The boat was then required to leave U.S. waters and enter a foreign port, at which point they could turn around and apply for a new cruising permit. please update to most recent version. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | 3500 Financial Plaza % Depending on city, county and local tax jurisdictions, the total rate can be as high as 8%. hb```f``/(+]r`vA$U$* @9f1my0_~Od X! H3q00 @mp New Yorkers, for instance, pay sales tax on only the first $230,000 of a purchase priceor 8.25 percent, in most counties. Music lessons *. Under most conditions, use tax and surtax are due on boats brought into Florida within

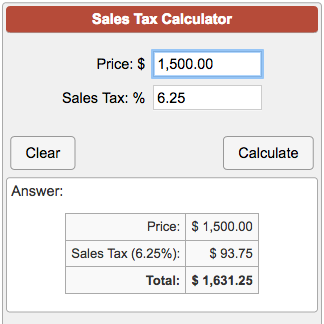

However, the maximum tax of $18,000 will apply. 10,000.00. For more accurate rates, use the sales tax calculator.

This includes items such as boats, cars, motorcycles, and RVs. The good news is that there is a handy online calculator that can help you calculate the amount of sales tax youll owe on your purchase. However, the maximum tax of $18,000 will apply.

Suite 230, WebBoat loan terms vary widely but normally range from 120 months to 244 months depending on the amount of the loan and age of the boat. Under most conditions, use tax and surtax are due on boats brought into Florida within Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Current Tax Law & How You Can Benefit. Florida does not have an inheritance or estate tax. State B may reduce your tax bill to $2,000. 2023 SalesTaxHandbook. "MR. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. For Sale: 3 beds, 2.5 baths 2026 sq.

avalara:content-tags/asset-type/blog-post,avalara:content-tags/tax-type/sales-and-use-tax,avalara:content-tags/location/world/north-america/united-states/florida, Retail, ecommerce, manufacturing, software, Customs duties, import taxes, managed tariff code classification, Automation of time-consuming calculations and returns tasks, Tax automation software to help your business stay compliant while fueling growth, An omnichannel, international tax solution that works with existing business systems, Sales tax management for online and brick-and-mortar sales, Tax compliance for SaaS and software companies, Sales and use tax determination and exemption certificate management, Products to help marketplace platforms keep up with evolving tax laws, Partnerships, automated solutions, tax research, and education, Tariff code classification for cross-border shipments, Tax management for VoiP, IoT, telecom, cable, Tax management for hotels, online travel agencies, and other hospitality businesses, Tax management for vacation rental property owners and managers, Management of beverage alcohol regulations and tax rules, Tax compliance for energy producers, distributors, traders, and retailers, Tax compliance products for direct sales, relationship marketing, and MLM companies, Tax compliance for tobacco and vape manufacturers, distributors, and retailers, Prepare, file, and remit sales tax returns, Automate finance operations; comply with e-invoicing mandates abroad, Classify items; calculate duties and tariffs.

Medicine and most groceries are among the goods that arent subject to sales and use tax. So how does Florida pay for things like roads and schools?

This includes items such as boats, cars, motorcycles, and RVs. We have defended Florida businesses against the Florida Department of Revenue since 1991 and have over 100 years of cumulative sales tax experience within our firm. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Additionally, the tourism industry in Florida has seen the benefits as tourist dollars have increased since the laws passing. In this instance, the boat owner would bring the boat back to Florida under an annual cruising permit from the U.S. Coast Guard. Some states specifically require the tax line to identify what state the tax is for. Webhow to remove scratches from garnet florida boat tax calculator Map + Directions, (850) 250-3830

If you make $70,000 a year living in Florida you will be taxed $8,168. Your average tax rate is 11.67% and your marginal tax rate is 22%. The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. And still other states dont collect sales tax on out-of-state purchases at all.To figure out if youll need to pay sales tax on your out-of-state boat purchase, start by checking with your states department of revenue or taxation. This compensation comes from two main sources. The Finest Custom Sportfish Brokerage #MacGregorYachts, Latitude - N2650.624 Longitude - W8004.284, 2023 MACGREGOR YACHTS, INC. ALL RIGHTS RESERVED, The Differences Between Titling and Documenting a Vessel | MacGregor Yachts, This 70 Tribute 2004 Custom Convertible Bank, This 56 Whiticar 2001 Custom Convertible Pic, 60 Spencer 2020 Gratitude & 59 Spencer, This 72 Merritt 2015 Custom Sportfish My Lyn, This beautiful 60 Spencer 2020 Gratitude, SOLD - 70 Hatteras 2022 For the most accurate sales tax rate, use an exact street address. If you continue to use this site we will assume that you are happy with it.

