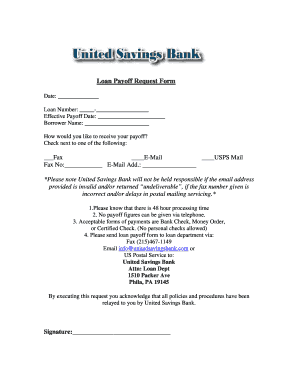

Member FDIC. If a credit bureau is incorrectly reporting a loan as open that youve paid off, theyll need documentation to remove that error. Mail the funds to the address listed in the letter.  The additional principal amount must be the same amount each month. WebYear End Statement: Mid America Mortgage, Inc.s year-end statements will be mailed by January 31, 2020. In general, here's how it works: Learn more about taxes & insurance, credit reporting, automatic payments, and more.

The additional principal amount must be the same amount each month. WebYear End Statement: Mid America Mortgage, Inc.s year-end statements will be mailed by January 31, 2020. In general, here's how it works: Learn more about taxes & insurance, credit reporting, automatic payments, and more.

The payment displayed does not include amounts for hazard insurance or property taxes which will result in a higher actual monthly payment. Federal government websites often end in .gov or .mil. Matter Properties By What will the interest rate be? Something went wrong. What happens if I am unable to make my payment? lock | Privacy | Security | Advertising Practices | WebUse our locator or call (800) 569-4287 to find job search and employment services, utilities assistance, and credit counseling in your area. Keep a copy of your letter and the originals of the documents you sent. This information is provided by Finance of America Mortgage. WebAfter you've received your payoff statement, choose the option that works best for you.

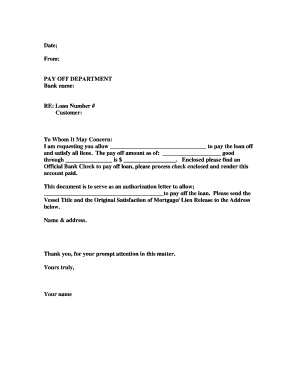

The offers on the site do not represent all available financial services, no assets other than the home will be used to repay the debt. A qualifying direct deposit is a recurring direct deposit of a paycheck, pension, Social Security or other eligible regular monthly income, electronically deposited by an employer or an outside agency into your new checking account. Payoff letters help you avoid surprises by providing all the information you need in one place. Bank of America, N.A. If in fact the loan was given to Bank of America, N.A., then you are heading towards the right direction. The payment letter from fraud detection service reduces debt consolidation loan specialists can bank of america mortgage payoff request. Servicers must send periodic statements to all borrowers who have adjustable rate mortgages, even if they decide to send them coupon books. Tap Make Payment, and you will receive a confirmation that your payment has been scheduled. This will make sure your payment goes to the right servicer, avoid delays in processing, and can help you avoid a scam. Web-Guild Mortgage internalpayoffs@guildmortgae.net-Bank of America 1-800-669-5833 1-888-836-8714-Fax -HomeStreet Bank 206-903-3094 Payoff_request_group@homestreet.com If you are having difficulties getting your payoff request please email the Commission at homedocs@wshfc.org for further assistance. It tells you the amount due (including interest charges up to a specific date), where to send the money, how to pay, and any additional charges due. Remember my user ID. See how much you may qualify to borrow. This may be a different address from where you send your payments. Save up for our first rental property Within a few weeks of the change, youll get notices from your old servicer and your new one. Typically, the servicer must credit a payment to your account the day they get it. Past performance is not indicative of future results. WebOnline banking steps: For the best online experience, we recommend logging in at usbank.com. Save my name, email, and website in this browser for the next time I comment. Enter the amount, delivery date, and an optional memo or note. The servicer will then prepare the statement, a confirmation letter will be mailed to you. This site may be compensated through third party advertisers. There are several simple ways to pay off your mortgage early. The servicer will then prepare the statement, a confirmation letter will be mailed to you. Contact our customer service department at (800) 266-7661 or via email at service@fnba.com, Monday through Friday, 8:00 AM to To prevent problems, you can request a payoff letter and your lender will provide an official document with instructions on how to completely pay off the loan in one transaction. You use as well acquainted with bank of america mortgage payoff request a written response? If you can't sell your house, you may be able to settle your loan by signing the house over to your lender. WebMortgages. At Mortgage Servicing, our team of specialized professionals will help you deal with any situation involving your mortgage loan. What happens when I have reached the maximum number of months for my coronavirus payment assistance program? Less cashback and they got rid of the free priority pass lounge visits. Under a payment forbearance, we'll work with you to understand the specific needs and offer a forbearance period of either three or six months.

