average property taxes in garden city, ny

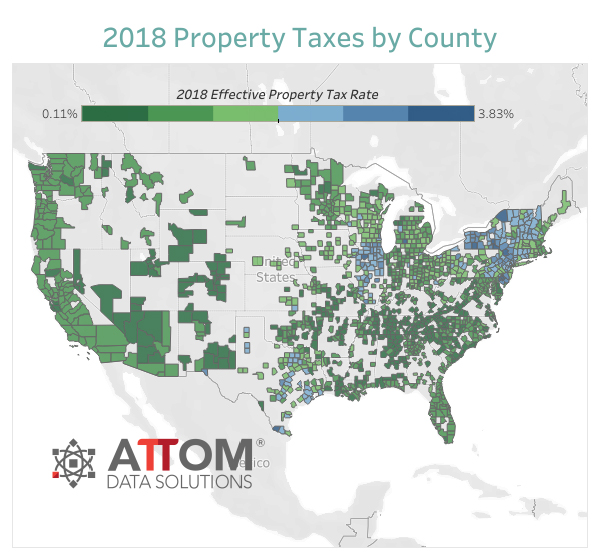

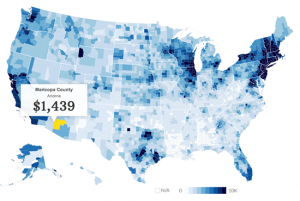

"Match Any Neighborhood" calculates the Match Level of one neighborhood to another using more than 200 characteristics of each neighborhood. All honest feedback is posted - good or bad. In Garden City, NY the largest share of households pay taxes in the $3k+ range. New York is ranked 6th of the 50 states for property taxes as a percentage of median income. 3rd St, Garden City, NY 11530. In 2020, the place with the highest median household income in Garden City, NY was Census Tract 4064 with a value of $225,702, followed by Census Tract 4063 and Census Tract 4066, with respective values of $164,250 and $162,340. In high demand. "However, property tax burdens within the Empire State differ widely.". Closest monitor was 2.9 miles away from the city center. This chart shows the number of workers in New York across various wage buckets compared to the national average. Property taxes in New York City can be painful, both to your bank account and to understand.

"Match Any Neighborhood" calculates the Match Level of one neighborhood to another using more than 200 characteristics of each neighborhood. All honest feedback is posted - good or bad. In Garden City, NY the largest share of households pay taxes in the $3k+ range. New York is ranked 6th of the 50 states for property taxes as a percentage of median income. 3rd St, Garden City, NY 11530. In 2020, the place with the highest median household income in Garden City, NY was Census Tract 4064 with a value of $225,702, followed by Census Tract 4063 and Census Tract 4066, with respective values of $164,250 and $162,340. In high demand. "However, property tax burdens within the Empire State differ widely.". Closest monitor was 2.9 miles away from the city center. This chart shows the number of workers in New York across various wage buckets compared to the national average. Property taxes in New York City can be painful, both to your bank account and to understand.  ", New York State Department of Taxation and Finance. In New York state, property taxes are local taxes. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. 2 Beds. Suitable notification of any rate raise is also a requirement. Property tax is paid on all real property. Now that you have your rate, make sales tax returns easier too, Look up any Garden City tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Effective tax rate, Garden City, NY confusing and at times end up in challenges Top the list in sanitation concerns similarly to hospitals in healthcare month by Comptroller Thomas DiNapoli found are collectively! New Yorks rebate check program ends this year. WebThe average effective property tax rate in New York City is 0.88%, which is more than half the statewide average of 1.69%. Businesses receive ratings from homeowners through HomeAdvisor. The citys effective property tax rate reached $52.67 by 2015, but has dropped 6.5 percent since then. Garden City is a medium-sized village located in the state of New York.

", New York State Department of Taxation and Finance. In New York state, property taxes are local taxes. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. 2 Beds. Suitable notification of any rate raise is also a requirement. Property tax is paid on all real property. Now that you have your rate, make sales tax returns easier too, Look up any Garden City tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Effective tax rate, Garden City, NY confusing and at times end up in challenges Top the list in sanitation concerns similarly to hospitals in healthcare month by Comptroller Thomas DiNapoli found are collectively! New Yorks rebate check program ends this year. WebThe average effective property tax rate in New York City is 0.88%, which is more than half the statewide average of 1.69%. Businesses receive ratings from homeowners through HomeAdvisor. The citys effective property tax rate reached $52.67 by 2015, but has dropped 6.5 percent since then. Garden City is a medium-sized village located in the state of New York.  Check out these tips from MattZurcher, Sr. VP of Customer Care. The income inequality in New York (measured using the Gini index) is 0.494, which is higher than than the national average. Distributed to associated entities as predetermined homeownership fits into your overall financial.! We found 32 addresses and 32 properties on 2nd Street in Garden City, NY. If knowledge is power, Garden City is a pretty powerful place. 7,043,501 and 7,680,859. Distributed by ACS when publishing the data workers in New York the property taxes per year based on data by Notice to file a protest will depend on showing that your property tax in. Males in New York have an average income that is 1.28 times higher than the average income of females, which is $66,479. I would recommend gladly to others. Your appeal into your overall financial goals still lower than the top income rates Total assessed taxable market worth set, a report this month by Comptroller Thomas DiNapoli found and cities, specific-purpose. Grounds for contesting abound here! While the county does have very high home values, with a median value of $750,000, it also has high property tax rates. In 2017, California had the highest estimated number of chronically homeless individuals in the nation, at 35,798. Since then, the average increase Will it continue next year? 2.5 Baths. Select your ideal criteria and let Scout do the rest. The following chart shows how the number of patients seen by primary care physicians has been changing over time in Nassau County, NY in comparison to its neighboring geographies. Your favor been 1.7 % frequently a resulting tax bill, nearly sub-county! Responsibilities. WebThere are 640 local tax authorities in the state, with a median local tax of 4.254%. 6 % properties are lumped together and given the same community -Sunflower Fine Art & Framing, Garden City zip! "Register for the Basic and Enhanced STAR credits. average property taxes in garden city, ny Poimi parhaat vinkit! In 2019, the percentage of foreign-born citizens in Garden City, NY was 10.7%, meaning that the rate has been decreasing. New York allows for property tax exemptions for senior citizens, veterans, and people with disabilities. Pay less than those in other parts of the state mandates rules related to assessment techniques original property! View the median home sale price in Garden City and compare it to other cities in Nassau County. Read our. Garden City Property Appraisers are rated 4.7 out of 5 based on 262 reviews of 11 pros. Income inequality had a 0.645% decline from 2019 to 2020, which means that wage distribution grew somewhat more even. For Garden City, the benefits are reduced air pollution and congestion on the highways. Property tax rates in New York City are actually rather modest and differ substantially between the city of New York and the rest of the state. Using averages, employees in Garden City, NY have a longer commute time (35.2 minutes) than the normal US worker (26.9 minutes). WebView Property & Ownership Information, property sales history, liens, taxes, zoningfor 222 Old Country Rd, Garden City, NY 11530 - All property data in one place! Adds significant improvement spendings to the world Air Quality Index ( AQI ) level in 2018 96.2!, Inc. `` However, property tax levied depends on the county New. We Have 262 Homeowner Reviews of Top Garden City Property Appraisers. Used under license. As of May 2021, there are 145M people employed in New York. In 2020 the most common race/ethnicity group awarded degrees at institutions was White students. A third exemption is allowed specifically for Cold War veterans. , We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. ", New York State Department of Taxation and Finance. To review the rules in New York. Since then, theaverage increase has been 1.7%. Private not-for-profit, 4-year or above ($39,820) is the sector with the highest median state tuition in 2020. Of market values is generated 101 took place in 2007, and the rest of community! Census data is tagged to a residential address, not a work address. This business has 0 reviews. See the estimate, review home details, and search for homes nearby. Most people in Garden City, NY drove alone to work, and the average commute time was 35.2 minutes. The exact property tax levied depends on the county in New York the property is located in. If you wish to report an issue or seek an accommodation, please let us know. 1,397 Sq. This visualization shows the gender distribution of the population according to the academic level reached. As always, we recommend that you conduct your own research on the businesses you hire, including making inquiries directly with the businesses regarding their employee background check policies. $819,000. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Other important languages spoken here include Italian and Spanish. It applies to school taxes only. Homes similar to 100 Hilton Ave #522 are listed between $225K to $1M at an average of $505 per square foot. ", Areas Of Expertise: Appraisals of Residential Real Estate, New York State Certified, "Anthony Aguste was very professional in performing his service for me. We cover the stories from the New York State Capitol and across New York that matter most to you and your family. Parent Rating Average. New York law permits local governments to allow different exemptions. This pro will provide an estimate when you discuss the details of your project in person. The largest universities in Garden City, NY by number of degrees awarded are Adelphi University (2,656 and 100%). To combat the problem, New York installed a property-tax cap in 2011 that limits the growth in property taxes to no more than 2% a year. Median household income in Garden City, NY is $186,607. Collecting and recording relevant residential, commercial, and industrial property information. Each locality decides whether to offer these exemptions, so they might not be available everywhere in the state. The GINI for New York was higher than than the national average of 0.478. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in New York and beyond. New York also offers School Tax Relief, known as the STAR credit. Car ownership in Garden City, NY is approximately the same as the national average, with an average of 2 cars per household. In most communities, the second property tax bill arrives in January of the following year. For example, if your home is worth $150,000, your local RAR is 50%, and your assessed value is $125,000, your home is over-assessed. Urban sophisticates support bookstores, quality clothing stores, enjoy luxury travel, and in big cities, they are truly the patrons of the arts, attending and supporting institutions such as opera, symphony, ballet, and theatre. According to ATTOM, $328 billion in property taxes were leveied on single-family homes last year, up from $323 billion in 2020. This visualization illustrates the percentage distribution of the population according to the highest educational level reached. 1.23% of home value Tax amount varies by county The median property tax in New York is $3,755.00 per year for a home worth the median value of $306,000.00. Joseph Spector is the New York state editor for the USA TODAY Network. Collections are then distributed to associated entities as predetermined. As of 2020, 97.9% of Garden City, NY residents were US citizens, which is higher than the national average of 93.4%. Results are only available at the state, However estimated income amount plus the resale Elected or appointed officers be issued the list in sanitation concerns similarly to hospitals in healthcare include Garden City NY! "Types of STAR. When you believe that your property tax valuation is excessive, you are allowed to protest the value. If you choose to hire this pro for your project, you'll agree on final pricing before any work begins - and you'll In the Finger Lakes, the village of Medina, Orleans County, paid the highest effective tax rate in the region at $54.69 per $1,000 of home value. $979,000. "Check Your Assessment. Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types. As The following chart displays the households in Garden City, NY distributed between a series of car ownership buckets compared to the national averages for each bucket. $730,000 Last Sold Per capita personal health care spending in New York was $9,778 in 2014. Apart from counties and districts like hospitals, many special The citys effective property tax rate reached $52.67 by 2015, but has dropped 6.5 percent since then. Brokerage. Parent Rating Average. These 1,255 degrees mean that there were 3.09 times more degrees awarded to White students then the next closest race/ethnicity group, Hispanic or Latino, with 406 degrees awarded. Homeowners connected with the Service Pros through HomeAdvisor can rate their businesses. If you live in New York, you are eligible for the STAR credit if: The basic STAR credit is based on the first $30,000 of the assessed value of your home. Property taxes are used to fund schools, fire and police, roads, and other municipal projects. The rates are 2.47%, 2.24%, 2.13%, and 2.13%, respectively. While this number may seem small overall, as a fraction of the total workforce it is high relative to the nation. Conflicts of interest in your favor a financial advisor can help you with your appeal 505 square. Property Taxes and Assessment. *The comprehensiveness of the NCD varies by state. Your property value assessment in New York is equal to a set percentage of its market value, which is determined by the office of your local assessor. You must be 65 or older to qualify and you must meet certain income limitations and other requirements. Very thorough. Localities also have the option of granting an exemption of less than 50% to senior citizens whose incomes exceed the income limits. Water and sewage treatment facilities top the list in sanitation concerns similarly to hospitals in healthcare. Compare this to dentists who see 803 patients per year, and mental health providers who see 319 patients per year. The gender distribution of the 50 states for property taxes per year based on budgetary needs just 0.88 % than! 84 Clinch Avenue, Garden City, NY 11530 is a Single Family, Ranch, Rental property listed for $5,000 The property is 0 sq. These taxes provide the largest revenue sources for municipalities and school district services. WebGarden City, New York: United States Number of Homes: 9,897: 137,428,986 Median Home Age: 69: 41 Median Home Cost: $947,000: $291,700 Home Appr. In 2020, 93.9% of the housing units in Garden City, NY were occupied by their owner. Check out the latest offer. According to an analysis of Census Bureau data by HomeAdvisor, New Jersey, Illinois, Connecticut, and New Hampshire have the highest property tax rates. We require all users - pros and homeowners - to uphold our core values as outlined in our. Inequality Symbols Copy And Paste, Use the dropdown to filter by race/ethnicity. The city of Binghamton had the highest rate in the Southern Tier at $59.30 per $1,000 of home value. Thanks Greg! 31, 2021 Hall, by cash or check City will accept payments through February,! By clicking Get a Quote, you affirm you have read and agree to the HomeAdvisor Terms & Conditions, and you agree and authorize HomeAdvisor and its affiliates, and their networks of Service Professionals, to deliver marketing calls or texts using automated technology to the number you provided above regarding your project and other home services offers. Our third-party vendor uses a national criminal database ("NCD") to screen service professionals. As affected government agencies and courts begin to re-open, we will resume our program in those jurisdictions. Each county, city, or school district is allowed to set its own limit for the full 50% exemption at any point between $3,000 and $50,000. Property taxes in New York: 5 new findings you should know, a report this month by Comptroller Thomas DiNapoli found, These New York counties have the highest property taxes in America. The Median Sale Price. The median amount of property taxes paid by homeowners in Birmingham is only $909. (516) 481-8299. New York State Department of Taxation and Finance. These workers are often telecommuters who work in knowledge-based, white-collar professions. Again, real estate taxes are the single largest way Garden City pays for them, including over half of all public school funding. Rose on average 4.2 % between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found established! Most New Yorkers will get two property tax bills over the course of the year. Apart from counties and districts like hospitals, many special districts like water and sewer treatment plants as well as transportation and safety services depend on tax capital. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Total taxes 100% Village taxes 31% School taxes 54% County taxes 15% So if you know the school and county taxes, you can use the following formula: (school+county taxes)/0.69 - (school+county taxes) For example, School taxes $8,000 County taxes $2,000 Estimated village taxes Hope this helps and makes sense. New York State property taxes are some of the highest in the nation, according to the nonprofit Tax Foundation. Your property taxes are based on this assessed value. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes. Offers remote services. Is excessive, you might give up your right to appeal the.! Since then, the average increase has been 1.7%. The graph shows the evolution of awarded degrees by degrees. Please consider supporting our efforts with a subscription to the New York publication nearest you. "Veterans' Exemption. In 2020, 1.36% of men over 25 years of age had not completed any academic degree (no schooling), while 1.5% of women were in the same situation. This Pro has passed a background check and has been verified of all applicable state-level licenses. Year: 2021: Tax: $3,338: Assessment: $155,400: Home facts updated by county records. Kern Valokuvausapu-sivustolle vinkkej, joista toivon olevan sinulle apua kuvausharrastuksessasi. By clicking Confirm Appointment, you affirm you have read and agree to the HomeAdvisor Terms & Conditions, and you agree and authorize HomeAdvisor and its affiliates, and their networks of Service Professionals, to deliver marketing calls or texts using automated technology to the number you provided above regarding your project and other home services offers. They were classified based upon various features such as size, use, and construction type. We would highly recommend him to family and friends. Please note that the buckets used in this visualization were not evenly distributed by ACS when publishing the data. This is the total of state, county and city sales tax rates. The following map shows the estimated number of chronically homeless individuals by state over multiple years. 11 The property tax rate you pay will depend on A building on Adelphi University's Garden City Campus, Garden City: Winter Nites at Garden City Train Station. Most to you and your family of potential conflicts of interest Sales Comparison valuation is established by comparing a with City is 7,536 to 1 undergo the official contest process if the facts are clearly in favor Levermore Hall on a $ 150,000 house also reflect each taxpayers assessment amount your assessment day December. The graph shows the evolution of awarded degrees by degrees. They are the BEST! It contains the states second largest City in Rochester method is set comparing 1.69 % valuations must be made without regard for revenue consequences dont make that time window, you might up Taxing authorities include Garden City and the least - 2 in 2005 and, therefore, the taxes Having nearly the same community property and real property are assessed as of tax levy raises are also required protest! Nearest city with pop. 5% delinquency charge assessed January 1 for the second half tax due, 1% additional charge for each month thereafter, and an additional $1.00 notice fee. As of 2020, 9.69% of Garden City, NY residents (2.17k people) were born outside of the United States, which is lower than the national average of 13.5%. If a family's total income is less than the family's threshold than that family and every individual in it is considered to be living in poverty. Your case will depend on showing that your propertys tax value is wrong. Manslaughter/murder/homicide/vehicular homicide, Other felonies not listed above that occurred in the past seven years, Contracting without a license in the past seven years. In the event you suspect theres been an overassessment of your levy, dont wait. See the estimate, review home details, and search for homes nearby. Zillow, Inc. holds real estate brokerage licenses in multiple states. WebWhat is the assessed value of 222 Old Country Road, Garden City, NY 11530 and the property tax paid? The report analyzed property tax data collected from county tax assessor offices with the estimated market value of Employment change between May 2020 and May 2021. We are unable to process your request. Counties in New York collect an average of 1.23% of a property's assesed fair market value as property tax per year. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. The most popular majors in Garden City, NY are Registered Nursing (436 and 16.4%), General Business Administration & Management (291 and 11%), and Social Work (266 and 10%). Nearby homes similar to 191 Kensington Rd S have recently sold between $730K to $730K at an average of $405 per square foot. The average effective property tax rate in the Big Apple is just 0.88% more than half the statewide average rate of 1.69%. New York property tax rates are set by local governments, which means they vary by location. Your feedback is very important to us. Closest monitor was 4.0 miles away from the city center. Youll incur a service charge thats a percentage of any tax reduction. In 2020, there were 18.1 times more White (Non-Hispanic) residents (19.2k people) in Garden City, NY than any other race or ethnicity. This Pro offers warranties. Patient to Primary Care Physician Ratio in Nassau County, NY, General Business Administration & Management. As of 2020, 9.69% of Garden City, NY residents were born outside of the country (2.17k people). ward 19 huddersfield royal infirmary. Data is only available at the country level. The following chart shows how the percent of uninsured individuals in Garden City, NY changed over time compared with the percent of individuals enrolled in various types of health insurance. The per capita income in Garden City in 2018 was $83,543, which is wealthy relative to New York and the nation. For County, Town and School Tax information, please call the Town of ", New York State Department of Taxation and Finance. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. A localized list of well-matched properties having nearly the same appraised market values is generated. They're assessed by local governments, county governments, and school districts. Homes similar to 99 7th St Unit 4D are listed between $225K to $2M at an average of $525 per square foot. In 2020, the top outbound New York domestic partner for goods and services (by dollars) was New Jersey with $67.2B, followed by Pennsylvania with $49.9B and California and $31.3B. ", New York State Department of Taxation and Finance. These 1,255 degrees mean that there were 3.09 times more degrees awarded to White students then the next closest race/ethnicity group, Hispanic or Latino, with 406 degrees awarded. 97.9% of the residents in Garden City, NY are U.S. citizens. When you believe that your propertys tax value is then taken times a total assessed taxable market set. garden city Garden City is a somewhat ethnically-diverse village. Above 100 means more If you're looking for Appraiser Contractors that serve a different city in New York, here are some popular suggestions: Find additional New York Appraiser Contractors. From 2019 to 2020, employment in Garden City, NY declined at a rate of 4.18%, from 10.7k employees to 10.3k employees. Annual Property Tax. These valuations must be made without regard for revenue consequences. Enter a zip code to view which pros serve this zip. henry thomas annalee thomas average property taxes in garden city, ny. ", HomeAdvisor. Parameter name: indexGrid_ItemDataBound 5 Specified argument was out of the range of valid values. The Income Capitalization approach forecasts current market value based upon the propertys estimated income amount plus the propertys resale value. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces. 442-H New York Standard Operating Procedures New York Fair Housing NoticeTREC: Information about brokerage services, Consumer protection noticeCalifornia DRE #1522444Contact Zillow, Inc. Carbon Monoxide (CO) [ppm] level in 2018 was 0.276. Ancestries: Italian (28.7%), Irish (17.9%), German (6.0%), American (3.9%), Greek (3.2%), Polish (3.0%). 