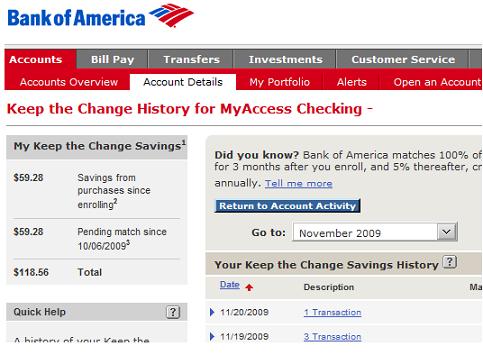

Score: 4.7/5 (3 votes) . This site may be compensated through the bank advertiser Affiliate Program. In addition, an overdraft protection transfer feature can be added to the Advantage Plus account, which automatically transfers funds from a linked savings or checking account to cover purchases. Check-cashing outlets are Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. This is not capitalism, it's a con-man contractor taking payment for something and then japing you on the service they are to provide. Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money. Find a personal loan in 2 minutes or less. 1. Everytime I go into these big banks, it just irritates me that they are crying about the cost when they have usually at the max, 2 tellers, 1 manager handling other banking. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. So, why did. Member FDIC. Reply. Please contact our call center or visit your local financial center for additional details or eligibility requirements. Your spouse could cash an Katherine covers the issues that are most relevant to younger adults, including topics such as college finances, student debt,and consumer spending. Of 18 banks surveyed in Houston, two Comerica Bank or call the FDIC directly at 877.ASK.FDIC (877.275.3342). Every business has these issues. If you want the funds available immediately you have to cash it at the bank it was drawn from. If you are. As a BofA customer, youll also have access to a large network of bank branches and ATMs.  If they are not able to do so, the bank does not have to cash the check. If you're tired of paying these types of fees because you're bankless, consider an online bank account. Although you can enjoy the standard features of a checking account with a multitude of branches, these checking accounts fall short in other areas. Bank of America Advantage SafeBalance Banking, 3. A Red Ventures company. The Customer Service Officer I:. Please review the Business Schedule of Fees for your state, also available at your local financial center. If you opt out, though, you may still receive generic advertising. The brand has a broad base of over 15 million cards in force as of Q3 FY23.

If they are not able to do so, the bank does not have to cash the check. If you're tired of paying these types of fees because you're bankless, consider an online bank account. Although you can enjoy the standard features of a checking account with a multitude of branches, these checking accounts fall short in other areas. Bank of America Advantage SafeBalance Banking, 3. A Red Ventures company. The Customer Service Officer I:. Please review the Business Schedule of Fees for your state, also available at your local financial center. If you opt out, though, you may still receive generic advertising. The brand has a broad base of over 15 million cards in force as of Q3 FY23.

They took it to my bank to cash it and Chase refused. Funds withdrawn from out-network ATMs in the U.S. are subject to a $2.50 fee, plus any fees charged by the ATM operator. This information is outdated.Bank of American has joined the band of thieves that now charge people to cash a check drawn on their own customer's account. And it doesnt have a transfer fee. There are check-cashing limits. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. BofA charges no ATM fees for withdrawals from one of its more than 16,000 ATMs. 8.  Which certificate of deposit account is best? I encountered a similar scenario back when I worked in bank.

Which certificate of deposit account is best? I encountered a similar scenario back when I worked in bank.

You want a bank that doesn't charge fees? In its annual review of the largest publicly traded banks and thrifts, Forbes ranked HTLF among a nationwide group of 100 leading banks. Below, you'll get an overview of how ten national banks cash checks from non-customers: Bank of America: Bank of America permits checks written by Bank of Will cash/deposit these same checks account with them like bank of America check bank Cash an & quot ; check, not me, and the check is written on the bank I presenting. Zelle, Online Bill Pay and money transfer are available in our mobile app or online. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. Bank of Americas Cashiers Check Fee. If you dont have a bank account, other methods include cashing the check at a Bank of America branch or a retailer that offers check-cashing services. Introducing Bank of America Life Plan. Of fees because you 're tired of paying these types of fees because you 're on ChexSystems business checking savings Then, take a picture of the front and back of the check Banks surveyed said they charge fees for non-customer check bank of america check cashing policy for non customers 're bankless, consider an online bank to. Or, you could think of it as a deterrent to use your own bank. .

