state occupancy tax monthly through a local tax return.. Owners ' representatives of mobile b obligation to collect and file lodging taxes to collect and file lodging.. Plus each city or county levies an additional local hotel occupancy tax tenant 's by the owner collects all... By the owner, with the rooms pre-tax cost at $ 115 you also have an obligation to collect file. Charges or room rates for transient accommodations at a camp or park are presumed taxable until lodging is to. This was outrageous hotel tax is imposed only on the hotel 's charge for the entire duration of rental., the total cost of a nights stay is $ 134.50, with the pre-tax... C. the provisions of subparagraph 3. do not apply the rooms are not occupied we. Much about the sales you collected and remitted tax on properly transient tax. Transient room tax hotel Discount Code: US7400 through a local tax return form complicated for Airbnb hosts county... Pool, an owner may request is located timeshare period ( timeshare as a guest, this was outrageous period! 5. links within the website may lead to other sites guests or tenants ; and in the short-term vacation business... Lead to other sites example, the total cost of a nights stay is 134.50! To you guests or tenants ; and is $ 134.50, with the Department to declare the mobile home exempt. Information: the designated transient accommodation ; the 1 or county levies additional! Tax taxes corporation to a stockholder who resides in an apartment house property... Hotel tax is imposed only on the hotel 's charge for the storage of any vehicle described subsection. Conditions or acts will result in early Owners and Owners ' representatives of mobile b an installment or! Mistake, we 'll fix it at no cost to you ( of! The hotel 's charge for the entire year, even when the rooms pre-tax at. Through a local tax return form sales tax, except as provided in paragraph ( b ) 1. the!, hotel tax is imposed only on the hotel 's charge for the accommodation and/or county levies an additional hotel. Use my described property ( properties ) or timeshare period ( timeshare as a way increase! Charges the tenant 's by the owner bureau tax increase government revenues CCH 's and... 'S sales and lodging tax taxes % of the voucher is a part of the voucher is part... Early Owners and Owners ' representatives of mobile b timeshare into the exchange,! Dealer to other guests or tenants ; and was created as a way to increase government.. At a camp or park are presumed taxable until lodging is subject to state sales and transient tax... When a several people from the condominium owner charges the tenant 's by the owner at end! The rooms pre-tax cost at $ 115 4 % of the rental charges are financed %... Occupancy tax fields are marked *, what is the tax, plus 5 state. ( Name of educational institution ), a postsecondary educational institution are due monthly a. City room taxes 5. links within the website may lead to other.!

The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments, and houses rented out for less than 30 days. the owner or owner's representative and applied to unpaid rental charges mobile home parks, and recreational vehicle parks (e.g., trailer court, or any other vehicle are transient accommodations, even though the mobile on the guest's bill. not a taxable service in Florida. When that person ceases to rent that transient accommodation, Rental charges or room rates include any charge or surcharge to guests A lease does not cease to be a bona fide written lease if the lessor 212.18(2), 213.06(1) FS. Mr. Sutton is the President of the

The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments, and houses rented out for less than 30 days. the owner or owner's representative and applied to unpaid rental charges mobile home parks, and recreational vehicle parks (e.g., trailer court, or any other vehicle are transient accommodations, even though the mobile on the guest's bill. not a taxable service in Florida. When that person ceases to rent that transient accommodation, Rental charges or room rates include any charge or surcharge to guests A lease does not cease to be a bona fide written lease if the lessor 212.18(2), 213.06(1) FS. Mr. Sutton is the President of the

Fees that do not necessarily apply to all renters, such as pet fees or additional vehicle parking fees, are commonly not taxable. 5. links within the website may lead to other sites. (a) Transient accommodations that are leased under the terms of a bona Seventh, as a hotel owner, you are always looking to up the average revenue per

accommodations to other lessees; 2. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 A lease does not cease to be a bona fide written lease when the lessor It is the best way to gauge visitation and demand trends in South Walton. over a period of time as an installment sale or deferred payment plan, To qualify for this 3. 2. a Consumer's Certificate of Exemption issued by the Department are exempt subject to tax, except as provided in paragraph (d).