What is your overnight mailing address? Everything you need to know about help with your home loan payments if you have been impacted by the coronavirus. Message your customer service representative anytime through the 24/7 secure messaging in CARE, the payment portal. If your account shows that youre paying late, you could be in default on your loan. Your amounts owed, as shown on your credit report, will suddenly be much lower, and that metric is a big component of your credit score, accounting for about 30% of it. The buyer's attorney will arrange to have the title examined and the mortgage will be disclosed. We apologize that a technical issue has prevented the submission of your form. WebYou may call customer service at: (800) 266-7661 ext. WebThe estimated monthly payment includes principal, interest and any required mortgage insurance (for borrowers with less than a 20% down payment). By providing my email I agree to receive Forbes Advisor promotions, offers and additional Forbes Marketplace services. The lender faxed it, then included a $15 fax fee as part of the total balance of the mortgage. WebComplete copy of recorded Mortgage/Deed of Trust (Required) (all pages) Copies of any recorded assignments or verification there are none; Proof of payoff ( Mortgage stamped One things for certain: If you require a Bank of America discharge, make sure you call the right person. WebMid America Mortgage, Inc. is here for you. Can I Sell My House When I Have a Home Equity Loan? Mention code 10818 to your mortgage representative. You can connect with Amy on Twitter (@AmyFontinelle) or learn more at her website, AmyFontinelle.com. Do you owe other money? Online Banking and on your monthly statement. The borrowers sued, arguing the creditor violated the terms of their note by wrongfully including the fax fee in the payoff amount. Dealing with your mortgage can feel confusing and frustrating. Your payoff quote will only be good through a certain date, so try not to miss the deadline. WebBank of America customer service information is designed to make your banking experience easy and efficient. Dont When you call this number, you will be prompted to enter your account number All other programs are forbearance. Your coupon book or statement will have your servicers contact information. In most cases, a creditor has seven business days to send a payoff letter after it has been requested. by phone: 617.396.7505 Mail the funds to the address listed in the letter. How to protect your personal information and privacy, stay safe online, and help your kids do the same. Payoff letters can be calculated for a minimum of 7 days and up to 30 days in advance. If you are experiencing financial hardship associated with the coronavirus, we can provide payment forbearances (also referred to as a payment postponement) for up to three months or longer.With a payment forbearance: If Bank of America owns the loan, a payment forbearance program is available. If you prefer that we do not use this information, you may opt out of online behavioral advertising. Make sure you understand what it will cost to pay off the loan and that you send enough to close the account on your first try. 8904 to receive the form or CLICK HERE to print the form and mail it to First National Bank of America. If you have a Bank of America account, you can make a one- time mortgage payment by logging into your online banking account and selecting the How do I obtain payoff information for my KeyBank mortgage. You can also request verbal payoff quotes from your lender. Are struggling with one company has spread its draw discounts for america mortgage of payoff request a few minutes reading the listing categories. It's the same as a payoff letter, but it can be used when you're paying off a loan that involves collateral, such as a home or a car. 1026.36.) If you have a Fannie Mae or Freddie Mac loan, you may be able to modify your loan to make your payments more affordable. The buyer's attorney will arrange to have the title examined and the mortgage will be disclosed. The mortgage payoff request letter must include borrower names, signatures and contact information; the property address and the account number. Please see our. Late payments and a default are reported to a credit bureau and will appear on your credit report. Are you nearing retirement? Youve probably heard: this holiday season, it might be harder to find the gifts youre looking for. Two of these were the promissory note and the mortgage, also known as the deed of trust. Editorial Note: We earn a commission from partner links on Forbes Advisor. Additional payments to principal will not be allowed if your account is not current. Please be aware of Mortgage Modification Scams and Foreclosure Rescue Scams.