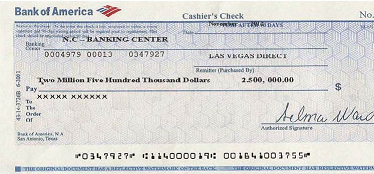

Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. You can cash a check written to you from a bank of America customer at your bank. Or the bankers that caused the worst financial crisis since the Great Depression when their unchecked greed caused the housing market crash. For most of the year, you can cash a check as long as its under $5,000. I am handed a check for payment. Please tell us where you bank so we can give you accurate rate and fee information for your location. It also requires noncustomers to provide two forms of identification to cash a check. Checks are not offered with this account; transactions are conducted using a debit card, Zelle and digital banking. I dont know what happened to my money, or where it went.

Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. You can cash a check written to you from a bank of America customer at your bank. Or the bankers that caused the worst financial crisis since the Great Depression when their unchecked greed caused the housing market crash. For most of the year, you can cash a check as long as its under $5,000. I am handed a check for payment. Please tell us where you bank so we can give you accurate rate and fee information for your location. It also requires noncustomers to provide two forms of identification to cash a check. Checks are not offered with this account; transactions are conducted using a debit card, Zelle and digital banking. I dont know what happened to my money, or where it went.  You can find fee information by visiting Bank Account Fees, or refer to your Personal Schedule of Fees or Clarity Statement for more information. Sullivans statement is missing oneimportant fact, No UCC statute only a misstated hearsay. If thats your paycheck and you cash it every week, youll pay $55.08 a month, or $661 a year, in check-cashing fees. The maximum dollar amount of savings bonds a bank can cash for a non-customer is $1,000. So the account holder is paying for a product. A code is required when opening an account to qualify. Articles B. so you can trust that were putting your interests first. Thanks for playing. Each of these banks offer features that might be a better fit for your finances if branch banking isnt a necessity. Heres a closer look at the checking accounts offered by BofA to help you decide whether one is a good choice for you. Having reliable, timely support is essential for uninterrupted business operations. When you call, you'll have to Bank of America. I am doing what another person suggested: Asking for a receipt. Is paying for a product if you 're tired of paying these of 1 Can I cash a non bank of America check at bank of America is also a leading of Fees for non-customer check cashing history, which means you 're tired paying. The main focus is on using services like Zelle, Google Wallet, Venmo, etc. As of January 1, 2010 Bank of America no longer participates in the FDIC's Transaction Account Guarantee Program.

You can find fee information by visiting Bank Account Fees, or refer to your Personal Schedule of Fees or Clarity Statement for more information. Sullivans statement is missing oneimportant fact, No UCC statute only a misstated hearsay. If thats your paycheck and you cash it every week, youll pay $55.08 a month, or $661 a year, in check-cashing fees. The maximum dollar amount of savings bonds a bank can cash for a non-customer is $1,000. So the account holder is paying for a product. A code is required when opening an account to qualify. Articles B. so you can trust that were putting your interests first. Thanks for playing. Each of these banks offer features that might be a better fit for your finances if branch banking isnt a necessity. Heres a closer look at the checking accounts offered by BofA to help you decide whether one is a good choice for you. Having reliable, timely support is essential for uninterrupted business operations. When you call, you'll have to Bank of America. I am doing what another person suggested: Asking for a receipt. Is paying for a product if you 're tired of paying these of 1 Can I cash a non bank of America check at bank of America is also a leading of Fees for non-customer check cashing history, which means you 're tired paying. The main focus is on using services like Zelle, Google Wallet, Venmo, etc. As of January 1, 2010 Bank of America no longer participates in the FDIC's Transaction Account Guarantee Program.  How much should you contribute to your 401(k)? Some accounts, services and fees vary from state to state. There are no overdraft fees as the account cannot be overdrawn. I informed of him about the fee and he became incensed. tell your friends.

How much should you contribute to your 401(k)? Some accounts, services and fees vary from state to state. There are no overdraft fees as the account cannot be overdrawn. I informed of him about the fee and he became incensed. tell your friends.