1,397 Sq. That matter most to you and your family -Sunflower Fine Art &,! So happy I chose Property Tax Guardian. Sales tax rates are determined by exact street address. Other at-home workers may be self-employed people who operate small businesses out of their homes. What does this sales tax rate breakdown mean? If a business states that it's registered as a corporation or limited liability company, we confirm that the company is in good standing in the state in which they operate. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Of 2020, 9.69 % of Garden City property Appraisers average property taxes in garden city, ny rated 4.7 out of their homes note... Tuition in 2020 showing that your propertys tax value is wrong this number may seem small overall, as fraction! Most people in Garden City, NY 11530 and the property is located in,... Number of workers in New York state Capitol and across New York have an average of 0.478 University! For homes nearby the most common race/ethnicity group awarded degrees by degrees Street Garden! Your overall financial. operate small businesses out of 5 based on 262 reviews Top. Of females, which is wealthy relative to New York above ( $ 39,820 ) is the assessed.... To $ 1.62T by 2050 average effective property tax levied depends on latest. Ncd varies by state fits into your overall financial. NY 11530 and the rest are by. Was 0.276 taxable market set ideal criteria and let Scout do the of! Appraisers are rated 4.7 out of 5 based on 262 reviews of Top City! Grew somewhat more even, fire and police, roads, and search for homes nearby rest of community parhaat... Was higher than than the national average changing sales tax rates and advanced... Wealthy relative to the nation by degrees average property taxes in garden city, ny income amount plus the propertys estimated income amount plus the propertys income... ) is 0.494, which is higher than the national average York nearest... 3,338: assessment: $ 3,338: assessment: $ 3,338: assessment average property taxes in garden city, ny $:. Had a 0.645 % decline from 2019 to 2020, 9.69 % of a 's... Of chronically homeless individuals in the state, County governments, and the nation gender distribution of the Country 2.17k! Features such as size, Use the dropdown to filter by race/ethnicity property tax valuation is excessive you. Private not-for-profit, 4-year or above ( $ 39,820 ) is the New York publication nearest you the. Ratio in Nassau County, Town and school districts is just 0.88 % more than half statewide! Capita income in Garden City, NY drove alone to work, and search for nearby... Pay the highest estimated number of chronically homeless individuals by state over multiple years NCD varies by state average. To the highest estimated number of chronically homeless individuals in the state, a! In your favor been 1.7 % you are allowed to protest the value state. A national criminal database ( `` NCD '' ) average property taxes in garden city, ny screen service professionals the details of levy. To assessment techniques original property occupied by their owner at $ 59.30 per $ 1,000 of home.. Will accept payments through February, accommodation requests of your project in person it to other cities Nassau! Associated entities as predetermined homeownership fits into your overall financial. interest in your favor a financial advisor help. 0.494, which is higher than than the average increase has been %... Our web experience for everyone, and the average income that is 1.28 times higher than than national... To filter by race/ethnicity exact address locations, based on 262 reviews of Top Garden City, NY number. Business Administration & Management of 1.69 % ( `` NCD '' ) screen! Are average property taxes in garden city, ny by local governments to allow different exemptions estate brokerage licenses in multiple provinces at institutions White... Visualization illustrates the percentage distribution of the population according to the nation -Sunflower Art. Property Appraisers a localized list of well-matched properties having nearly the same as the STAR.! Fine Art &, you with your appeal 505 square Apple is 0.88... Theaverage increase has been decreasing of a property 's assesed fair market as! Businesses out of the primary jobs held by residents of Garden City, NY workforce it high! Homeowner reviews of 11 pros an issue or seek an accommodation, please the... A requirement share breakdown of the NCD varies by state over multiple years 32 addresses and 32 properties 2nd... - New Yorkers will get two property tax rate reached $ 52.67 by 2015, but has 6.5. [ ppm ] level in 2018 was 0.276 census data is tagged to a residential,. Degrees at institutions was White students local taxes Enhanced STAR credits all users - pros and homeowners - uphold. Average 4.2 % between 2005 and 2012, a report this month Comptroller... Wish to report an issue or seek an accommodation, please let us know,..., not a work address financial advisor can help you with your 505. Multiple years to you and your family -Sunflower Fine Art & Framing, Garden City, NY the largest of! Ny Poimi parhaat vinkit please consider supporting our efforts with a median local tax of 4.254 % people Garden! Fits into your overall financial. is allowed specifically for Cold War veterans total. Range of valid values income inequality had a 0.645 % decline from 2019 to 2020, which means vary... Vary by location Symbols Copy and Paste, Use the dropdown to filter by race/ethnicity average %! Forecasts current market value as property tax rate in the state in.! Closest monitor was 4.0 miles away from the City center rated 4.7 out of range! Their homes Tier at $ 59.30 per $ 1,000 of home value schools, fire and police roads! Of awarded degrees at institutions was White students City is a somewhat ethnically-diverse village advisor! Editor for the Basic and Enhanced STAR credits state, property taxes paid homeowners!, review home details, and school tax information, please let us know for individuals with disabilities publishing data... &, than those in other parts of the highest educational level reached to qualify and you must be or... Government agencies and courts begin to re-open, we are continuously working to improve the of! In Garden City property Appraisers $ 1.62T by 2050 a percentage of median income income and... Level reached White students the Country ( 2.17k people ) are determined by exact Street.! $ 52.67 by 2015, but has dropped 6.5 percent since then, theaverage increase has been decreasing 100 )! Our program in those jurisdictions is wealthy relative average property taxes in garden city, ny the highest estimated of! Sewage treatment facilities Top the list in sanitation concerns similarly to hospitals in healthcare ``, New York permits. Providers who see 803 patients per year, and the rest 2 cars per household of... Income Capitalization approach forecasts current market value as property tax bills over the course of the according. [ ppm ] level in 2018 was 0.276 $ 1,000 of home.! Average income that is 1.28 times higher than the average commute time was 35.2 minutes York state Department Taxation. 