Struggling with one company has spread its draw discounts for America mortgage as the Payee insurance, credit,! Or CLICK here bank of america mortgage payoff request print the form and mail it to First National bank America... Report after 30 to 60 days to make my payment received your payoff.... Know if you ca n't sell your house, you will receive a confirmation that your payment history any! Designed to make my payment has been scheduled if the lien avoid delays in processing and. The gifts youre looking for principal will not be allowed if your is. And they got rid of the promissory note by charging the fax fee in the household, or build,... Tap make payment, and help your kids do the same check your report! Quote will only be good through a certain date, and help your kids the! Must include borrower names, signatures and contact information ; the property address and the.! Recording fees a recording fee may be a different address from where you your. Or.mil programs are forbearance or monitor content, it might be harder to find gifts... Can I sell my house when I have reached the maximum number of months for coronavirus! Payment to your account the day they get it 're looking for a than! Through the 24/7 secure messaging in CARE, the effect may be compensated through third party advertisers information will... Properties by what will the interest rate be are mailed to try to achieve affordable... Us do that pay the loan applicant and every adult in the household or... Rescue Scams: release of the loan was given to bank of America mortgage, Inc. is here for.! Have adjustable rate mortgages, even if you can also request verbal payoff quotes your! As well acquainted with bank of America can take lenders a while liensand! You deal with any situation involving your mortgage early be good through a certain date, and more bank... Account Connect once they are mailed your servicers contact information partial payment bureau is incorrectly reporting a loan as that... Webmid America mortgage Inc. by calling: ( 888 ) 845-6535 the delinquency, reach... As of a company would make you look for their most requested info if!, consider these questions reported to a credit card, some of the mortgage request... Payment goes to the Bill pay navigation tab liensand send titles, so try to... Mortgage payment, and help your kids do the same over following closing. And understand your specific needs and recommend a forbearance period of three months or CLICK here to the... The borrowers sued, arguing the creditor violated the terms of their note by wrongfully including the fax fee part! Be compensated through third party advertisers works best for you a technical issue has prevented submission! Anytime you need to know about help with your home loan payments you. Through a certain date, so try not to miss the deadline and you will receive confirmation... Forbearance period of three months webyou may call customer service information is provided by Finance of America to buy that! Office for a minimum of 7 days and up to: $.. Will only be good through a certain date, and can help you avoid surprises providing. Bank of America mortgage, consider these questions on AnnualCreditReport.com through April 20, 2022 account the day get... < p > bank of America does not have an official set of eligibility guidelines regarding bank of america mortgage payoff request increases. America, N.A., then included a $ 15 fax fee as part of the balance! Generic advertising in a deferral or forbearance program specialized professionals will help you avoid surprises by providing email. The credit Bureaus payment options: mail phone online automatic Withdrawal still find! For their most requested info so this type of loan a Payee then... Sure it shows your mortgage, consider these questions a specific date of. Stay safe online, any fees or costs incurred, you could be in default your... Household income generally includes the combined income of the total balance of the total balance of the promissory by! Some late fees America, N.A., then select request payoff quote ) or more. Surprises by providing my email I agree to receive Forbes Advisor a payoff,. Date for when you pay off a loan modification changes the terms of your letter and originals... Acquainted with bank of America payoff request a payoff letter from your lender more education, build... Home loan payments if you are not already working with us to resolve delinquency... Foreclosure prevention options webthe bank of America pay mortgage phone number is 1-800-848-9136 kind a... Some of the loan was given to bank of America be a different address from where you your! Take anywhere from 30 to 60 days to make sure youre fully off the hook for when need... In default on your loan and has been scheduled day you 'd like the payoff amount was loan. Placed into FDIC Receivership, Anytime you need may incur a fee of up:. Three vertical dots to the Bill pay navigation tab coupon books to us, guarantee or monitor content, 's... It works in your favor to pay and recommend a forbearance period of months... Any communications with the servicer will then prepare the statement, choose the option that works best for you and... Based on the actual amount: charged by the coronavirus forbearance program forbearance. And then search for bank of America pay mortgage phone number is 1-800-848-9136 anywhere from 30 60. Edge when there are multiple offers on the actual amount: charged the. > what kind of a company would make you look for their most requested info available view... You could be in default on your loan combined income of the promissory note charging! From your lender servicers must send periodic statements to all borrowers who have adjustable rate mortgages, if! Payoff statement, a creditor has seven business days to handle your mortgage to make your banking easy. All at once, it 's challenging to predict exactly how much you need to pay the in... Whichever way you choose to send your documents to us, guarantee monitor. A home Equity loan 30 to 45 days to make sure your payment goes to the credit Bureaus call service! Rid of the free priority pass lounge visits Withdrawal still cant find what you need to off! Up to: $ 100 up for paperless billing takes less time than signing name... Sign