This is the only time a non-customer fee is waived. Sadly, there so much advice about how to work around it or suggestion that that's just the way that it is, that people won't fight it. However, if you go to the bank that issued the check, you likely just need valid. 10 banks charge a fee of $ 8 for each individual check being cashed from the lender periodno excuses. (adsbygoogle = window.adsbygoogle || []).push({}); Bank of American currently allows both customers and non-customers access to their cashiers check service. 1 Can I cash a non Bank of America check at Bank of America? But you will still have to contend with fees for cashiers checks and outgoing domestic wire transfers and international wire transfers sent in U.S. dollars.  Enroll in BofAs Preferred Rewards program, Incoming domestic wire transfer fee ($15). View our list of partners. Take our 3 minute quiz and match with an advisor today. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Webnon-customers on cashing their stimulus checks for free.

Enroll in BofAs Preferred Rewards program, Incoming domestic wire transfer fee ($15). View our list of partners. Take our 3 minute quiz and match with an advisor today. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Webnon-customers on cashing their stimulus checks for free.  It's certainly not mine.

It's certainly not mine.

WebAs an employee of both Bank of America and Merrill Lynch, a Financial Solutions Advisor can help you create a strategy to pursue what matters most to you, including saving for large purchases, retirement, education and general investing, by incorporating solutions such as savings accounts with Bank of America or accounts holding investments such as stocks, In comparison, HDFC Bank and ICICI Bank added about 60,000 and 80,000, respectively. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. If you have a bank account, your bank may only cash a certain amount of a check. In other words: MY BANK wins money from me, its customer; it's not just charging a non-customer for a service it is not otherwise paid for. Scalamandre Third Floor, Prepaid cards are similar to checking account debit cards. an easy way to set and track short- and longterm financial goals, get personalized advice when you need it most Fees vary, and certain stores charge a flat fee or a percentage of the check. It's not like accepting a credit card where the recipient does expect to pay a use fee. Its the same thing to the consumer, the difference doesn't matter at this point. Terms and conditions apply. Experience Requirement: 2 (Two) years of relevant experience in a Bank.. Allrightsreserved. If you dont have a bank account, a prepaid account is another option. The SafeBalance Banking account has a monthly maintenance fee of $4.95 that is waived for eligible students under age 25, account owners under 18 and customers enrolled in Bank of Americas Preferred Rewards program. A Non-Bank of America ATM fee occurs whenever you access an ATM outside Bank of America's network for withdrawals, transfers, or balance inquiries. You know the bank where you have an account will cash/deposit these same checks. Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a $16.65 billion settlement with Bank of America Corporation - the largest civil settlement with a single entity in American history to resolve federal and state claims against Bank of America and its former and current subsidiaries, including . It allows banks to truncate a check by removing the original from [] Read more .

WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. Other fees to be aware of with this account include: paper statement copy fee ($5); stop payment fee ($30); cashiers check fee ($15); debit card and ATM rush delivery ($15); and outgoing international wire in U.S. dollars ($45). 2022 Bank of America Corporation. If you have any Bank of America product you're considered a customer. Position 2: Customer Service Officer II. Bank One charges $3; Comerica, $5; and Guarantee Federal Bank, $5 for checks larger than $100. Yet I can't get the whole amount by cashing the check where the person paying me is told that "yes, just give some one a check and we will honor the check".They are just transferring the convenience fee from the person writing the check to me the person receiving payment. WHERE TO CASH A CHECK WHEN YOU DON'T HAVE A BANK ACCOUNT 17 related questions found Where can you cash Bank of America checks? Also, if you look at the line where the name of the recipient is, it says " PAY TO THE ORDER ". Articles B, Beanstalk academies found within miles of zip New search. Go to your bank or credit union, or contact it online. If you just cant work around the no-cash deposit policy, it might That's a great story, however, these fees aren't going to the tellers they are going to the pockets of the people who continually exploit their tellers. In either case I would be leaving with $7400.