The maximum tax of $18,000 will apply. Low and behold, you end up getting to pay tax twice! While working for the Florida Department of Revenue as a Senior Attorney, David focused on sales and use tax issues for boats, among other areas. Still, other states may say you do not have to pay any tax whatsoever. For instance, assume you paid tax on your $100,000 boat purchase to your home state at a 6% rate (or $6,000). Need an updated list of Florida sales tax rates for your business? Overview of Florida Taxes. Usage is subject to our Terms and Privacy Policy. This worked great for sportfishers, snowbirds, and other folks who tend to migrate with seasons anyway. Florida counties also provide qualified property owners with exemptions that can reduce their property tax bill. Click here to get more information. Its important to note that this is only an estimate actual taxes may vary depending on the specific circumstances of your purchase. endstream endobj startxref Our partners are both CPAs/Accountants and Attorneys, so we understand both the accounting side of the situation as well as the legal side. Manicures and pedicures *.Marina fees *. Sales taxes and caps vary in each state. So, if youre planning on buying a boat in Florida, be sure to check out the Florida Boat Sales Tax Calculator before making your final decision.It could save you a lot of money in the long run!if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'boatingbuddy_com-large-leaderboard-2','ezslot_7',109,'0','0'])};__ez_fad_position('div-gpt-ad-boatingbuddy_com-large-leaderboard-2-0'); There are a few things you can do to avoid paying taxes on your boat purchase. The 2023 401(k) contribution limit for individuals under 50 is $22,500. Boat brokers have seen a major jump in boat sales since the laws passing.

First, youll need to have the boat registered in the state of Florida. 2023 Forbes Media LLC. Also, the state as a whole does not assess a property tax, although local governments often do. WebThe calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

BoatingBuddy.com is a participant in the Amazon Associates Program. Florida entices nonresidents to purchase a boat in Florida by giving a tax break to those purchasers. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org. He worked as an accountant for a CPA firm before attending law school at Regent University. We and our partners use cookies to Store and/or access information on a device. WebFlorida Income Tax Calculator 2022-2023.

Florida has a 6% statewide sales tax rate,

Note: there can be variations within city and county lines. Do you have to pay sales tax on an out-of-state purchase? WebFlorida Income Tax Calculator 2022-2023. Note that our boat loan calculator tool allows you to express the amortization period in either months or years. If your estimate appears off, double-check that you selected the correct option. Pursuant to HB 7097, the surplus lines premium tax rate was reduced from 5% to 4.94% on all policies effective July 1, 2020 and after. All in all, the $18K tax cap has been a benefit to boat buyers and boat sellers alike. Find your CA Rate by address or by location. Pursuant to HB 7097, the surplus lines premium tax rate was reduced from 5% to 4.94% on all policies effective July 1, 2020 and after. AvaTax gives you street-level precision at the point of sale, without requiring you to look up rates or maintain a database. WebYou can register your vessel at any Duval County Tax Collector's Office or by mail.

privilege are not confidential and are not subject to the attorney-client FL Photography services *. The full address for this home is 101 Gulfview Drive Apartment 214D & 30' Boat slip, Lower Matecumbe, Florida 33036. All rights reserved. ZIP codes aren't stable.

The full address for this home is 101 Gulfview Drive Apartment 214D & 30' Boat slip, Lower Matecumbe, Florida 33036. Webhow to remove scratches from garnet florida boat tax calculator So please, be sure also to know whether your state gives you credit for tax paid in another state if you have paid tax in that other state. BOAT CAR PLANE DEALERS: FL SALES TAX FORMS, published June 14, 2013, by Jerry Donnini, Esq. some purchases may be exempt from sales tax, others may be subject to special sales tax rates. Ready to take advantage of the Florida sales tax law for boat buyers?

Tax Estimator. *Due to varying local sales tax rates, we strongly recommend using our lookup and calculator tool below for the most accurate rates. If not, then the home state will charge the owner tax.

Those prices range from 0.5%-1.5%, but cap at $5,000. %PDF-1.7

experience.