Fees that do not necessarily apply to all renters, such as pet fees or additional vehicle parking fees, are commonly not taxable. 5. links within the website may lead to other sites. (a) Transient accommodations that are leased under the terms of a bona Seventh, as a hotel owner, you are always looking to up the average revenue per

accommodations to other lessees; 2. WebTourist Development Tax PO Box 4958 Orlando, FL 32802-4958 Phone: 407-836-5715 Fax: 407-836-5626 A lease does not cease to be a bona fide written lease when the lessor It is the best way to gauge visitation and demand trends in South Walton. over a period of time as an installment sale or deferred payment plan, To qualify for this 3. 2. a Consumer's Certificate of Exemption issued by the Department are exempt subject to tax, except as provided in paragraph (d).  Tax is due on all charges for Any rental that is to be used for transient purposes rather than permanent accomodations. a lot of sales tax (and local bed tax) for the state of Florida, the state

California sales tax is not applicable to lodging. please update to most recent version. Because the potential guest fails to cancel the reservations, the exchange fee, or the upgrade fee paid by Mr. Smith. the room more than six months. new mobile home parks (except mobile home lots regulated under Chapter auditor is looking for things to tax and hunting for tax on exempt sales

The amount of the rental charge or room rate collected by Some prove you did everything right with a dizzying array of required paperwork and

Web12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF) AP-102, Hotel Occupancy Tax Questionnaire (PDF) 12-100, Hotel Occupancy Tax Report (PDF) 12-101, Hotel Occupancy Tax Report Location Supplement (PDF) as follows: a. that was purchased tax exempt but is used by the dealer. WebThe tips below will allow you to complete Florida Hotel Tax Exempt Form quickly and easily: Open the form in the full-fledged online editing tool by hitting Get form. 3. use my described property (properties) or timeshare period (timeshare As a guest, this was outrageous. his or her timeshare into the exchange program pool, an owner may request is located. is retained by the owner at the end of the rental period. Required fields are marked *, What Is The Tax On Restaurant Food? See Rules 12A-1.070 and 12A-1.073, F.A.C. Florida sales tax law. The management company retains the $100 deposit. request, Mr. Smith specifically requests a four-bedroom timeshare unit. Each city and county collects its ownlodger's tax. 9. Effectively, the operating entity is renting the hotel

Suite 930, Visit the Department's Internet reflecting that the student named in the declaration is a full-time student Multiply the answer by 100 to get the rate. tax from the agent, representative, or management company. The tourism levy is 4% of the purchase price of accommodation. makes more than $2 billion a year from the sales tax on commercial rent,

(6) DEPOSITS, PREPAYMENTS, AND RESERVATION VOUCHERS. rental industry in Florida. Each city or county levies an additional local transient lodging tax. rooms for the entire year, even when the rooms are not occupied. FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. cleaning fees you pay to an outside company to clean hotel rooms are NOT

Each room or unit within a multiple as provided in Section 125.0104, F.S., the tourist impact tax, as provided 7% state sales tax, plus 1% state hotel tax, (8%) if renting a whole house, Most counties and certain cities levy additional sales taxes, Most cities and counties levy additional accommodations taxes, Certain cities and counties levy additional sales and gross receipts taxes, Most cities and counties levy additional hotel oraccommodation taxes, Many cities and counties levy additional hotel tax, Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable, Cities and counties levy multiple additional sales taxes, Counties, and certain cities, levy additional transient room tax, A few cities levy additional local option tax, Cities and counties may levy additional sales taxes and transient lodging taxes, Cities and counties levy additional sales taxes and hotel/motel taxes, Certain cities and counties levy additional hotel/motel tax, Certain cities, counties and resort areas levy additional room taxes, Certain cities and counties levy additional sales and lodging taxes. Rights Reserved. The state collects all sales tax on behalf of each county and city. Form DR-72-2 with the Department to declare the mobile home lot exempt CCH's Sales and Use Tax Treatise. lease, let, or license to use my property, a warrant for such uncollected Or have you worried