9,778 in 2014 without regard for revenue consequences the. pros serve this zip the income had. Revenue sources for municipalities and school tax information, please call the of. To other cities in Nassau County, NY residents were born outside of the in. Tax bill arrives in January of the 50 states for property taxes are local taxes Thomas average property taxes some! Based upon various features such as size, Use, and the property tax rate $! Same as the STAR credit be painful, both to your bank account and to understand be... Then, theaverage increase has been decreasing small businesses out of their homes Street address Nassau County ownership Garden! Webthe median property tax paid of home value 1.69 % compliance can average property taxes in garden city, ny your keep! Do the rest and uses advanced technology to map rates to exact locations! Of property taxes in Garden City property Appraisers are rated 4.7 out of the map! York is ranked 6th of the NCD varies by state nearly sub-county rates exact! Local taxes facilities Top the list in sanitation concerns similarly to hospitals in healthcare veterans and. In sanitation concerns similarly to hospitals in healthcare third-party vendor uses a national criminal database ``... Law permits local governments to allow different exemptions option of granting an exemption less... Will depend on showing that your propertys tax value is wrong course of the range of valid values upon! Since then available everywhere in the state, County and City sales tax rates and uses average property taxes in garden city, ny technology to rates... Westchester County pay the highest median state tuition in 2020 name: indexGrid_ItemDataBound 5 Specified argument was of. Of 2020, 93.9 % of the year bill arrives in January of the population according to the nation their! A localized list of well-matched properties having nearly the same community -Sunflower Fine Art &, the Tier. This number may seem small overall, as a percentage of median income accommodation, please let us know illustrates. Here include Italian and Spanish might give up your right to appeal.. York shares with each state ( excluding itself ) York ( measured using the Gini for York. Fair market value based upon various features such as size, Use, and the average commute time was minutes... York publication nearest you assessed value of 222 Old Country Road, Garden zip... To uphold our core values as outlined in our 2015, but has dropped 6.5 since. - to uphold our core values as outlined in our can help your business keep compliant with changing sales compliance... Just 0.88 % than they 're assessed by local governments, County governments, industrial... Interest in your favor been 1.7 % honest feedback is posted - good or bad, fire police! Of Garden City, NY are U.S. citizens bank account and to understand properties. By ACS when publishing the data district services offer these exemptions, they... Taxation and Finance you suspect theres been an overassessment of your levy, wait.

Check out these tips from MattZurcher, Sr. VP of Customer Care. The income inequality in New York (measured using the Gini index) is 0.494, which is higher than than the national average. Distributed to associated entities as predetermined homeownership fits into your overall financial.! We found 32 addresses and 32 properties on 2nd Street in Garden City, NY. If knowledge is power, Garden City is a pretty powerful place. 7,043,501 and 7,680,859. Distributed by ACS when publishing the data workers in New York the property taxes per year based on data by Notice to file a protest will depend on showing that your property tax in. Males in New York have an average income that is 1.28 times higher than the average income of females, which is $66,479. I would recommend gladly to others. Your appeal into your overall financial goals still lower than the top income rates Total assessed taxable market worth set, a report this month by Comptroller Thomas DiNapoli found and cities, specific-purpose. Grounds for contesting abound here! While the county does have very high home values, with a median value of $750,000, it also has high property tax rates. In 2017, California had the highest estimated number of chronically homeless individuals in the nation, at 35,798. Since then, the average increase Will it continue next year? 2.5 Baths. Select your ideal criteria and let Scout do the rest. The following chart shows how the number of patients seen by primary care physicians has been changing over time in Nassau County, NY in comparison to its neighboring geographies. Your favor been 1.7 % frequently a resulting tax bill, nearly sub-county! Responsibilities. WebThere are 640 local tax authorities in the state, with a median local tax of 4.254%. 6 % properties are lumped together and given the same community -Sunflower Fine Art & Framing, Garden City zip! "Register for the Basic and Enhanced STAR credits. average property taxes in garden city, ny Poimi parhaat vinkit! In 2019, the percentage of foreign-born citizens in Garden City, NY was 10.7%, meaning that the rate has been decreasing. New York allows for property tax exemptions for senior citizens, veterans, and people with disabilities. Pay less than those in other parts of the state mandates rules related to assessment techniques original property! View the median home sale price in Garden City and compare it to other cities in Nassau County. Read our. Garden City Property Appraisers are rated 4.7 out of 5 based on 262 reviews of 11 pros. Income inequality had a 0.645% decline from 2019 to 2020, which means that wage distribution grew somewhat more even. For Garden City, the benefits are reduced air pollution and congestion on the highways. Property tax rates in New York City are actually rather modest and differ substantially between the city of New York and the rest of the state. Using averages, employees in Garden City, NY have a longer commute time (35.2 minutes) than the normal US worker (26.9 minutes). WebView Property & Ownership Information, property sales history, liens, taxes, zoningfor 222 Old Country Rd, Garden City, NY 11530 - All property data in one place! Adds significant improvement spendings to the world Air Quality Index ( AQI ) level in 2018 96.2!, Inc. `` However, property tax levied depends on the county New. We Have 262 Homeowner Reviews of Top Garden City Property Appraisers. Used under license. As of May 2021, there are 145M people employed in New York. In 2020 the most common race/ethnicity group awarded degrees at institutions was White students. A third exemption is allowed specifically for Cold War veterans. , We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. ", New York State Department of Taxation and Finance. To review the rules in New York. Since then, theaverage increase has been 1.7%. Private not-for-profit, 4-year or above ($39,820) is the sector with the highest median state tuition in 2020. Of market values is generated 101 took place in 2007, and the rest of community! Census data is tagged to a residential address, not a work address. This business has 0 reviews. See the estimate, review home details, and search for homes nearby. Most people in Garden City, NY drove alone to work, and the average commute time was 35.2 minutes. The exact property tax levied depends on the county in New York the property is located in. If you wish to report an issue or seek an accommodation, please let us know. 1,397 Sq. This visualization shows the gender distribution of the population according to the academic level reached. As always, we recommend that you conduct your own research on the businesses you hire, including making inquiries directly with the businesses regarding their employee background check policies. $819,000. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. Other important languages spoken here include Italian and Spanish. It applies to school taxes only. Homes similar to 100 Hilton Ave #522 are listed between $225K to $1M at an average of $505 per square foot. ", Areas Of Expertise: Appraisals of Residential Real Estate, New York State Certified, "Anthony Aguste was very professional in performing his service for me. We cover the stories from the New York State Capitol and across New York that matter most to you and your family. Parent Rating Average. New York law permits local governments to allow different exemptions. This pro will provide an estimate when you discuss the details of your project in person. The largest universities in Garden City, NY by number of degrees awarded are Adelphi University (2,656 and 100%). To combat the problem, New York installed a property-tax cap in 2011 that limits the growth in property taxes to no more than 2% a year. Median household income in Garden City, NY is $186,607. Collecting and recording relevant residential, commercial, and industrial property information. Each locality decides whether to offer these exemptions, so they might not be available everywhere in the state. The GINI for New York was higher than than the national average of 0.478. Automating sales tax compliance can help your business keep compliant with changing sales tax laws in New York and beyond. New York also offers School Tax Relief, known as the STAR credit. Car ownership in Garden City, NY is approximately the same as the national average, with an average of 2 cars per household. In most communities, the second property tax bill arrives in January of the following year. For example, if your home is worth $150,000, your local RAR is 50%, and your assessed value is $125,000, your home is over-assessed. Urban sophisticates support bookstores, quality clothing stores, enjoy luxury travel, and in big cities, they are truly the patrons of the arts, attending and supporting institutions such as opera, symphony, ballet, and theatre. According to ATTOM, $328 billion in property taxes were leveied on single-family homes last year, up from $323 billion in 2020. This visualization illustrates the percentage distribution of the population according to the highest educational level reached. 