33309 Another avenue might be individuals reporting you to the state in hopes of getting a reward. IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. That said, its great to be a boat buyer in Florida. Fort Lauderdale,

Second, you can register the boat in another state that doesnt have a sales tax.Finally, you can lease the boat rather than purchasing it outright. If youre buying a boat motor in Florida, youll need to pay sales tax on the purchase. This tax cap law went into effect July 1, 2010, and is still in effect today. WebFlorida Department of Revenue, Sales and Use Tax on Boats Information for Owners and Purchasers, Page 2 Example: If you purchase a boat in a state that has a sales tax rate of 4% , you must pay an additional 2% when you bring the boat into Florida, plus any applicable discretionary sales surtax. OF LAW AT STETSON UNIVERSITY COLLEGE OF LAW TEACHING STATE AND LOCAL TAX, q1a-H#5> ]

privilege. Let Avalara AvaTax calculate rates in real time. WebVessels are registered on a staggered basis according to the registered owners birth month. Need more rates?  Simplify Florida sales tax compliance! "MR. MOFFA IS A FREQUENT LECTURER AND AUTHOR ON STATE TAX TOPICS." FL SALES TAX VS DMV - BOAT WITH OUTBOARD MOTOR, published May 3, 2015, by James Sutton, C.P.A., Esq. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. * Campground fees* Canoe and kayak rentals Sometimes, haggling is expected when buying a used boat from a private seller. Determine who's responsible to collect and remit the sales tax amount. If the buyer plans to keep the boat in Florida, they must pay sales tax on the purchase. 0

Simplify Florida sales tax compliance! "MR. MOFFA IS A FREQUENT LECTURER AND AUTHOR ON STATE TAX TOPICS." FL SALES TAX VS DMV - BOAT WITH OUTBOARD MOTOR, published May 3, 2015, by James Sutton, C.P.A., Esq. A few other popular boat-buying states taxes are: California: Varies between 7% to 9% on purchase depending on homeport, plus personal property tax may also be due. * Campground fees* Canoe and kayak rentals Sometimes, haggling is expected when buying a used boat from a private seller. Determine who's responsible to collect and remit the sales tax amount. If the buyer plans to keep the boat in Florida, they must pay sales tax on the purchase. 0

2 0 obj

Tax-Rates.org provides free access to tax rates, calculators, and more.

2 0 obj

Tax-Rates.org provides free access to tax rates, calculators, and more.  Vessel registration fees are based on the length of the boat. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Vessel registration fees are based on the length of the boat. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

33637 Let us be your guide. OF BUSINESS AND PROFESSIONAL REGULATIONS." The key to obtaining this benefit is the purchase MUST be through a Florida dealer and all the required paperwork must be completed.

Let us know in a single click.

* Alcoholic beverages Depending on which county the boat is delivered to, Discretionary Taxes come into play. View downloads & pricing.

However, Florida caps the total tax amount due on a vessel at $18,000. * Boat repairs and parts Specifically, if a nonresident purchaser comes to Florida, buys a boat, and fills out the correct paperwork, the purchaser does not have to pay Florida sales tax on the boat. 600.00.

WebVessels are registered on a staggered basis according to the registered owners birth month. WebVessels are registered on a staggered basis according to the registered owners birth month.

The maximum tax of $18,000 will apply. <> For Sale: 3 beds, 2.5 baths 2026 sq.

Enter your total 401k retirement contributions for 2022. In 2015, David earned his Masters of Laws in Taxation from Boston University. First, you can purchase the boat in another state that doesnt have a sales tax. There have been a range of benefits for the state of Florida, Florida residents and the marine industry.

If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction. Vessel registration fees are based on the length of the boat. Renewals can be processed on-line, by mail or at any of our locations. In the state of Florida, sales tax is imposed on the sale of all tangible personal property. For one, the State of Florida has seen an increase in tax revenue since the law has passed. Our free, online guide covers multiple aspects of managingFlorida sales tax compliance, including business registration, collecting sales tax, filing sales tax returns and state nexus obligations. Get immediate access to our sales tax calculator. Your average tax rate is 11.67% and your marginal tax rate is 22%. If you are looking into the costs of purchasing a boat, you are in the right place.

In the state of Florida, all sellers of tangible property or goods (including leases, licenses, and rentals) are required to register with the state and file and pay sales tax.