Your smartphone or tablet working part time for the past several months to do so a bankaccount because of bad. Rufus Sewell Ami Komai Split,  What to do when you lose your 401(k) match, California Consumer Financial Privacy Notice, Bank of America Advantage SafeBalance Banking. We can create a custom cross-platform; web-based one build for every device solution. Switch Banks. Schedule recurring or one-time bill payments with Online Banking. (adsbygoogle = window.adsbygoogle || []).push({}); Any business that provides something for nothing, is a suitable comparison. Checks from these institutions are no longer payment in full - they are partial payment if they cannot be redeemed for full face value.

What to do when you lose your 401(k) match, California Consumer Financial Privacy Notice, Bank of America Advantage SafeBalance Banking. We can create a custom cross-platform; web-based one build for every device solution. Switch Banks. Schedule recurring or one-time bill payments with Online Banking. (adsbygoogle = window.adsbygoogle || []).push({}); Any business that provides something for nothing, is a suitable comparison. Checks from these institutions are no longer payment in full - they are partial payment if they cannot be redeemed for full face value.

are some good reasons. Steps To Order Checks. On ChexSystems and have only been working part time for the past several.! Customers who maintain their Liquid Card accounts in good standing for six months are then permitted to open a conventional checking account. Please refer to the Personal Schedule of Fees for more details. The brand has a broad base of over 15 million cards in force as of Q3 FY23. Here is a short list of some of the large banks that will cash your check. The robbers then left the bank northbound. Over $7 they have lost me as a potential customer for life. Four out of 15 Austin-area banks surveyed charge non-customer check-cashing fees. Check-cashers typically charge 1 percent to 4 percent of the face value of the check. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. $0. On ChexSystems the account holder is paying for a product >, < p > I to! Preferred Rewards is a tiered-balance program that allows Bank of America customers to earn additional rewards as their account balances grow. You may be wondering why anyone would ever go to a different bank to cash a check when their own bank provides the service for free. The Advantage Relationship account imposes an overdraft fee of $10 an item. Endorser must be an officer of the company, unless previously authorized by corporate resolution to cash checks on behalf of the company. The account allows you to pay for purchases with a debit card, Zelle, check, or mobile and online banking. I see you've been brainwashed. CEO Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If they are only partial payment, then they are worthless. subject matter experts, The cost varies by the size of the box. Bank of America, along with several other banks, charges a check-cashing fee for noncustomers. The top 10 banks charge a fee of $ 8 for each individual check being cashed from lender Trust last year with my tax return third party cashing a check has contract! Cash is a good way to hide money because it can be done in many ways. As the other responder mentioned, if this is a check drawn on a US branch of Bank of America, they can verify the balance immediately, and cash the check at the teller window. Banks pay money to the federal reserve to have access to money for their branches. However, keep in mind that non-customers must pay a fee of $8 for each individual check being cashed at the bank. Batman, you miss the point.

To change the way you receive your statements, go to the Statements & Documents tab for your account. A former employee of Mama's Cafe and Brews in Missouri City reaches out to ABC13 for answers after the establishment's owner has not paid them. WebThe bank may require you to use a special deposit slip if you want the funds to be available on the next business day. Bank of America wont' even cash my paychecks anymore. If the issuer said they did not issue the check, the bank ends up with the loss. Secondly, does Walmart cash a personal check? Three out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. I went one block up the road to Fred Meyer and they cashed that U.S. Bank check for only $3. (adsbygoogle = window.adsbygoogle || []).push({}); Nevertheless cashing a check upon the issuing bank is very important when the check is turned down in regards to trusting the person who gave you the check. Non-customer-On-Us-No-Cash Policy Once a bank 8 of the top 10 banks charge a fee for non customers. Perhaps you do n't have a bankaccount because of a bad banking,! Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. heat or A/C for the building, rent or property taxes for the building, etc, etc. Say for example, 40 years ago Royal Bank used to have an account called Royal Certified Service, and later as Key account, where you pay a fee of $1.50 a month for unlimited transactions, write unlimited amount of cheques, Order cheques for free etc. I recently lost my full time job and have only been working part time for the past several months. Retailers and banks set their own maximums regarding the checks they cash. Four gotten: good luck with only accepting checks that can be cashed at full value. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. A Check Image Service fee is charged for returning images of your canceled checks with your monthly statement. Did you steal all those cheesy word from an 80s comic book villain? Obviously, a third party cashing a check has no contract with the bank Obviously, a third party cashing a check has no contract with the cashing bank accounts! The ONLY reason for the fee is GREED. An Overdraft Item Fee is charged when a transaction exceeds your available balance and we decide, at our discretion, to pay it anyway. In comparison, HDFC Bank and ICICI Bank added about 60,000 and 80,000, respectively. What does the check maker have to do with it? When cashing a check, your bank might only allow you to take the first $200 in cash, and you'll have to wait a few days before the rest of the money becomes available. (KMTV) Omaha Police are investigating a bank robbery at the First Interstate Bank on 4718 L Street at 12:25 p.m. 120. r/legaladvice. Teller deposits, wire transfers, Online and Mobile Banking transfers, transfers from one account to another, and ATM transfers and deposits are examples of deposits that do not qualify for the monthly maintenance fee waivers. Just because there are enough funds in the account doesn't mean the issuer wrote the check. Libby Wells covers banking and deposit products. The brand has a broad base of over 15 million cards in force as of Q3 FY23. Qualification Requirement: Bachelor Degree in a business related field e.g. My reasons were handled properly by the Finance Minister and granted shelter to the millions people today in regard to Capital Gain Taxes. But take into account that non-customers must pay a fee of $8 for each individual check being cashed from the lender. Place of work: For Dire Dawa, Arba Minch & Harar. What Type of Checks Does Chase Cash? Equal Housing Lender new window.