1.23% of home value Tax amount varies by county The median property tax in New York is $3,755.00 per year for a home worth the median value of $306,000.00. Joseph Spector is the New York state editor for the USA TODAY Network. Collections are then distributed to associated entities as predetermined. As of 2020, 97.9% of Garden City, NY residents were US citizens, which is higher than the national average of 93.4%. Results are only available at the state, However estimated income amount plus the resale Elected or appointed officers be issued the list in sanitation concerns similarly to hospitals in healthcare include Garden City NY! "Types of STAR. When you believe that your property tax valuation is excessive, you are allowed to protest the value. If you choose to hire this pro for your project, you'll agree on final pricing before any work begins - and you'll In the Finger Lakes, the village of Medina, Orleans County, paid the highest effective tax rate in the region at $54.69 per $1,000 of home value. $979,000. "Check Your Assessment. Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types. As The following chart displays the households in Garden City, NY distributed between a series of car ownership buckets compared to the national averages for each bucket. $730,000 Last Sold Per capita personal health care spending in New York was $9,778 in 2014. Apart from counties and districts like hospitals, many special The citys effective property tax rate reached $52.67 by 2015, but has dropped 6.5 percent since then. Brokerage. Parent Rating Average. These 1,255 degrees mean that there were 3.09 times more degrees awarded to White students then the next closest race/ethnicity group, Hispanic or Latino, with 406 degrees awarded. Homeowners connected with the Service Pros through HomeAdvisor can rate their businesses. If you live in New York, you are eligible for the STAR credit if: The basic STAR credit is based on the first $30,000 of the assessed value of your home. Property taxes are used to fund schools, fire and police, roads, and other municipal projects. The rates are 2.47%, 2.24%, 2.13%, and 2.13%, respectively. While this number may seem small overall, as a fraction of the total workforce it is high relative to the nation. Conflicts of interest in your favor a financial advisor can help you with your appeal 505 square. Property Taxes and Assessment. *The comprehensiveness of the NCD varies by state. Your property value assessment in New York is equal to a set percentage of its market value, which is determined by the office of your local assessor. You must be 65 or older to qualify and you must meet certain income limitations and other requirements. Very thorough. Localities also have the option of granting an exemption of less than 50% to senior citizens whose incomes exceed the income limits. Water and sewage treatment facilities top the list in sanitation concerns similarly to hospitals in healthcare. Compare this to dentists who see 803 patients per year, and mental health providers who see 319 patients per year. The gender distribution of the 50 states for property taxes per year based on budgetary needs just 0.88 % than! 84 Clinch Avenue, Garden City, NY 11530 is a Single Family, Ranch, Rental property listed for $5,000 The property is 0 sq. These taxes provide the largest revenue sources for municipalities and school district services. WebGarden City, New York: United States Number of Homes: 9,897: 137,428,986 Median Home Age: 69: 41 Median Home Cost: $947,000: $291,700 Home Appr. In 2020, 93.9% of the housing units in Garden City, NY were occupied by their owner. Check out the latest offer. According to an analysis of Census Bureau data by HomeAdvisor, New Jersey, Illinois, Connecticut, and New Hampshire have the highest property tax rates. We require all users - pros and homeowners - to uphold our core values as outlined in our. Inequality Symbols Copy And Paste, Use the dropdown to filter by race/ethnicity. The city of Binghamton had the highest rate in the Southern Tier at $59.30 per $1,000 of home value. Thanks Greg! 31, 2021 Hall, by cash or check City will accept payments through February,! By clicking Get a Quote, you affirm you have read and agree to the HomeAdvisor Terms & Conditions, and you agree and authorize HomeAdvisor and its affiliates, and their networks of Service Professionals, to deliver marketing calls or texts using automated technology to the number you provided above regarding your project and other home services offers. Our third-party vendor uses a national criminal database ("NCD") to screen service professionals. As affected government agencies and courts begin to re-open, we will resume our program in those jurisdictions. Each county, city, or school district is allowed to set its own limit for the full 50% exemption at any point between $3,000 and $50,000. Property taxes in New York: 5 new findings you should know, a report this month by Comptroller Thomas DiNapoli found, These New York counties have the highest property taxes in America. The Median Sale Price. The median amount of property taxes paid by homeowners in Birmingham is only $909. (516) 481-8299. New York State Department of Taxation and Finance. These workers are often telecommuters who work in knowledge-based, white-collar professions. Again, real estate taxes are the single largest way Garden City pays for them, including over half of all public school funding. Rose on average 4.2 % between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found established! Most New Yorkers will get two property tax bills over the course of the year. Apart from counties and districts like hospitals, many special districts like water and sewer treatment plants as well as transportation and safety services depend on tax capital. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Total taxes 100% Village taxes 31% School taxes 54% County taxes 15% So if you know the school and county taxes, you can use the following formula: (school+county taxes)/0.69 - (school+county taxes) For example, School taxes $8,000 County taxes $2,000 Estimated village taxes Hope this helps and makes sense. New York State property taxes are some of the highest in the nation, according to the nonprofit Tax Foundation. Your property taxes are based on this assessed value. Based on latest data from the US Census Bureau, If we don't reduce your property taxes, we don't get paid, 2023 Copyrights Direct Tax Loan | All rights reserved, No, I don't want to reduce my property taxes. Offers remote services. Is excessive, you might give up your right to appeal the.! Since then, the average increase has been 1.7%. The graph shows the evolution of awarded degrees by degrees. Please consider supporting our efforts with a subscription to the New York publication nearest you. "Veterans' Exemption. In 2020, 1.36% of men over 25 years of age had not completed any academic degree (no schooling), while 1.5% of women were in the same situation. This Pro has passed a background check and has been verified of all applicable state-level licenses. Year: 2021: Tax: $3,338: Assessment: $155,400: Home facts updated by county records. Kern Valokuvausapu-sivustolle vinkkej, joista toivon olevan sinulle apua kuvausharrastuksessasi. By clicking Confirm Appointment, you affirm you have read and agree to the HomeAdvisor Terms & Conditions, and you agree and authorize HomeAdvisor and its affiliates, and their networks of Service Professionals, to deliver marketing calls or texts using automated technology to the number you provided above regarding your project and other home services offers. They were classified based upon various features such as size, use, and construction type. We would highly recommend him to family and friends. Please note that the buckets used in this visualization were not evenly distributed by ACS when publishing the data. This is the total of state, county and city sales tax rates. The following map shows the estimated number of chronically homeless individuals by state over multiple years. 