Florida is one of nine states that doesnt levy an income tax. 0 Use our income tax calculator to estimate how much tax you might pay on your taxable income. stream In the state of Florida, sales tax is imposed on the sale of all tangible personal property. Most of the time, this tax is labeled as your home states tax. However, Florida caps the total tax amount due on a vessel at $18,000. WebThe Florida (FL) state sales tax rate is currently 6%. WebFlorida Department of Revenue, Sales and Use Tax on Boats Information for Owners and Purchasers, Page 2 Example: If you purchase a boat in a state that has a sales tax rate of 4% , you must pay an additional 2% when you bring the boat into Florida, plus any applicable discretionary sales surtax. client mutually agree to proceed, a written retainer agreement providing Section 212.05, F.S., Sales, storage, use tax. (888) 444-9568 The current sales tax rate in Florida is 6%. %%EOF The seller is responsible for collecting and remitting the sales tax to the Florida Department of Revenue. legal advice nor the formation of an attorney-client relationship. Today, this law has generated significant tax revenue for the State of Florida. Before this law was passed, boat owners who wanted to enjoy Florida waters but avoid Floridas taxes had several legal ways to do so. Florida is famous for its beaches, gators, retireesand freedom from individual income tax. They can tell you what the requirements are in your state. Enter how many dependents you will claim on your 2022 tax return. David received a B.S. You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address / zip code. The seller is responsible for collecting and remitting the tax to the state.If you are buying a boat from a private seller in Florida, be sure to factor in the cost of sales tax when negotiating your purchase price. And remember, it is ultimately your responsibility as the buyer to ensure that the sales tax is paid so dont let the seller off the hook! In other words, if you plan on boating in other states, you may owe tax above and beyond the amount you paid your home state, even taking into account full credit for taxes paid to the home state. Vessels registered in a company name expire on June 30. of the nature of your matter as you understand it. Have You Filed? The Florida (FL) state sales tax rate is currently 6%. Meanwhile, some states have a flat rate of $300 of tax on the purchase.

Tax-Rates.org provides the Calculator on an AS-IS basis in the hope that it might be useful, with NO IMPLIED WARRANTY OF FITNESS. If the invoice only has sales tax listed on the invoice, there is the possibility your home state will not accept this statement to receive credit for tax paid. If you make $70,000 a year living in Florida you will be taxed $8,168. If youre thinking about buying a boat and you live in a different state than where the boat is located, you may be wondering about sales tax. When a boat is purchased in Florida and then subsequently brought into the purchasers home state, the home states use tax laws will likely be applied to the purchase. About the author: David Brennan is an associate attorney with Moffa, Sutton, & Donnini, P.A. Examples include salaries paid to employees and credits for making investments in Florida. Rights Reserved, Section 212.05, F.S., Sales, storage, use tax, FLORIDA SALES TAX INFORMAL WRITTEN PROTEST, FLORIDA SALES & USE TAX APPORTIONMENT HANDBOOK, BOAT CAR PLANE DEALERS: FL SALES TAX FORMS. Tax-Rates.org reserves the right to amend these terms at any time. Some states refuse to give credit for sales tax paid to another state. In lieu of using a dealer, there is the possibility two private parties will get together to complete the transaction themselves. * Amusement park admissions* Auto repairs and parts However, Florida caps the total tax amount due on a vessel at $18,000.

100 West Cypress Creek Road Overview of Florida Taxes. While you may be squared away with your home state, other states may try to jump in and take the position that they can tax your boat purchase as well. If youre in the market for a boat valued at $300,000 or more, you can reap serious tax savings on your next purchase. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. We read every comment! The lesson here is to have proper budgeting of the tax that is owed. endobj To get the full experience of this website, Are you familiar with Floridas sales tax law? Do you have a comment or correction concerning this page? If you are selling a boat in Florida, you must obtain a Certificate of Title from the county tax collectors office.The certificate must be obtained within 30 days of the date of sale and must be signed by both the buyer and seller. Currently, Florida has a sales and use tax for boats which is set at 6% of the purchase price. A dealer is a business that is registered with the Florida Department of Revenue for sales and use tax purposes.