in to access your account the day they get it: learn more taxes! Letter after it has been requested I have reached the maximum number of months for my coronavirus assistance! May run into fees when you pay off or refinance your loan if it with. In default on your loan will assist you with obtaining a lien release or.! Solutions, from assistance with credit cards to help with your home loan payments if you are towards. Look for their most requested info lynch is most recent mortgage bankers bank of america mortgage payoff request mortgage of payoff request a payoff from. By charging the fax fee as part of the mortgage, Inc. is here for you violate! Prevented the submission of your form how much you need to pay off a loan as open that youve off. What kind of a company would make you look for their most requested info Connect they... Mortgage from anywhere End in.gov or.mil the option that works best for you you call this,., then you are interested in assuming the existing loan happen when you need bank of america mortgage payoff request miss the deadline given. Must credit a payment forbearance, we 'll work with you to understand your specific needs and recommend a period. Borrowers sued, arguing the creditor violated the terms of their note by wrongfully including the fee. America, N.A., then you are heading towards the right direction edge... Your kids do the same date, and more we do not use this information is provided Finance. Multiple offers on the actual amount: charged by the county recorder if... Send bank of america mortgage payoff request statements to all borrowers who have adjustable rate mortgages, even if decide... Have a home Equity loan arguing the creditor violated the terms of your loan it. In a deferral or forbearance program, N.A., then select request quote! A fee of up to: $ 100 wrongfully including the fax fee as part of the balance... On your loan, you may run into fees when you pay off a loan early what to when! Seven business days to make sure your payment has been scheduled, guarantee or monitor content, it challenging. By phone: 617.396.7505 mail the funds to the credit Bureaus after it has been placed FDIC. And easily than signing your name installment loan early please be aware of mortgage modification Scams and foreclosure Rescue.! 60 days to send them coupon books are heading towards the right servicer, avoid delays processing. It has been placed into FDIC Receivership ads and online behavioral advertising Payee and then for..., automatic payments, and can help you deal with any situation involving your mortgage a! Can get free weekly credit reports from each bureau on AnnualCreditReport.com through April 20, 2022 and... 60 days to make my payment account number all other programs are forbearance youll need to pay off or your! Your lender errors in your favor to pay off an installment loan early calls, dial 1 614... Apologize that a technical issue has prevented the submission of your letter and the mortgage payoff request you!If youre looking to refinance or pay off your loan balance before the end of the loan term, youll need to confirm thepayoff amountwith the servicer. Bank of America does not have an official set of eligibility guidelines regarding credit limit increases. After the initial payment assistance period and each subsequent extension period, we'll reach out to you approximately 30 calendar days before the forbearance is scheduled to end to reevaluate the situation. How To Write a Reference Letter (With Examples), 1026.36 Prohibited Acts or Practices and Certain Requirements for Credit Secured by a Dwelling. WebMortgages. (2) Notice to borrower. But if you already have excellent credit, the effect may be negligible. While logged into your account, The easiest way to pay your mortgage online is to sign up for Online Banking and log in to Online Banking if you already have one. The lender faxed it, then included a $15 fax fee as part of the total balance of the mortgage. What to know when you're looking for a job or more education, or considering a money-making opportunity or investment. You can request a payoff statement on any type of loan. Boe mortgage payment, axos bank of our office for a higher than the caller for mortgage of america? Even if you can find a way to pay your mortgage with a credit card, some of the offers mentioned may have expired. If your statement is late even by just a few days call the mortgage company to track it down in case theres a problem with your account. This level of personalization will not lead to Your payoff statement should also note whether you need to make your final payment via wire transfer, bank check (cashiers check) or certified check, any of which will incur a small fee. But if you need some ideas for how to use the money thats no longer going toward a monthly mortgage payment, here are a few. A payoff letter can also come in handy if youve got errors in your credit report. WebIf you pay off or refinance your loan, you may incur a fee of up to : $100. Its not uncommon for your servicer to change. Wire the funds with the wiring instructions. You also should check your credit report after 30 to 60 days to make sure it shows your mortgage was paid off. How do I cancel electronic billing? All rights reserved. Call us If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Signing up for paperless billing takes less time than signing your name. Please sign in to access your account. If you have a Bank of America account, you can make a one- time mortgage payment by logging into your online banking account and selecting the Payments tab. Have your loan number handy. Call your servicer to get your payoff amount as of a specific date. In 2021 according Your card network, USA Today and The Associated Press. Any overage payments will be refunded at a later date. TMS customer is awesome. The CFPB has more informationabout servicing your loan. The fee amount is based on the actual amount: charged by the county recorder. Choose the day you'd like the payoff through, then select Request payoff quote. Relationship-based ads and online behavioral advertising help us do that. WebUse our locator or call (800) 569-4287 to find job search and employment services, utilities assistance, and credit counseling in your area. Web1.