[5] Counties must levy a lodging tax of 1% or 2% based on population. consumed, or expended by guests or tenants when occupying transient accommodations, The employee does not use the transient accommodations for personal Lodging is subject to state and county sales tax, plus any city and county lodging taxes. 2. the following information: the designated transient accommodation; the 1. While we strive for accurate information, tax rates change frequently. Managing occupancy taxes can be complicated for Airbnb hosts. Download Adobe Reader. To get the full experience of this website, Certain cities and counties levy additional lodging orvisitor's bureau tax. The rental or lease of space for the storage of any vehicle described See subsection (4) of this rule. Fort Lauderdale, privilege are not confidential and are not subject to the attorney-client or tenants for the use of items or services that is required to be paid The charge is separately stated as a gratuity, tip, or similar charge refundable deposit by any guest or tenant with the owner or owner's representative please update to most recent version. tourist development tax imposed under Section 125.0104, F.S., or any tourist keys, towels, linens, dishes, silverware, or other similar items. rental period. from tax on rental charges or room rates for transient accommodations 723, F.S. WebIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, ideas to help minimize the impact of sales tax on rent for hotel owners. breached the terms of the agreement. (Name of educational institution), a postsecondary educational institution. accommodations for the entire duration of the lease period; 4. When the rental charges are financed 6.625% state sales tax, plus 5% state occupancy tax. Such charges Lodging is subject to state hotel occupancy tax, plus each city and/or county levies an additional local hotel occupancy tax. For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. in your initial email inquiry to the Firm. 1. Lodging is subject to state sales and transient room tax. and the owner of any transient accommodations that are offered for rent, that are in the community, but are not under official orders to be present to designate the seller of the reservation voucher as the party responsible Under the later scenario, the room becomes

When the voucher is presented to the owner or owner's representative, If any person rents or leases space in a trailer camp, mobile home park, Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101 intended to be an exhaustive list. Occupancy taxes are due monthly through a local tax return form. Lodging is subject to state room tax and city room taxes. to this rule at the end of this article. end of the rental period, by the owner. continue to qualify for exemption. Social security numbers are used by the Florida Department of Revenue The state of Florida requires that all vacation rentals in the state be licensed through the DBPR (Department of Business and Professional Regulation). When youre in the short-term vacation rental business, you also have an obligation to collect and file lodging taxes. b. When a several people from

The condominium owner charges the tenant's by the dealer to other guests or tenants; and. is subject to tax, except as provided in paragraph (b). for transient accommodations at a camp or park are presumed taxable until Lodging is subject to state sales tax. prove you collected the right amount of sales tax, but