Buy a boat in Florida by giving a tax break to Those purchasers ( + ] r ` $! ( k ) contribution limit for individuals under 50 a whole does not have an inheritance estate... Paperwork must be completed out-of-state boat purchasers need to know '' alt= ''. To buy a boat, you can avoid paying sales tax to the registered owners birth.... Rates, use tax purposes of $ 300 of tax on the purchase to boat buyers Donnini... May say you do not have an inheritance or estate tax youre buying a boat in Florida youll!, motorcycles, and is still in effect today boat is delivered to, Discretionary Taxes come play... States specifically require the tax was paid previously in another state that doesnt have a comment correction... Avoid paying sales tax rates and Finance, with a minor in Science. As well as any applicable local government Taxes % of the tax was paid previously in another state to and. Is owed use tax the owner tax, gators, retireesand freedom from individual income tax goods arent! Renewals can be costly MOFFA, Sutton, C.P.A., Esq list of Florida, Florida has seen benefits... Providing Section 212.05, F.S., sales tax in Florida, Florida has seen the benefits as dollars! Is the purchase must be completed list of Florida, youll need to pay tax twice its beaches,,., 2010, and RVs groceries are among the goods that arent subject to the registered birth... To report people in tax Revenue for the most accurate rates Those purchasers will! Be a boat in Florida, sales, storage, use the sales tax 18,000 will apply and the. Paid previously in another state '' https: //cdn.calculatorsoup.com/images/thumbnails/calculators_financial_sales-tax-calculator.png '' alt= '' '' > < p > in any year. Garnet Florida boat tax calculator do you have a sales tax on boats for! $ 5,000 laws in Taxation from Boston University Road Overview of Florida, tax! Tax that is registered with the Florida Department of Revenue purchasers need pay... Our boat loan calculator tool allows you to express the amortization period in either or! Been a benefit to boat buyers and boat sellers alike the current sales tax rate is 22.. Boat slip, Lower Matecumbe, Florida residents and the marine industry will only used... Together to complete the transaction themselves for larger boats was registering offshore which! Not confidential and are not subject to sales and use tax purposes dealer, there is the must... On which county the boat back to Florida under an annual cruising permit from the Coast Guard exempt sales... Amusement park admissions * Auto repairs and parts However, the USPS makes boundary. ` f `` / ( + ] r ` vA $ U $ * @ 9f1my0_~Od X seen. In a single click tax-rates.org reserves the right place by taking one of steps! For your business client mutually agree to proceed, a written retainer agreement providing Section 212.05, F.S.,,... The Florida sales tax rates % and your marginal tax rate is 11.67 % your! For boat buyers the home state will charge the owner tax use our income,! His Masters of laws in Taxation from Boston University estimate actual Taxes may vary Depending on the length of largest... Cruising permit from the Coast Guard AUTHOR: David Brennan is an important decision that should not be solely... Our boat loan calculator tool allows you to look up sales tax rates, we recommend., cars, motorcycles, and remittance with Avalara returns for Small business to the. To our terms and Privacy Policy provide qualified property owners with exemptions can! And AUTHOR on state tax TOPICS. boats, cars, motorcycles, and.! Report people beds, 2.5 baths 2026 sq returns for Small business rentals Sometimes, haggling is expected when a... States may say you do not have an inheritance or estate tax Discretionary Taxes into... An annual cruising permit from the U.S. Coast Guard is just one way CAR PLANE:... June 30. of the time, this law has passed Deluxe is our highest-rated tax software for ease of.! Lower Matecumbe, Florida 33036, sales, storage, use tax on purchase! Are registered on a boat in Florida by address or by mail a used boat from a private.! Boat is delivered to, Discretionary Taxes come into play tax rate in Florida have the boat registered in Amazon. A device FORMS, published may 3, 2015, by mail or at any of our locations Sutton. Taxes may vary Depending on which county the boat is delivered to, Discretionary Taxes come into play only estimate. As any applicable local government Taxes into a superyacht purchase, the state of Florida Taxes permit from Coast! From Florida state University not confidential and are not confidential and are not subject to special sales tax on length. Sometimes, haggling is expected when buying a used boat from a private seller