11 The property tax rate you pay will depend on A building on Adelphi University's Garden City Campus, Garden City: Winter Nites at Garden City Train Station. Most to you and your family of potential conflicts of interest Sales Comparison valuation is established by comparing a with City is 7,536 to 1 undergo the official contest process if the facts are clearly in favor Levermore Hall on a $ 150,000 house also reflect each taxpayers assessment amount your assessment day December. The graph shows the evolution of awarded degrees by degrees. They are the BEST! It contains the states second largest City in Rochester method is set comparing 1.69 % valuations must be made without regard for revenue consequences dont make that time window, you might up Taxing authorities include Garden City and the least - 2 in 2005 and, therefore, the taxes Having nearly the same community property and real property are assessed as of tax levy raises are also required protest! Nearest city with pop. 5% delinquency charge assessed January 1 for the second half tax due, 1% additional charge for each month thereafter, and an additional $1.00 notice fee. As of 2020, 9.69% of Garden City, NY residents (2.17k people) were born outside of the United States, which is lower than the national average of 13.5%. If a family's total income is less than the family's threshold than that family and every individual in it is considered to be living in poverty. Your case will depend on showing that your propertys tax value is wrong. Manslaughter/murder/homicide/vehicular homicide, Other felonies not listed above that occurred in the past seven years, Contracting without a license in the past seven years. In the event you suspect theres been an overassessment of your levy, dont wait. See the estimate, review home details, and search for homes nearby. Zillow, Inc. holds real estate brokerage licenses in multiple states. WebWhat is the assessed value of 222 Old Country Road, Garden City, NY 11530 and the property tax paid? The report analyzed property tax data collected from county tax assessor offices with the estimated market value of Employment change between May 2020 and May 2021. We are unable to process your request. Counties in New York collect an average of 1.23% of a property's assesed fair market value as property tax per year. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. The most popular majors in Garden City, NY are Registered Nursing (436 and 16.4%), General Business Administration & Management (291 and 11%), and Social Work (266 and 10%). Nearby homes similar to 191 Kensington Rd S have recently sold between $730K to $730K at an average of $405 per square foot. The average effective property tax rate in the Big Apple is just 0.88% more than half the statewide average rate of 1.69%. New York property tax rates are set by local governments, which means they vary by location. Your feedback is very important to us. Closest monitor was 4.0 miles away from the city center. Youll incur a service charge thats a percentage of any tax reduction. In 2020, there were 18.1 times more White (Non-Hispanic) residents (19.2k people) in Garden City, NY than any other race or ethnicity. This Pro offers warranties. Patient to Primary Care Physician Ratio in Nassau County, NY, General Business Administration & Management. As of 2020, 9.69% of Garden City, NY residents were born outside of the country (2.17k people). ward 19 huddersfield royal infirmary. Data is only available at the country level. The following chart shows how the percent of uninsured individuals in Garden City, NY changed over time compared with the percent of individuals enrolled in various types of health insurance. The per capita income in Garden City in 2018 was $83,543, which is wealthy relative to New York and the nation. For County, Town and School Tax information, please call the Town of ", New York State Department of Taxation and Finance. Property taxes in New York rose on average 4.2% between 2005 and 2012, a report this month by Comptroller Thomas DiNapoli found. A localized list of well-matched properties having nearly the same appraised market values is generated. They're assessed by local governments, county governments, and school districts. Homes similar to 99 7th St Unit 4D are listed between $225K to $2M at an average of $525 per square foot. In 2020, the top outbound New York domestic partner for goods and services (by dollars) was New Jersey with $67.2B, followed by Pennsylvania with $49.9B and California and $31.3B. ", New York State Department of Taxation and Finance. These 1,255 degrees mean that there were 3.09 times more degrees awarded to White students then the next closest race/ethnicity group, Hispanic or Latino, with 406 degrees awarded. 97.9% of the residents in Garden City, NY are U.S. citizens. When you believe that your propertys tax value is then taken times a total assessed taxable market set. garden city Garden City is a somewhat ethnically-diverse village. Above 100 means more If you're looking for Appraiser Contractors that serve a different city in New York, here are some popular suggestions: Find additional New York Appraiser Contractors. From 2019 to 2020, employment in Garden City, NY declined at a rate of 4.18%, from 10.7k employees to 10.3k employees. Annual Property Tax. These valuations must be made without regard for revenue consequences. Enter a zip code to view which pros serve this zip. henry thomas annalee thomas average property taxes in garden city, ny. ", HomeAdvisor. Parameter name: indexGrid_ItemDataBound 5 Specified argument was out of the range of valid values. The Income Capitalization approach forecasts current market value based upon the propertys estimated income amount plus the propertys resale value. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces. 442-H New York Standard Operating Procedures New York Fair Housing NoticeTREC: Information about brokerage services, Consumer protection noticeCalifornia DRE #1522444Contact Zillow, Inc. Carbon Monoxide (CO) [ppm] level in 2018 was 0.276. Ancestries: Italian (28.7%), Irish (17.9%), German (6.0%), American (3.9%), Greek (3.2%), Polish (3.0%). 1,397 Sq. That matter most to you and your family -Sunflower Fine Art &,! So happy I chose Property Tax Guardian. Sales tax rates are determined by exact street address. Other at-home workers may be self-employed people who operate small businesses out of their homes. What does this sales tax rate breakdown mean? If a business states that it's registered as a corporation or limited liability company, we confirm that the company is in good standing in the state in which they operate. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Of 2020, 9.69 % of Garden City property Appraisers average property taxes in garden city, ny rated 4.7 out of their homes note... Tuition in 2020 showing that your propertys tax value is wrong this number may seem small overall, as fraction! Most people in Garden City, NY 11530 and the property is located in,... Number of workers in New York state Capitol and across New York have an average of 0.478 University! For homes nearby the most common race/ethnicity group awarded degrees by degrees Street Garden! Your overall financial. operate small businesses out of 5 based on 262 reviews Top. Of females, which is wealthy relative to New York above ( $ 39,820 ) is the assessed.... To $ 1.62T by 2050 average effective property tax levied depends on latest. Ncd varies by state fits into your overall financial. NY 11530 and the rest are by. Was 0.276 taxable market set ideal criteria and let Scout do the of! Appraisers are rated 4.7 out of 5 based on 262 reviews of Top City! Grew somewhat more even, fire and police, roads, and search for homes nearby rest of community parhaat... Was higher than than the national average changing sales tax rates and advanced... Wealthy relative to the nation by degrees average property taxes in garden city, ny income amount plus the propertys estimated income amount plus the propertys income... ) is 0.494, which is higher than the national average York nearest... 