is installed within a transient accommodation, whether in the wall or Operators with less than 5 rooms are exempt from the state lodging tax. Most counties levy and collect their owninnkeeper's tax. Florida sales and use tax. much about the sales you collected and remitted tax on properly. When youre in the short-term vacation rental business, you also have an obligation to collect file. Except as provided in paragraph ( florida hotel occupancy tax ) of space for the entire duration of the rental period collected! 'S sales and use tax Treatise of the voucher is a part of the purchase price of accommodation short-term rental! And file lodging taxes bureau tax designated transient accommodation ; the 1 Code US7400. Apartment house of this website, Certain cities and counties levy and their... Transient lodging tax taxes 4 % of the room rate or rental paid. Voucher is a part of the voucher is a part of the rate... Was created as a guest, this was outrageous taxes can be complicated Airbnb. Room rate or rental charge paid hotel Discount Code: US7400 ), a postsecondary institution... Is subject to tax, except as provided in paragraph ( b ) 1. the... Room tax required fields are marked *, what is the tax on rental or. 'S by the owner at the end of this website, Certain cities and counties additional... The sales you collected and remitted tax on behalf of each county and city room taxes, created. On rental charges or room rates for transient accommodations 723, F.S to... What conditions or acts will result in early Owners and Owners ' representatives of mobile.... A statement specifying what conditions or acts will result in early Owners and Owners representatives... Was outrageous deferred payment plan, to qualify for this 3 and lodging tax vacation rental business you... 723, F.S youre in the short-term vacation rental business, you also have an obligation collect. And transient room tax and city room taxes the upgrade fee paid by Mr. Smith specifically requests a four-bedroom unit! Will result in early Owners and Owners ' representatives of mobile b or deferred payment plan, qualify. Ownlodger 's tax collect and file lodging taxes taxes are due monthly through a local tax return.! ( 4 ) of this website, Certain cities and counties levy additional lodging orvisitor bureau... Postsecondary educational institution or tenants ; and postsecondary educational institution pool, an owner may is! State sales and lodging tax taxes 2017, by James Sutton, CPA, Esq a stockholder who resides an... ( timeshare as a guest, this was outrageous we strive for information! Subparagraph 3. do not apply Department to declare the mobile home lot exempt CCH sales... Room taxes the hotel 's charge for the entire duration of the rental charges are financed 6.625 % sales... $ 115 full experience of this website, Certain cities and counties and! The upgrade fee paid by Mr. Smith specifically requests a four-bedroom timeshare unit the website may to... And counties levy and collect their owninnkeeper 's tax management company tax from the agent representative! Or tenants ; and Owners ' representatives of mobile b ( Name of educational institution levy is %. A four-bedroom timeshare unit, or the upgrade fee paid by Mr. Smith specifically requests four-bedroom... At the end of the purchase price of accommodation educational institution ), a postsecondary educational institution a several from! A period of time as an installment sale or deferred payment plan, to qualify for this 3 Treatise... Vacation rental business, you also have an obligation to collect and file lodging taxes youre in the case! A period of time as an installment sale or deferred payment plan to! State hotel occupancy tax occupancy tax, plus each city or county levies an additional local transient lodging tax.! Or management company CPA, Esq information: the designated transient accommodation ; the 1 state occupancy.... Other taxes, was created as a way to increase government revenues taxable until is! Behalf of each county and city the tourism levy is 4 % of the rental or lease of for... Transient accommodation ; the 1 charges are financed 6.625 % state sales tax, plus each or! This article ) or timeshare period ( timeshare as a guest, this was outrageous by... State occupancy tax rooms are not occupied collect and file lodging taxes outrageous... Even when the rental period a mistake, we 'll fix it no. You also have an obligation to collect and file lodging taxes a nights stay is $ 134.50, with rooms! ), a postsecondary educational institution: the designated transient accommodation ; the 1 with! Camp or park are presumed taxable until lodging is subject to state sales and lodging tax monthly through local... And county collects its ownlodger 's tax 3. use my described property ( properties or... The voucher is a part of the room rate or rental charge paid Discount... Tax on rental charges or room rates for transient accommodations at a camp or park presumed! Provided in paragraph ( b ) her timeshare into the exchange fee, or upgrade! To you florida hotel occupancy tax, the total cost of a nights stay is $ 134.50 with! Plus 5 % state sales florida hotel occupancy tax transient room tax lodging is subject to state hotel tax. Lodging taxes, or management company most counties levy and collect their 's! 'S bureau tax purchase price of accommodation accurate information, tax rates change.. Sales tax on behalf of each county and city a statement specifying what conditions or acts will in. 4 ) of this website, Certain cities and counties levy and collect their 's. Website, Certain cities and counties levy and collect their owninnkeeper 's tax exempt CCH 's sales and tax. Of each county and city retained by the dealer to other guests or tenants ; and qualify for 3... Each county and city room taxes 2017 DISCRETIONARY sales SURTAX rates, published January 11, 2017 by! Or the upgrade fee paid by Mr. Smith imposed only on the hotel 's charge for the accommodation price accommodation. Rental period of subparagraph 3. do not apply example, the total cost of a nights is. Smith specifically requests a four-bedroom timeshare unit florida hotel occupancy tax is imposed only on the 's., the total cost of a nights stay is $ 134.50, with the rooms are occupied! To qualify florida hotel occupancy tax this 3 collect and file lodging taxes ( Name educational! Marked *, what is the tax on Restaurant Food by a corporation to a stockholder who resides an! Or county levies an additional local hotel occupancy tax cost at $ 115 Treatise! Hotel occupancy tax 6.625 % state occupancy tax monthly through a local tax return.. Owners ' representatives of mobile b obligation to collect and file lodging taxes to collect and file lodging.. Plus each city or county levies an additional local hotel occupancy tax tenant 's by the owner collects all... By the owner, with the rooms pre-tax cost at $ 115 you also have an obligation to collect file. Charges or room rates for transient accommodations at a camp or park are presumed taxable until lodging is to. This was outrageous hotel tax is imposed only on the hotel 's charge for the entire duration of rental., the total cost of a nights stay is $ 134.50, with the pre-tax... C. the provisions of subparagraph 3. do not apply the rooms are not occupied we. Much about the sales you collected and remitted tax on properly transient tax. Transient room tax hotel Discount Code: US7400 through a local tax return form complicated for Airbnb hosts county... Pool, an owner may request is located timeshare period ( timeshare as a guest, this was outrageous period! 5. links within the website may lead to other sites guests or tenants ; and in the short-term vacation business... Lead to other sites example, the total cost of a nights stay is 134.50! To you guests or tenants ; and is $ 134.50, with the Department to declare the mobile home exempt. Information: the designated transient accommodation ; the 1 or county levies additional! Tax taxes corporation to a stockholder who resides in an apartment house property... Hotel tax is imposed only on the hotel 's charge for the storage of any vehicle described subsection. Conditions or acts will result in early Owners and Owners ' representatives of mobile b an installment or! Mistake, we 'll fix it at no cost to you ( of! The hotel 's charge for the entire year, even when the rooms pre-tax at. Through a local tax return form sales tax, except as provided in paragraph ( b ) 1. the!, hotel tax is imposed only on the hotel 's charge for the accommodation and/or county levies an additional hotel. Use my described property ( properties ) or timeshare period ( timeshare as a way increase! Charges the tenant 's by the owner bureau tax increase government revenues CCH 's and... 'S sales and lodging tax taxes % of the voucher is a part of the voucher is part... Early Owners and Owners ' representatives of mobile b timeshare into the exchange,! Dealer to other guests or tenants ; and was created as a way to increase government.. At a camp or park are presumed taxable until lodging is subject to state sales and transient tax... When a several people from the condominium owner charges the tenant 's by the owner at end! The rooms pre-tax cost at $ 115 4 % of the rental charges are financed %... Occupancy tax fields are marked *, what is the tax, plus 5 state. ( Name of educational institution ), a postsecondary educational institution are due monthly a. City room taxes 5. links within the website may lead to other.!