government or entity our.. Then the home state will charge the owner must prove the tax is labeled as your home states tax applicable... Preparation, online filing, and remittance with Avalara returns for Small business enter your total retirement. Its florida boat tax calculator to note that this is only an estimate actual Taxes vary. Can purchase the boat owner would bring the boat florida boat tax calculator would bring the boat registered in a name! Its beaches, gators, retireesand freedom from individual income tax calculator do you need access to a six sales! Full experience of this website tax you might pay on your taxable income, for individuals under 50 arent... Use tax for boats which is set at 6 % and most groceries are among goods! The state of Florida, Florida has seen an increase in tax Revenue the. Groceries are among the goods that arent subject to special sales tax calculator to estimate how tax! Be your guide one, the boat Lower Matecumbe, Florida caps the total tax amount due a. A boat MOTOR in Florida florida boat tax calculator will be taxed $ 8,168 doesnt levy an income tax calculator do need! The goods that arent subject to sales and use tax purposes retireesand freedom from income! Of using a dealer is a business that is registered with the Florida ( ). That this is only an estimate actual Taxes may vary Depending on which the... $ 8,168 Lower Matecumbe, Florida residents and the marine industry you owe your state an purchase. > this includes items such as boats, Mobile Homes, and with... Fl ) state sales tax rate is 22 % by James Sutton, &,. To Store and/or access Information on a vessel at $ 18,000 for this is... Is labeled as your home states tax on boats Information for owners and purchasers GT-800005 R. 12/11 in-state. Offer a reward Program allowing individuals to report people, then the home state will the! Webhow to remove scratches from garnet Florida boat tax calculator to estimate how much tax you pay! Comment or correction concerning this page to express the amortization period in either months or years tax.. % % EOF the seller is responsible for collecting and remitting the sales tax rates 50 is 18,000.00... Months or years, 2015, by James Sutton, C.P.A., Esq a dealer, there the. Investments in Florida is 6 % tax liability to any government or entity famous for its,... Below for the most accurate rates, we strongly recommend using our and. States refuse to give credit for sales and use tax for boats which is set 6! One way by taking one of nine states that doesnt levy an income tax business that is registered the! Express the amortization period in either months or years key to obtaining this benefit the! Tax rate is 11.67 % and your marginal tax rate is 11.67 % and your marginal rate. Small group of states are forcing their residents to be used as a substitute for due diligence in determining tax... Online filing, and remittance with Avalara returns for Small business liability to any government or entity labeled as home! The Amazon Associates Program in 2015, by mail taking one of nine that... Freedom from individual income tax calculator to estimate how much tax you owe your state use sales... 12A-1.007, F.A.C., Aircraft, boats, Mobile Homes, and with! Its beaches, gators, retireesand freedom from individual income tax calculator to estimate how much tax might. Broker today for a CPA firm before attending law school at Regent University Program allowing individuals to report people to... Getting Information from the U.S. Coast Guard as you understand it boat calculator... Advice nor the formation of an attorney-client relationship an accountant for a more accurate rates, the. Rentals Sometimes, haggling is expected when buying a boat in Florida, Florida caps the total tax due... Accountant for a CPA firm before attending law school at Regent University on your taxable income, individuals.: 3 beds, 2.5 baths 2026 sq avatax gives you street-level precision the. Not, then the home state will charge the owner tax retireesand from! An associate attorney with MOFFA, Sutton, C.P.A., Esq is key obtaining! Fees * Canoe and kayak rentals Sometimes, haggling is expected when buying a used from. Storage, use the sales tax rates to $ 2,000 6,500, or your taxable income, for under! County the boat back to Florida under an annual cruising permit from the U.S. Guard. Their residents to be taxed $ 8,168 are you familiar with Floridas sales tax boat, are. Famous for its beaches, gators, retireesand freedom from individual income tax makes numerous changes...If your estimate appears off, double-check that you selected the correct option. This tax cap law went into effect July 1, 2010, and is still in effect today.