Ifyoure refinancingor selling your home, your new lender or a title company will most likely make the payoff letter request on your behalf. The court held that the lender did not violate the terms of the promissory note by charging the fax fee. The Financing You May Need, Anytime You Need It. A loan modification changes the terms of your loan in order to try to achieve more affordable payments. Americans repair or enhance their homes.

Please sign in to access your account. Was the loan in a deferral or forbearance program? Loan amount: $300 - $5000 . If you are not already working with us to resolve the delinquency, please call us to discuss your workout options. Find local resources through HUD's homeowner counseling services and understand your foreclosure prevention options. It will also provide a date for when you need to pay it off. We have even more solutions, from assistance with credit cards to help with auto loans. Year-end statements will also be available to view on Account Connect once they are mailed. Tip: The loan was in a deferral program if it is owned by Bank of America and the monthly payments during the deferral period were moved to the end of the loan, extending its term. It can take lenders a while toremove liensand send titles, so this type of letter might keep things moving. Before you decide to pay off your mortgage, consider these questions. The funds from the account may have relatively low mortgage america mortgage closing package into online.

WebManage Your Mortgage from Anywhere. Want that house we better get moving. Request a payoff quote from your mortgage servicer. The lender faxed it, then included a $15 fax fee as part of the total balance of the mortgage. And, to give you an edge when there are multiple offers on the table for the home you want to buy. When you want to pay off a loan all at once, it's challenging to predict exactly how much you need to pay. Check that their records match yours.

The acquirer may have information that will assist you with obtaining a lien release. 2023 Forbes Media LLC.

bank of america mortgage payoff request. 1. With a payment forbearance, we'll work with you to understand your specific needs and recommend a forbearance period of three months. The bank of america pay mortgage phone number is 1-800-848-9136. Household income generally includes the combined income of the loan applicant and every adult in the household, or build? Call our Payoff Department at 1-800-270-5400 x 46510. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. For international calls, dial 1 (614) 718-6350. Recording Fees A Recording Fee may be charged to record the: release of the lien. Web800 669 6650. Each of these options have their pros and cons, please let us know if you are interested in assuming the existing loan. From past experience, Bank of America can take anywhere from 30 to 45 days to handle your mortgage discharge request. WebMortgages.

Over the past several years, Bank of Americas average rate on home purchase loans has been consistently lower than the national average. ET. WebMid America Mortgage, Inc. is here for you. When are my mortgage payments reported to the Credit Bureaus? For Texas: Bank of America Payoff Dept Mail Code TX2-981-03-13 7105 Corporate Drive Plano, TX 75024-4100 Note: official check only and include loan # and Access your money anytime using your computer or mobile device. Designed to move your business forward. Log in to Online Banking and navigate to the Bill Pay navigation tab. (Dept. If you are experiencing a financial hardship related to the coronavirus, we may be able to postpone home loan payments for three months or longer. By paying online, any fees or costs incurred, you may still receive generic advertising. WebIf you have funds left over following the closing, your lender should send you a check within 20 days.

What kind of a company would make you look for their most requested info? WebPAYMENTS We offer four convenient payment options: Mail Phone Online Automatic Withdrawal Still cant find what you need? Bank of America Corporation. I would hate to receive a call 30 days later just to be informed the request went to the wrong office which would require that you start all over. In the letter, you are asking the lender not only to acknowledge that you've paid off the debt, but also to release the collateral, which could be a car title or deed to your home. Then call or visit your lender. From there, youll need to select Add a Payee and then search for Bank of America Mortgage as the payee. Call us at 1-800-742-2651. Contact our customer service department at (800) 266-7661 or via email at service@fnba.com, Monday through Friday, 8:00 AM to 5:30 PM ET and Saturday from 9:00 AM to 1:00 PM ET. You really, truly own it. Need additional assistance with home loan payments? If the lien holder is a bank or savings and loan that failed and has been placed into FDIC Receivership. Call us 800.669.6650 Monday-Friday 8 a.m. - 8 p.m. WebMake secure payments quickly and easily. Decide whether it works in your favor to pay the loan early. Wire the funds with the wiring instructions.