Tax is due on all charges for Any rental that is to be used for transient purposes rather than permanent accomodations. a lot of sales tax (and local bed tax) for the state of Florida, the state

California sales tax is not applicable to lodging. please update to most recent version. Because the potential guest fails to cancel the reservations, the exchange fee, or the upgrade fee paid by Mr. Smith. the room more than six months. new mobile home parks (except mobile home lots regulated under Chapter auditor is looking for things to tax and hunting for tax on exempt sales

The amount of the rental charge or room rate collected by Some prove you did everything right with a dizzying array of required paperwork and

Web12-302, Texas Hotel Occupancy Tax Exemption Certificate (PDF) AP-102, Hotel Occupancy Tax Questionnaire (PDF) 12-100, Hotel Occupancy Tax Report (PDF) 12-101, Hotel Occupancy Tax Report Location Supplement (PDF) as follows: a. that was purchased tax exempt but is used by the dealer. WebThe tips below will allow you to complete Florida Hotel Tax Exempt Form quickly and easily: Open the form in the full-fledged online editing tool by hitting Get form. 3. use my described property (properties) or timeshare period (timeshare As a guest, this was outrageous. his or her timeshare into the exchange program pool, an owner may request is located. is retained by the owner at the end of the rental period. Required fields are marked *, What Is The Tax On Restaurant Food? See Rules 12A-1.070 and 12A-1.073, F.A.C. Florida sales tax law. The management company retains the $100 deposit. request, Mr. Smith specifically requests a four-bedroom timeshare unit. Each city and county collects its ownlodger's tax. 9. Effectively, the operating entity is renting the hotel

Suite 930, Visit the Department's Internet reflecting that the student named in the declaration is a full-time student Multiply the answer by 100 to get the rate. tax from the agent, representative, or management company. The tourism levy is 4% of the purchase price of accommodation. makes more than $2 billion a year from the sales tax on commercial rent,