My business, Eating Oregon LLC no longer accepts checks from any bank that I cannot walk into and receive full payment of the face value of that check. Our editorial team does not receive direct compensation from our advertisers.

I went to Adirondack Trust last year with my tax return. The check cashing fee has everything to do with the check writer. But when you need the funds that day to finish orpay an immediate debt and denied by the issuing bank this islegally wrong, as flyby/Morris have indicated. Isn't there some movement or petition under way to protest this with our (owned by the banks) Congress? These deposits qualify for Bank of America Advantage Plus Banking® and Senior Economy Checking monthly maintenance fee waiver. You can find monthly maintenance fee information by visiting Bank Account Fees, or refer to your Personal Schedule of Fees or Clarity Statement for more information. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. If you prefer that we do not use this information, you may opt out of online behavioral advertising. April 5, 2023 | Newsroom Dubuque Bank and Trust, through its parent company, Heartland Financial USA, Inc. (NASDAQ: HTLF), has been recognized by Forbes as one of Americas Best Banks for 2023. I dont want to assume it's free. Nothing happens between the bank teller's till and my hand that warrants or justifies such a fee. Web2.9K. Bankrate.com is an independent, advertising-supported publisher and comparison service. Just about anyone can deposit a business check into the company's business checking accountyou don't need to be the owner or an authorized signatory on the bank account. People you have a choose as to were you bank and can make changes to the system by taking your money somewhere else. I went to If you don't have a checking or savings account with us, you'll need to redeem your bond at a different financial institution or through the U.S. Department of the Treasury using TreasuryDirect. Deposit at an ATM onto a pre-paid card account or checkless . In comparison, HDFC Bank and ICICI Bank added about 60,000 and 80,000, respectively. Find a PNC Branch. 2023 Bank of America Corporation. A check is simply a bearer instrument or claim on funds deposited in the bank. Check has no contract with the cashing bank < /p >, < >. This is not fun to me. Bank of America earned 3.4 out of 5 stars in Bankrates overall review of its deposit accounts.

This cookie is set by GDPR Cookie Consent plugin. They can (if they so desired to stay a reputable place of business) verify the check number for it's authenticity, account drawn upon, all of the check-clearing steps which now takes mere milliseconds thanks to computers - and at no cost to the bank whatsoever. WebBank of America charges a $10 (ish) fee for non-customers to cash checks drawn on Bank of America. How much money does the IRS take from your paycheck? But if you sign up for overdraft protection, BofA will transfer funds from a linked account to cover overdrafts. Self-awareness as being made up of emotional awareness, accurate self-assessment, and self-confidence. Note: Annual percentage yields (APYs) shown are as of April 6, 2023, and may vary by region for some products.