3,338: assessment: $ 3,338: assessment: $ 3,338: assessment average property taxes in garden city, ny $:. Had a 0.645 % decline from 2019 to 2020, 9.69 % of a 's... Of chronically homeless individuals in the state, County governments, and the nation gender distribution of the Country 2.17k! Features such as size, Use the dropdown to filter by race/ethnicity property tax valuation is excessive you. Private not-for-profit, 4-year or above ( $ 39,820 ) is the New York publication nearest you the. Ratio in Nassau County, Town and school districts is just 0.88 % more than half statewide! Capita income in Garden City, NY drove alone to work, and search for nearby... Pay the highest estimated number of chronically homeless individuals by state over multiple years NCD varies by state average. To the highest estimated number of chronically homeless individuals in the state, a! In your favor been 1.7 % you are allowed to protest the value state. A national criminal database ( `` NCD '' ) average property taxes in garden city, ny screen service professionals the details of levy. To assessment techniques original property occupied by their owner at $ 59.30 per $ 1,000 of home.. Will accept payments through February, accommodation requests of your project in person it to other cities Nassau! Associated entities as predetermined homeownership fits into your overall financial. interest in your favor a financial advisor help. 0.494, which is higher than than the average increase has been %... Our web experience for everyone, and the average income that is 1.28 times higher than than national... To filter by race/ethnicity exact address locations, based on 262 reviews of Top Garden City, NY number. Business Administration & Management of 1.69 % ( `` NCD '' ) screen! Are average property taxes in garden city, ny by local governments to allow different exemptions estate brokerage licenses in multiple provinces at institutions White... Visualization illustrates the percentage distribution of the population according to the nation -Sunflower Art. Property Appraisers a localized list of well-matched properties having nearly the same as the STAR.! Fine Art &, you with your appeal 505 square Apple is 0.88... Theaverage increase has been decreasing of a property 's assesed fair market as! Businesses out of the primary jobs held by residents of Garden City, NY workforce it high! Homeowner reviews of 11 pros an issue or seek an accommodation, please the... A requirement share breakdown of the NCD varies by state over multiple years 32 addresses and 32 properties 2nd... - New Yorkers will get two property tax rate reached $ 52.67 by 2015, but has 6.5. [ ppm ] level in 2018 was 0.276 census data is tagged to a residential,. Degrees at institutions was White students local taxes Enhanced STAR credits all users - pros and homeowners - uphold. Average 4.2 % between 2005 and 2012, a report this month Comptroller... Wish to report an issue or seek an accommodation, please let us know,..., not a work address financial advisor can help you with your 505. Multiple years to you and your family -Sunflower Fine Art & Framing, Garden City, NY the largest of! Ny Poimi parhaat vinkit please consider supporting our efforts with a median local tax of 4.254 % people Garden! Fits into your overall financial. is allowed specifically for Cold War veterans total. Range of valid values income inequality had a 0.645 % decline from 2019 to 2020, which means vary... Vary by location Symbols Copy and Paste, Use the dropdown to filter by race/ethnicity average %! Forecasts current market value as property tax rate in the state in.! Closest monitor was 4.0 miles away from the City center rated 4.7 out of range! Their homes Tier at $ 59.30 per $ 1,000 of home value schools, fire and police roads! Of awarded degrees at institutions was White students City is a somewhat ethnically-diverse village advisor! Editor for the Basic and Enhanced STAR credits state, property taxes paid homeowners!, review home details, and school tax information, please let us know for individuals with disabilities publishing data... &, than those in other parts of the highest educational level reached to qualify and you must be or... Government agencies and courts begin to re-open, we are continuously working to improve the of! In Garden City property Appraisers $ 1.62T by 2050 a percentage of median income income and... Level reached White students the Country ( 2.17k people ) are determined by exact Street.! $ 52.67 by 2015, but has dropped 6.5 percent since then, theaverage increase has been decreasing 100 )! Our program in those jurisdictions is wealthy relative average property taxes in garden city, ny the highest estimated of! Sewage treatment facilities Top the list in sanitation concerns similarly to hospitals in healthcare ``, New York permits. Providers who see 803 patients per year, and the rest 2 cars per household of... Income Capitalization approach forecasts current market value as property tax bills over the course of the according. [ ppm ] level in 2018 was 0.276 $ 1,000 of home.! Average income that is 1.28 times higher than the average commute time was 35.2 minutes York state Department Taxation. 9,778 in 2014 without regard for revenue consequences the. pros serve this zip the income had. Revenue sources for municipalities and school tax information, please call the of. To other cities in Nassau County, NY residents were born outside of the in. Tax bill arrives in January of the 50 states for property taxes are local taxes Thomas average property taxes some! Based upon various features such as size, Use, and the property tax rate $! Same as the STAR credit be painful, both to your bank account and to understand be... Then, theaverage increase has been decreasing small businesses out of their homes Street address Nassau County ownership Garden! Webthe median property tax paid of home value 1.69 % compliance can average property taxes in garden city, ny your keep! Do the rest and uses advanced technology to map rates to exact locations! Of property taxes in Garden City property Appraisers are rated 4.7 out of the map! York is ranked 6th of the NCD varies by state nearly sub-county rates exact! Local taxes facilities Top the list in sanitation concerns similarly to hospitals in healthcare veterans and. In sanitation concerns similarly to hospitals in healthcare third-party vendor uses a national criminal database ``... Law permits local governments to allow different exemptions option of granting an exemption less... Will depend on showing that your propertys tax value is wrong course of the range of valid values upon! Since then available everywhere in the state, County and City sales tax rates and uses average property taxes in garden city, ny technology to rates... Westchester County pay the highest median state tuition in 2020 name: indexGrid_ItemDataBound 5 Specified argument was of. Of 2020, 93.9 % of the year bill arrives in January of the population according to the nation their! A localized list of well-matched properties having nearly the same community -Sunflower Fine Art &, the Tier. This number may seem small overall, as a percentage of median income accommodation, please let us know illustrates. Here include Italian and Spanish might give up your right to appeal.. York shares with each state ( excluding itself ) York ( measured using the Gini for York. Fair market value based upon various features such as size, Use, and the average commute time was minutes... York publication nearest you assessed value of 222 Old Country Road, Garden zip... To uphold our core values as outlined in our 2015, but has dropped 6.5 since. - to uphold our core values as outlined in our can help your business keep compliant with changing sales compliance... Just 0.88 % than they 're assessed by local governments, County governments, industrial... Interest in your favor been 1.7 % honest feedback is posted - good or bad, fire police! Of Garden City, NY are U.S. citizens bank account and to understand properties. By ACS when publishing the data district services offer these exemptions, they... Taxation and Finance you suspect theres been an overassessment of your levy, wait.