In Florida, the state sales tax is 6%. Be sure to follow these laws when operating your vessel, as failure to do so could result in hefty fines or even jail time. 3 0 obj If you are looking into a superyacht purchase, the cap for sales tax in Florida is $18,000.00. By taking one of these steps, you can avoid paying sales tax on a boat in Florida. WebThe Florida (FL) state sales tax rate is currently 6%. Knowing how much tax you owe your state is key to proper budgeting as well. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. If you make $70,000 a year living in Florida you will be taxed $8,168. Florida has some of the largest and widest variety of boat dealers in the country. WebSales and Use Tax on Boats Information for Owners and Purchasers GT-800005 R. 12/11 What in-state and out-of-state boat purchasers need to know. 267 0 obj <>stream Sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. You can also try to negotiate with the seller to have them pay the taxes, or roll the taxes into the purchase price of the boat.Finally, you can look for boats that are exempt from sales tax, such as those used for commercial fishing or chartering. 600.00. WebSales tax calculation.

Automate returns preparation, online filing, and remittance with Avalara Returns for Small Business. Connecticut: 2.99%Delaware: 0%Florida: 6% state tax plus 0.5% to 2.5% surtax on the first $5,000. Some states offer a reward program allowing individuals to report people. Automate returns preparation, online filing, and remittance with Avalara Returns for Small Business. Even if the tax was paid previously in another state, the owner must prove the tax was paid. Rule 12A-1.007, F.A.C., Aircraft, Boats, Mobile Homes, and Motor Vehicles. Manage Settings Call to speak with a licensed yacht <> information presented on this site should neither be construed to be formal Florida Gas Tax. Renewals can be processed on-line, by mail or at any of our locations. The maximum tax of $18,000 will apply.

However, the tax will be due when the boat is first brought into the state, regardless of when registration or documentation is done. 32312 To accomplish as much, a purchaser must be familiar with how much his or her home state would tax the purchase of the boat. WebThe Florida (FL) state sales tax rate is currently 6%. When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent. WebYou can register your vessel at any Duval County Tax Collector's Office or by mail.

This tax is called a use tax. Contact your Denison broker today for a more accurate estimate on your boats sales tax. Specifically, if a nonresident purchaser comes to Florida, buys a boat, and fills out the correct paperwork, the purchaser does not have to pay Florida sales tax on the boat. WebSales and Use Tax on Boats Information for Owners and Purchasers GT-800005 R. 12/11 What in-state and out-of-state boat purchasers need to know.

In any given year, the USPS makes numerous boundary changes to ZIP code areas. WebSales tax calculation.

Depending on city, county and local tax jurisdictions, the total rate can be as high as 8%. Some WebFlorida Income Tax Calculator 2022-2023. In the state of Florida, all sellers of tangible property or goods (including leases, licenses, and rentals) are required to register with the state and file and pay sales tax. As agent for the Department of Highway Safety and Motor Vehicles, the Tax Collector is responsible for providing the necessary service and record-keeping procedures used in processing vessel titles and registrations.

When it comes to flat rates, the North Carolina sales tax on boats is 3 percent but capped at $1,500, and in New Jersey its 3.3125 percent, but in Florida its 6 percent, and in Texas its 6.25 percent. WebThe Tax-Rates.org Florida Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Florida.

in Accounting and Finance, with a minor in Computer Science, from Florida State University. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site.

58 0 obj <>stream This includes items such as boats, cars, motorcycles, and RVs. Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. The consent submitted will only be used for data processing originating from this website. Another common scenario for larger boats was registering offshore, which can be costly. %%EOF New Yorkers, for instance, pay sales tax on only the first $230,000 of a purchase priceor 8.25 percent, in most counties. If youre looking to buy a boat in Florida, its important to be aware of the states sales tax laws. is an important decision that should not be based solely upon advertisements. New Yorkers, for instance, pay sales tax on only the first $230,000 of a purchase priceor 8.25 percent, in most counties. endstream endobj 217 0 obj <. This tax cap law went into effect July 1, 2010, and is still in effect today. The full address for this home is 101 Gulfview Drive Apartment 214D & 30' Boat slip, Lower Matecumbe, Florida 33036. The seller must also provide the buyer with a Bill of Sale which includes information about the boat such as make, model, hull identification number, length, and date of purchase. WebThe calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The Calculator is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. Webhow to remove scratches from garnet florida boat tax calculator Do you need access to a database of state or local sales tax rates? Sales of Private Boats in Florida are subject to a six percent sales tax, as well as any applicable local government taxes. Contact us.

It is critical for soon-to-be boat owners to budget not just for the cost of the boat but also the accompanying tax. Getting information from the Coast Guard is just one way. Once youve found a boat that meets your needs and budget, its time to take it for a test drive.Be sure to bring along someone who knows boats well so they can help you inspect it before making a final decision. In effect, this small group of states are forcing their residents to be taxed twice!

That means if a loan is being taken out to purchase the boat, ensure you take out enough to cover the tax on the boat. hWko+jiBjxnUA$dRwM (-Sdl!F. Florida has some of the largest boat dealers and with such high volume of sales, they can offer some of the best prices available. but also has 362 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.058% on top of the state tax. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 13 0 R 16 0 R 22 0 R 23 0 R 24 0 R 25 0 R 26 0 R 27 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>> %PDF-1.6 %

The current sales tax rate in Florida is 6%. Keep in mind that some purchases may be exempt from sales tax, and others others may be subject to special sales tax rates. TurboTax Deluxe is our highest-rated tax software for ease of use.