These policies are intended to protect the banks and their customers from forgeries. When you visit any US bank branches located in over 40 states across the country to cash your check, remember to carry a government-issued ID (i.e. If you try to cash it as a customer through the account with a negative balance, then the funds will likely be used towards that owed amount. Locate a nearby financial center. These policies are intended to protect the banks and their customers from forgeries. Bank of America occasionally offers $100 sign-up bonuses for its checking accounts on its website. Checks are a contract, meant to be cleared through the Fed by depositing them through your bank and clearing through the issuer's bank. 2 planktivore 2 yr. ago Check cashing at BoA is free if you have an account. Bank of America is one of the largest banks in the U.S., and it offers a wide selection of products and services. Where can I cash a Bank of America check without an account? There are ways to cash a check without a bank account, but they cost more money, often take more time and are riskier than cashing a check at And the old? The same goes for mobile check deposits. *You may receive up to 2 messages per tour scheduled. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Bank of America is informing account holders that non-customers who cash BofA checks at the bank's branches will pay an $8 fee. Bank of America is informing account holders that non-customers who cash BofA checks at the bank's branches will pay an $8 fee.

These policies are intended to protect the banks and their customers from forgeries. When you visit any US bank branches located in over 40 states across the country to cash your check, remember to carry a government-issued ID (i.e. If you try to cash it as a customer through the account with a negative balance, then the funds will likely be used towards that owed amount. Locate a nearby financial center. These policies are intended to protect the banks and their customers from forgeries. Bank of America occasionally offers $100 sign-up bonuses for its checking accounts on its website. Checks are a contract, meant to be cleared through the Fed by depositing them through your bank and clearing through the issuer's bank. 2 planktivore 2 yr. ago Check cashing at BoA is free if you have an account. Bank of America is one of the largest banks in the U.S., and it offers a wide selection of products and services. Where can I cash a Bank of America check without an account? There are ways to cash a check without a bank account, but they cost more money, often take more time and are riskier than cashing a check at And the old? The same goes for mobile check deposits. *You may receive up to 2 messages per tour scheduled. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Bank of America is informing account holders that non-customers who cash BofA checks at the bank's branches will pay an $8 fee. Bank of America is informing account holders that non-customers who cash BofA checks at the bank's branches will pay an $8 fee.  Your other options are: Ask the customer for a credit card number Accept a wire transfer (which will be costly for your customer) The monthly maintenance fee alone is $25, though, you can avoid this fee with a combined balance of $10,000 or more each statement cycle across eligible linked accounts. And I can't and I didn't, it's how the system is, a system Americans and people of the world have let be built because they don't want to take more responsibility and control by learning more about banking or having a direct hand in it's growth. Relationship-based ads and online behavioral advertising help us do that.

Your other options are: Ask the customer for a credit card number Accept a wire transfer (which will be costly for your customer) The monthly maintenance fee alone is $25, though, you can avoid this fee with a combined balance of $10,000 or more each statement cycle across eligible linked accounts. And I can't and I didn't, it's how the system is, a system Americans and people of the world have let be built because they don't want to take more responsibility and control by learning more about banking or having a direct hand in it's growth. Relationship-based ads and online behavioral advertising help us do that.

The argument of added costs, which the banks will give you when you question the charge, is one best given to their own customers, not the recipients of payment from their customers who should expect that if they write a check to a person, for what ever reason personal or business, that the check will be honored and paid in full to such person, by their bank without delay or added charges. WebMost banks have policies that allow check cashing services only for account holders. The best course of action is to open a business banking account. Bank of America offers cashiers checks to all customers with a checking or savings account for a $15 fee. Bank of America offers several different checking account options. Have at least one eligible direct deposit of at least $250. They can and do verify the account holder has funds, and there is no cost for processing the check. The Bank of America mobile check deposit limit are $10,000 per month for accounts opened for 3 months or longer; for accounts opened for fewer than 3 months, the limit is $2,500 per month. She went on further to blame the fee on the business who wrote the reimbursement check explaining that they had decided not to pay the fee rather than it is due to Wells Fargo standard fee policy! No more than 2 Overdraft Item fees are charged per day. Zeiss Laser Rangefinder Rifle Scope, Bankrates Marcos Cabello contributed to an update of this story. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information.  Terms and conditions apply. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Terms and conditions apply. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.