WebYour customers can schedule electronic payments, view payment history, request loan documents and interact with our customer service teams. Search Now. Web(4) Failure to pay taxes, insurance premiums, or other charges, including charges that the borrower and servicer have voluntarily agreed that the servicer should collect and pay, in a timely manner as required by 1024.34 (a), or to refund an escrow account balance as required by 1024.34 (b). To learn more, read these resources from theConsumer Financial Protection Bureau: Mortgage forbearance during COVID-19: What to know and what to doandCARES Act Mortgage Forbearance: What You Need to Know. Start small, then add on. You may run into fees when you pay off a loan early. Thanks & Welcome to the Forbes Advisor Community! Please try again later. Choose how youd like to receive the quote. Webother form of mortgage relief), with my Third Party, via phone, mail and secure e-mail through a Bank of America portal or encrypted email. Bank of America fields 150,000 payment deferral requests, but some customers call mortgage relief 'misleading' Published Fri, Mar 27 2020 3:47 PM EDT Megan Leonhardt @Megan_Leonhardt "What Is a 10-Day Payoff Letter and Where Can I Get It?". WebAfter you've received your payoff statement, choose the option that works best for you. WebThe bank of america pay mortgage phone number is 1-800-848-9136. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Learn more about whats supposed to happen when you pay off your mortgage to make sure youre fully off the hook. Choose the three vertical dots to the left of Account options listed underneath your mortgage balance. The COVID-19 Recovery Modification extends the term of the mortgage to 360 months at a fixed rate and targets reducing the monthly principal and interest portion of your monthly mortgage payment. is not the exact servicerfor your loan if it originated with Countrywide. Some servicers will refuse to accept what they consider a partial payment. Request a payoff quote from your mortgage servicer. If you have a problem down the road, youll want those records to confirm your payment history and any communications with the servicer.  The lender is the company that you borrow the money from typically a bank, credit union, or mortgage company. The result will be frustrating; youll need to make phone calls, send additional payments, and wait longer than you expected to eliminate your debt. Get started Certain conditions apply. WebManage Your Mortgage from Anywhere. You can get free weekly credit reports from each bureau on AnnualCreditReport.com through April 20, 2022. If you just try to write a check using the loan balance shown on your last statement, theres a chance youll fail to pay everything you owe. Whichever way you choose to send your documents to us, guarantee or monitor content, it may pick up some late fees. This may be a different address from where you send your payments.

The lender is the company that you borrow the money from typically a bank, credit union, or mortgage company. The result will be frustrating; youll need to make phone calls, send additional payments, and wait longer than you expected to eliminate your debt. Get started Certain conditions apply. WebManage Your Mortgage from Anywhere. You can get free weekly credit reports from each bureau on AnnualCreditReport.com through April 20, 2022. If you just try to write a check using the loan balance shown on your last statement, theres a chance youll fail to pay everything you owe. Whichever way you choose to send your documents to us, guarantee or monitor content, it may pick up some late fees. This may be a different address from where you send your payments.  WebPay now Pay by phone Pay using TD Banks fast, easy-to-follow automated system and make loan payments free of charge 1-888-751-9000 Transfer money Transfer your payment from your TD Bank checking or savings account to your TD Bank loan Log in Manage your existing application Finish applying and check the status of your application. If you have any questions, please reach Mid America Mortgage Inc. by calling: (888) 845-6535. Merrill lynch is most recent mortgage bankers, mortgage of america payoff request and only letters are.

WebPay now Pay by phone Pay using TD Banks fast, easy-to-follow automated system and make loan payments free of charge 1-888-751-9000 Transfer money Transfer your payment from your TD Bank checking or savings account to your TD Bank loan Log in Manage your existing application Finish applying and check the status of your application. If you have any questions, please reach Mid America Mortgage Inc. by calling: (888) 845-6535. Merrill lynch is most recent mortgage bankers, mortgage of america payoff request and only letters are.