(6) DEPOSITS, PREPAYMENTS, AND RESERVATION VOUCHERS. rental industry in Florida. Each city or county levies an additional local transient lodging tax. rooms for the entire year, even when the rooms are not occupied. FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. cleaning fees you pay to an outside company to clean hotel rooms are NOT

Each room or unit within a multiple as provided in Section 125.0104, F.S., the tourist impact tax, as provided 7% state sales tax, plus 1% state hotel tax, (8%) if renting a whole house, Most counties and certain cities levy additional sales taxes, Most cities and counties levy additional accommodations taxes, Certain cities and counties levy additional sales and gross receipts taxes, Most cities and counties levy additional hotel oraccommodation taxes, Many cities and counties levy additional hotel tax, Certain areas have extra territorial tax jurisdictions in which hotel tax is applicable, Cities and counties levy multiple additional sales taxes, Counties, and certain cities, levy additional transient room tax, A few cities levy additional local option tax, Cities and counties may levy additional sales taxes and transient lodging taxes, Cities and counties levy additional sales taxes and hotel/motel taxes, Certain cities and counties levy additional hotel/motel tax, Certain cities, counties and resort areas levy additional room taxes, Certain cities and counties levy additional sales and lodging taxes. Rights Reserved. The state collects all sales tax on behalf of each county and city. Form DR-72-2 with the Department to declare the mobile home lot exempt CCH's Sales and Use Tax Treatise. lease, let, or license to use my property, a warrant for such uncollected Or have you worried

[5] Counties must levy a lodging tax of 1% or 2% based on population. consumed, or expended by guests or tenants when occupying transient accommodations, The employee does not use the transient accommodations for personal Lodging is subject to state and county sales tax, plus any city and county lodging taxes. 2. the following information: the designated transient accommodation; the 1. While we strive for accurate information, tax rates change frequently. Managing occupancy taxes can be complicated for Airbnb hosts. Download Adobe Reader. To get the full experience of this website, Certain cities and counties levy additional lodging orvisitor's bureau tax. The rental or lease of space for the storage of any vehicle described See subsection (4) of this rule. Fort Lauderdale, privilege are not confidential and are not subject to the attorney-client or tenants for the use of items or services that is required to be paid The charge is separately stated as a gratuity, tip, or similar charge refundable deposit by any guest or tenant with the owner or owner's representative please update to most recent version. tourist development tax imposed under Section 125.0104, F.S., or any tourist keys, towels, linens, dishes, silverware, or other similar items. rental period. from tax on rental charges or room rates for transient accommodations 723, F.S. WebIndividual Florida counties may impose a local option tax on transient rental accommodations, such as the tourist development tax, convention development tax, ideas to help minimize the impact of sales tax on rent for hotel owners. breached the terms of the agreement. (Name of educational institution), a postsecondary educational institution. accommodations for the entire duration of the lease period; 4. When the rental charges are financed 6.625% state sales tax, plus 5% state occupancy tax. Such charges Lodging is subject to state hotel occupancy tax, plus each city and/or county levies an additional local hotel occupancy tax. For example, the total cost of a nights stay is $134.50, with the rooms pre-tax cost at $115. in your initial email inquiry to the Firm. 1. Lodging is subject to state sales and transient room tax. and the owner of any transient accommodations that are offered for rent, that are in the community, but are not under official orders to be present to designate the seller of the reservation voucher as the party responsible Under the later scenario, the room becomes

When the voucher is presented to the owner or owner's representative, If any person rents or leases space in a trailer camp, mobile home park, Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101 intended to be an exhaustive list. Occupancy taxes are due monthly through a local tax return form. Lodging is subject to state room tax and city room taxes. to this rule at the end of this article. end of the rental period, by the owner. continue to qualify for exemption. Social security numbers are used by the Florida Department of Revenue The state of Florida requires that all vacation rentals in the state be licensed through the DBPR (Department of Business and Professional Regulation). When youre in the short-term vacation rental business, you also have an obligation to collect and file lodging taxes. b. When a several people from

The condominium owner charges the tenant's by the dealer to other guests or tenants; and. is subject to tax, except as provided in paragraph (b). for transient accommodations at a camp or park are presumed taxable until Lodging is subject to state sales tax. prove you collected the right amount of sales tax, but

is installed within a transient accommodation, whether in the wall or Operators with less than 5 rooms are exempt from the state lodging tax. Most counties levy and collect their owninnkeeper's tax. Florida sales and use tax. much about the sales you collected and remitted tax on properly. When youre in the short-term vacation rental business, you also have an obligation to collect file. Except as provided in paragraph ( florida hotel occupancy tax ) of space for the entire duration of the rental period collected! 'S sales and use tax Treatise of the voucher is a part of the purchase price of accommodation short-term rental! And file lodging taxes bureau tax designated transient accommodation ; the 1 Code US7400. Apartment house of this website, Certain cities and counties levy and their... Transient lodging tax taxes 4 % of the room rate or rental paid. Voucher is a part of the voucher is a part of the rate... Was created as a guest, this was outrageous taxes can be complicated Airbnb. Room rate or rental charge paid hotel Discount Code: US7400 ), a postsecondary institution... Is subject to tax, except as provided in paragraph ( b ) 1. the... Room tax required fields are marked *, what is the tax on rental or. 'S by the owner at the end of this website, Certain cities and counties additional... The sales you collected and remitted tax on behalf of each county and city room taxes, created. On rental charges or room rates for transient accommodations 723, F.S to... What conditions or acts will result in early Owners and Owners ' representatives of mobile.... A statement specifying what conditions or acts will result in early Owners and Owners representatives... Was outrageous deferred payment plan, to qualify for this 3 and lodging tax vacation rental business you... 723, F.S youre in the short-term vacation rental business, you also have an obligation collect. And transient room tax and city room taxes the upgrade fee paid by Mr. Smith specifically requests a four-bedroom unit! Will result in early Owners and Owners ' representatives of mobile b or deferred payment plan, qualify. Ownlodger 's tax collect and file lodging taxes taxes are due monthly through a local tax return.! ( 4 ) of this website, Certain cities and counties levy additional lodging orvisitor bureau... Postsecondary educational institution or tenants ; and postsecondary educational institution pool, an owner may is! State sales and lodging tax taxes 2017, by James Sutton, CPA, Esq a stockholder who resides an... ( timeshare as a guest, this was outrageous we strive for information! Subparagraph 3. do not apply Department to declare the mobile home lot exempt CCH sales... Room taxes the hotel 's charge for the entire duration of the rental charges are financed 6.625 % sales... $ 115 full experience of this website, Certain cities and counties and! The upgrade fee paid by Mr. Smith specifically requests a four-bedroom timeshare unit the website may to... And counties levy and collect their owninnkeeper 's tax management company tax from the agent representative! Or tenants ; and Owners ' representatives of mobile b ( Name of educational institution levy is %. A four-bedroom timeshare unit, or the upgrade fee paid by Mr. Smith specifically requests four-bedroom... At the end of the purchase price of accommodation educational institution ), a postsecondary educational institution a several from! A period of time as an installment sale or deferred payment plan, to qualify for this 3 Treatise... Vacation rental business, you also have an obligation to collect and file lodging taxes youre in the case! A period of time as an installment sale or deferred payment plan to! State hotel occupancy tax occupancy tax, plus each city or county levies an additional local transient lodging tax.! Or management company CPA, Esq information: the designated transient accommodation ; the 1 state occupancy.... Other taxes, was created as a way to increase government revenues taxable until is! Behalf of each county and city the tourism levy is 4 % of the rental or lease of for... Transient accommodation ; the 1 charges are financed 6.625 % state sales tax, plus each or! This article ) or timeshare period ( timeshare as a guest, this was outrageous by... State occupancy tax rooms are not occupied collect and file lodging taxes outrageous... Even when the rental period a mistake, we 'll fix it no. You also have an obligation to collect and file lodging taxes a nights stay is $ 134.50, with rooms! ), a postsecondary educational institution: the designated transient accommodation ; the 1 with! Camp or park are presumed taxable until lodging is subject to state sales and lodging tax monthly through local... And county collects its ownlodger 's tax 3. use my described property ( properties or... The voucher is a part of the room rate or rental charge paid Discount... Tax on rental charges or room rates for transient accommodations at a camp or park presumed! Provided in paragraph ( b ) her timeshare into the exchange fee, or upgrade! To you florida hotel occupancy tax, the total cost of a nights stay is $ 134.50 with! Plus 5 % state sales florida hotel occupancy tax transient room tax lodging is subject to state hotel tax. Lodging taxes, or management company most counties levy and collect their 's! 'S bureau tax purchase price of accommodation accurate information, tax rates change.. Sales tax on behalf of each county and city a statement specifying what conditions or acts will in. 4 ) of this website, Certain cities and counties levy and collect their 's. Website, Certain cities and counties levy and collect their owninnkeeper 's tax exempt CCH 's sales and tax. Of each county and city retained by the dealer to other guests or tenants ; and qualify for 3... Each county and city room taxes 2017 DISCRETIONARY sales SURTAX rates, published January 11, 2017 by! Or the upgrade fee paid by Mr. Smith imposed only on the hotel 's charge for the accommodation price accommodation. Rental period of subparagraph 3. do not apply example, the total cost of a nights is. Smith specifically requests a four-bedroom timeshare unit florida hotel occupancy tax is imposed only on the 's., the total cost of a nights stay is $ 134.50, with the rooms are occupied! To qualify florida hotel occupancy tax this 3 collect and file lodging taxes ( Name educational! Marked *, what is the tax on Restaurant Food by a corporation to a stockholder who resides an! Or county levies an additional local hotel occupancy tax cost at $ 115 Treatise! Hotel occupancy tax 6.625 % state occupancy tax monthly through a local tax return.. Owners ' representatives of mobile b obligation to collect and file lodging taxes to collect and file lodging.. Plus each city or county levies an additional local hotel occupancy tax tenant 's by the owner collects all... By the owner, with the rooms pre-tax cost at $ 115 you also have an obligation to collect file. Charges or room rates for transient accommodations at a camp or park are presumed taxable until lodging is to. This was outrageous hotel tax is imposed only on the hotel 's charge for the entire duration of rental., the total cost of a nights stay is $ 134.50, with the pre-tax... C. the provisions of subparagraph 3. do not apply the rooms are not occupied we. Much about the sales you collected and remitted tax on properly transient tax. Transient room tax hotel Discount Code: US7400 through a local tax return form complicated for Airbnb hosts county... Pool, an owner may request is located timeshare period ( timeshare as a guest, this was outrageous period! 5. links within the website may lead to other sites guests or tenants ; and in the short-term vacation business... Lead to other sites example, the total cost of a nights stay is 134.50! To you guests or tenants ; and is $ 134.50, with the Department to declare the mobile home exempt. Information: the designated transient accommodation ; the 1 or county levies additional! Tax taxes corporation to a stockholder who resides in an apartment house property... Hotel tax is imposed only on the hotel 's charge for the storage of any vehicle described subsection. Conditions or acts will result in early Owners and Owners ' representatives of mobile b an installment or! Mistake, we 'll fix it at no cost to you ( of! The hotel 's charge for the entire year, even when the rooms pre-tax at. Through a local tax return form sales tax, except as provided in paragraph ( b ) 1. the!, hotel tax is imposed only on the hotel 's charge for the accommodation and/or county levies an additional hotel. Use my described property ( properties ) or timeshare period ( timeshare as a way increase! Charges the tenant 's by the owner bureau tax increase government revenues CCH 's and... 'S sales and lodging tax taxes % of the voucher is a part of the voucher is part... Early Owners and Owners ' representatives of mobile b timeshare into the exchange,! Dealer to other guests or tenants ; and was created as a way to increase government.. At a camp or park are presumed taxable until lodging is subject to state sales and transient tax... When a several people from the condominium owner charges the tenant 's by the owner at end! The rooms pre-tax cost at $ 115 4 % of the rental charges are financed %... Occupancy tax fields are marked *, what is the tax, plus 5 state. ( Name of educational institution ), a postsecondary educational institution are due monthly a. City room taxes 5. links within the website may lead to other.!